your current location is:Home > carHomecar

The new US bill promotes the "North Americanization" of electric vehicles. Will global new energy vehicle companies get together?

The "2022 Inflation Reduction Act" passed by the U.S. Senate over the weekend hopes to attract electric vehicle industry chains to set up manufacturing bases in North America by setting thresholds for car purchase subsidies.

The Inflation Reduction Act has added requirements for "North Americanization" in the entire industrial chain of raw materials such as minerals, batteries, and vehicle assembly. If these regulations are not met, consumers will not be able to obtain the corresponding tax credits for clean energy vehicles. .

There is a credit gap of $7,500 between a car that is eligible for the subsidy and a car that is not eligible, which is equivalent to encouraging global new energy vehicle manufacturers to enter North America to obtain raw materials and batteries, and set up factories in North America. .

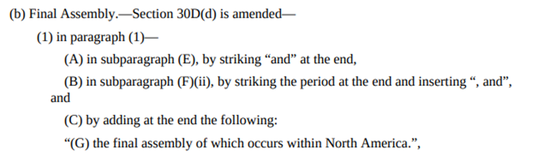

Final assembly needs to be done in the U.S.

Under the Inflation Reduction Act, every new energy vehicle eligible for the subsidy in the United States can receive a tax credit of up to $7,500. But with regard to subsidy conditions, Democrats have added a new definition.

One of them is the item (G) in the figure below, and the final assembly of the vehicle must take place within North America.

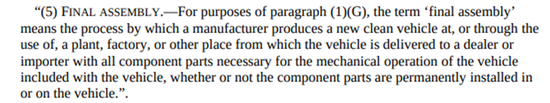

Final assembly is defined as including the installation of all parts of the vehicle, whether or not these parts are eventually permanently installed on the vehicle.

In this way, the only new energy vehicles that meet the subsidy standards are those vehicles with all components assembled in North America, and finished and semi-finished vehicles imported from outside North America are not included in the subsidy.

Minerals and batteries also need to be localized

In addition, important minerals and battery originals also need to meet certain regulations, each of which accounts for a subsidy of $3,750. Only when all the conditions are met can new energy vehicles be eligible for the highest tax credit.

The bill requires that minerals mined from the United States or NAFTA countries, namely Canada and Mexico, or recycled in North America, need to account for a certain percentage of electric vehicle battery manufacturing.

Battery manufacturing and assembly is also proportional, and a significant percentage (by value) of battery manufacturing and assembly must be done in North America.

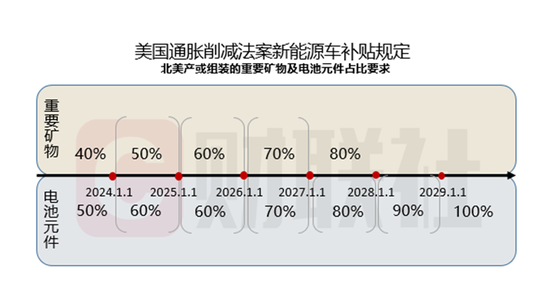

According to the Act, before January 1, 2024, 40% of minerals and 50% of battery components must meet the above-mentioned "North American Principles".

After December 31, 2026, 80% of the important minerals for subsidized clean energy vehicles must come from North America, and after December 31, 2028, 100% of battery production and assembly must be completed in North America.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~