your current location is:Home > Finance > depthHomedepth

Putting the Web3 "Crash" in perspective: This is the best "Ice Age"

Editor's note: "web3" is an improvement over "web2". The core business logic of web2 can be understood as "wool comes from pigs". Information and services are provided to users for free, but user data can be used to accurately place advertisements, and technology companies have become media companies supported by advertising. In web2, users can create content, but their work is ultimately contributing to the development of the platform and cannot be the true owner of the network. In web3, the ownership of digital assets can be confirmed, and users can create their own value, work hard and get ownership as a reward. Now that web3 is in the "ice age", a deep understanding of web3 allows us to seize the opportunities of the times. This article comes from compilation, I hope it inspires you.

Image credit: Medium

Image credit: MediumAn article in The New York Times noted: "A global industry worth hundreds of billions of dollars rose almost overnight, and now it is collapsing." The value of the web3 industry has fallen by an estimated 65% in a few weeks above.

And for serious "builders", "Crash" is a good time to build, both now and in the past. I see unprecedented opportunity in today's web3 "ice age".

1. Historical cycles: market crashes and the dawn of a new era

In mid-April 2000, the tech- heavy Nasdaq fell 25%. It marked the end of the era known as web1. By October 2002, the Nasdaq had fallen to its lows, and technology stocks had lost $5 trillion, or 78% of their market value, from their highs. This was the bursting of the "Internet Bubble".

The Internet age is rich, with more than $100 billion in venture capital funding the commercialization of the Internet. We can learn some lessons and lessons, but some of them are confusing, like the 1990s motto: "Information wants to be free."

Amid the rubble, a number of young companies have survived, including Amazon, Netflix and Google. At the same time, some new companies were established, such as YouTube, Facebook and MySpace. By 2006, a new business model had emerged. As the Los Angeles Times explained to readers at the time, "The focus of the Internet is now more on free services supported by online advertising, which has been growing dramatically."

Venture capitalists who persevered through the crisis embraced this controversial new model. If "information wants to be free," then maybe this business model is the real media model. Use advanced technology to create compelling consumer products, allow them to be used for free, and leverage rich behavioral data to efficiently match advertisers and consumers. Users use the service for free, but their data is used indirectly. This became the cornerstone of what we now call web2, and the economic engine behind a dizzying array of tech companies, most notably Facebook and Google.

Underneath this model lies a simple assertion: People will work for service if the motivation is right. This insight extended to the second wave of web2 innovation, later known as the "gig economy." Companies like Uber emerged, and drivers and passengers alike embraced the innovation. Uber is just a "marketplace", a "matchmaker between drivers and passengers," and the matchmaker gets a cut of the way.

The gig model created another kind of success.

However, a straight line connects all the web2 winners. Whether users of gig platforms, e-commerce platforms, social networks, or search engines, they can never be the owners of the web. They can be clients or "collaboration drivers," but in no case does their work translate into ownership of the platform. Users may be able to get paid, but it is impossible to enjoy the benefits of the enterprise. The people who can increase personal wealth as the business grows are limited to the "founding team," "investors," and perhaps some employees who hold stock options.

This status of the platform seems reasonable. Founders build data systems, algorithms, branding and marketing, they raise capital, so why should the "user" be the owner? After all, in the hard work of envisioning and launching a product, users don't do anything. They are not even investors. The user is the end, not the means.

2. web2: hidden costs

This seemingly fair deal began to be questioned in 2015. There is a feeling that these tech internet companies are getting too much good. Swap becomes unbalanced. Some seemingly innocuous, friendly platforms like Facebook, Instagram or YouTube are starting to take on a darker tone. People started talking about "social media addiction," "loss of privacy," and later, "the rise of disinformation." Climate scientists might call these "externalities," and these are the hidden costs of the web2 business model.

The market capitalization of these companies is so large that it has even crossed the trillion-dollar mark, which is much larger than the GDP of many countries, and one cannot help but feel a sense of powerlessness: Are we doomed to live forever in an irresponsible environment? Is it in a field controlled by a technology company? And these companies are accountable to no one but their investors. At this point, will there be anything new beyond Google or Facebook?

3. Decentralization: A solution to the shortcomings of web2?

In 2009, a project called "Bitcoin" was launched. This sounds like a very stupid and outlandish idea that 99% of people are not interested in. This is some kind of "digital currency", like a coin in a game.

But behind Bitcoin is an innovation that hits the heart of how web2 companies are built. At least in theory. The designers of Bitcoin wanted to solve a central problem: how to allow trusted transactions without a trusted central authority in the middle? If the answer can be found, it will be an interesting question with far-reaching implications.

Bitcoin started out as a game, and its designers made the following promises:

There will never be more than 21 million bitcoins in circulation.

Every Bitcoin is unique and cannot be copied, which means it cannot be counterfeited.

The creation of new bitcoins will be linked to the "work" done by the community, and they must be "mined". Over time, the mining process will become more difficult, which means that the sooner you join the work, the more reward you will get.

All of this will be controlled by a distributed network, with no central authority that can be trusted to make the right decisions.

Incredibly, these promises have come true. People try to break these so-called rules of the game for fun, but the designers stick to their promises. Because of their perseverance, the story started to get interesting and the price of Bitcoin started to rise. Early participants bought bitcoin for fun and gaming, and now they find their bitcoin worth thousands, then millions. The crazy development of Bitcoin exceeded most people's expectations, and even created a myth of some Bitcoin investors. So the public and the media took notice of Bitcoin because the stories were too cool to ignore.

In 2013, an interesting "coin" was launched called Ether (ETH). Ethereum is a digital token of Ethereum and is regarded as "Bitcoin 2.0", using a different blockchain technology than Bitcoin.

It's not quite like Bitcoin, it's not just "money", it has another set of properties. Ethereum is a protocol that lets people build technological products and services using the software principles that underpin Bitcoin. It comes with phrases that feel important like "trustless transactions", "decentralized", "proof of work", etc., and the most important one: "zones" Blockchain" (blockchain).

One of the founders of the Ethereum project tried to explain why the technology was so different from its predecessors, and in 2014 came up with a new term "web3" to describe it. For a long time, not many people paid attention to it.

But these words are important. The "winner-takes-all" web2 company reached its peak in the post-dot-com bust era, and upon closer inspection, these words seem to strike at the heart of the business model that propelled the web2 company to its peak.

After all, what are the core assets offered by Google, Facebook and Uber? They create and manage databases and software. As long as someone "trusts" these companies, their services will work. If people "trust" their friends on Facebook, they will happily communicate with them. If a retailer selling baby clothes believes that "Jennifer" is a new mother living in California who is interested in baby clothes, Facebook can get the retailer's advertising revenue. You may "hate" Facebook, or just use it, but either way, the key is to "believe" that it gives you what you want. Trust and hatred can coexist, albeit unpleasantly.

Just imagine, if one person can also build a trusted database and software system, and there is no central authority in the middle? In other words, what would happen if you could build a network without Facebook?

Bitcoin is decentralized. So in other ways, can we do it?

4. Get rid of the center: a network where users own the ownership

Answering this question in the affirmative becomes a very exciting proposition. This can be said to be revolutionary. If you don't need a central authority, how about:

Coordinate work to build a product or service?

Do people get paid for their work?

Is strategy made and decided collectively?

How is ownership distributed?

These are not just engineering issues, they also become "social contract" issues. These questions are reminiscent of 18th-century Enlightenment explorations. These social contract questions needed to be answered and then written into algorithms, later known as “smart contracts.” In effect, what was once a corporate bylaw agreement (the company’s bylaws and the commercial agreement between the company and its counterparty) will need to exist as an “untrusted” entity on the blockchain.

These issues, as well as the use of blockchain innovations to build new products and services in a decentralized manner, arise in the shadow of enormous external costs. This is also called a "casino".

The vast majority of crypto projects that emerged after 2018 were dominated by the casino mentality. The model is simple: launch a "coin," then convince people to buy it early, and then sell it as soon as possible.

This scam model is disgusting, it tarnishes "web3". But on the other hand, this "casino" has also brought a lot of attention and capital. After that, the market crashed. In the first half of May 2022, Bitcoin fell by about 25%. Just like when the dotcom bubble collapsed in 2000, Ethereum and many more projects continued to decline.

5. Put the 2022 crash in perspective

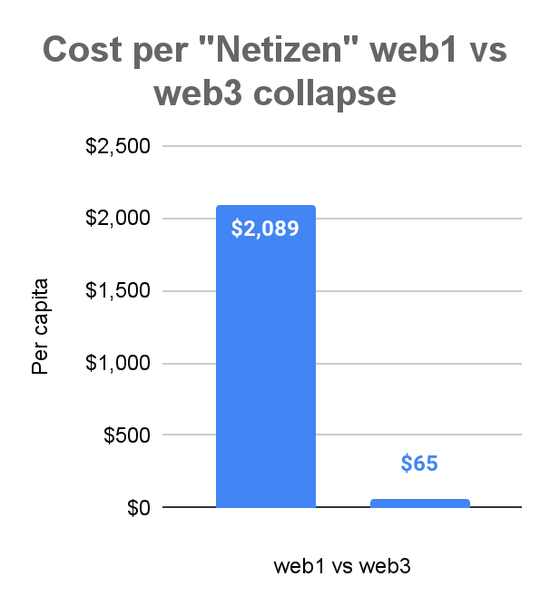

As of this writing, the total value of all crypto assets has fallen from $3 trillion to $800 billion, a 73% drop. By 2002, 18 months after the dot-com bubble burst, the market value of all tech companies had fallen by 76%. However, in real dollar terms, the decline in 2000-2002 was much worse than in 2022.

At the time, the Los Angeles Times estimated that the peak public value of these web1 companies was $6.7 trillion, or $11.4 trillion today. The peak capitalization of this ecosystem was almost four times that of web3, and the total "Internet population" back then was a fraction of what it is today: about 415 million, compared to 3.4 billion today.

On a "per capita" basis, the cost of a web3 crash per "netizen" (an outdated web1 term) is about $65 per person (3.4 billion people share the $2.2 trillion loss). In the debacle of web1, that meant a whopping $2,089 per person (415 million people shared a loss of $8.7 trillion when adjusted for inflation).

See the chart below.

To use an analogy, the collapse of web1 is like an asteroid hitting the earth 65 million years ago , causing the extinction of the dinosaurs, and web3 is like the last big ice age.

This is a fundamental difference in scale.

So what happens next?

6. The “Ice Age” of Web3: Perfect timing for serious investors

Unlike the bursting of the dot-com bubble in 2000, 2022 will have more investor “ammo,” that is, investment funds have more money to commit to financing private companies. Depending on the terms of the contract, these funds are either allocated over time or returned to fund investors. So, how many such "ammunition" are there on the market?

It depends on how one measures it, but if you have to give an opinion, you can use PitchBook (an investor database) to search for "VC" investors looking to invest in "blockchain" and the result is $47 billion in potential capital . There are 122 funds globally that meet this criterion. Some are well-known, like Andreessen Horowitz, and others are lesser-known, like Virginia Venture Partners.

The $47 billion in 2022 may not be "astronomical" yet. So in PitchBook, if you expand the search to any entity with an explicit mandate to invest in "blockchain", that number spirals to $76 billion. That $76 billion includes investors more likely to be "scared" by the Internet Ice Age, such as "hedge funds" and "Corporate Venture Capital." That's why the label "Venture Capital" is so significant throughout the process.

Venture capital funds are set up specifically for long-term investments. Anderson's latest 12-year web3 fund, which closed last month, drew widespread attention. That means if you're a limited partner in the fund, you'll be told that investments made in 2022 may not mature until 2034. Don't expect to get your money back before then! Similar terms were signed for $4.5 billion in investments.

In this case, would VCs "care" about the Ice Age hitting web3? Will care, but not in the way you might think.

If you have a 12-year time horizon, you might be thrilled to invest in freezing times. Frigid climates are excellent, and arguably the best time to invest, for serious venture investors. Far better than the days when tropical ecosystems were thriving. Ice ages are good for investors because:

Weak teams and projects are left out in the cold, leaving a stronger pool of candidates to consider for funding allocation.

Competition from "hot money" such as hedge funds, corporate venture capital and family finance tends to disappear. These "sunbirds" hate the cold. As a result, venture funds have access to investment opportunities, early-stage valuations have fallen, and competition for deals has diminished.

VCs correctly set investors' expectations. This is a long-term value investing fund, so there's no need to rush to a public sale (the casinos are closed!) Patience is a priority. If you want short-term returns, invest in hedge funds.

The market climate of the Ice Age is best for early-stage investing. You can ride a thermometer all the way to the tropics and leave in honor, the climate is your friend from start to finish.

Of course, people who believe in that "casino" logic are angry. They are the antithesis of venture capitalists and need hot tropical climates to thrive and hype. The cold is freezing them to death, but that's a good thing for us true builders, we're working on the hard stuff.

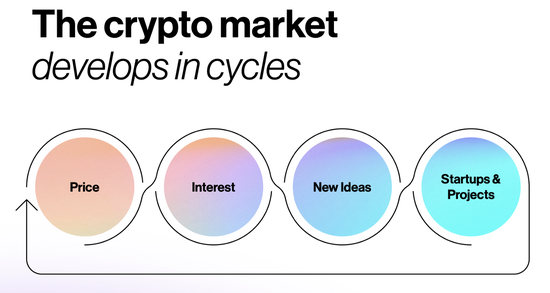

Under the "casino" mindset, starting a web3 project follows these steps:

1. Set a high price for the project and get the money.

2. Generate interest from price and money.

3. Use this price to justify your web3 idea (attract the team).

4. Create a project.

Image credit: Medium

Image credit: MediumDuring the Ice Age, the order was reversed due to the cold weather. The current web3 looks like this:

1. Create the project (get the team together, do some work) before getting funding.

2. Present new ideas.

3. Stimulate investor/partner interest with results of initial work.

4. Set a price based on the data to fund the project.

This sequence is essentially the traditional approach to startup venture capital in the 1990s. Here are some signs of promising web3 projects in the eyes of smart investors:

Does the project create meaningful, long-term incentives for ecosystem participants to contribute valuable work in exchange for community ownership?

Is the project capable of overthrowing the existing web2 dominance by attacking the same market but in a fundamentally more scalable, sustainable and competitive way?

Is there a self-sustaining economic model using web3 token economics that is absolutely impossible to replicate in web2 without token economics?

Is there a huge sustainable market that creates liquidity for token holders?

Every question is profound. Some of them, especially the last one, explicitly contradict the "casino" model.

7. Ownership in a tokenized economy

In the web3 world, the network is decentralized and participants gain fractional ownership through productive contributions to the network. Therefore, a token in this network is both an asset and part of ownership. It is very much like a security, the key difference is that you cannot issue more securities because the total issuance is capped from the start (meaning there is no future dilution risk for early token holders).

Tokens are earned through work that the community finds valuable. Like web2, this will be a "winner takes all" dynamic system. But unlike web2, the winner of web3 will be owned by the network's participants, not by a big company like Facebook.

In this case, allowing non-contributors to earn tokens just for money is detrimental to the ecosystem. This is a key distinction that the future of web3 must understand. A public sale of tokens, if it did happen, would be inherently inconsistent with the development and health of the project. They attract speculators and short-term traders and create a path to value without contributing work.

The market is good at solving these difficult problems, and there is still some innovation to be done in terms of how web3 projects are self-sustaining and long-term financing. In that sense, it's not too different from that paradoxical moment in the early 2000s, when it became clear that if "information wanted to be free," tech companies had to become ad-supported media companies . As crazy as the idea sounded at the time, it worked out.

In web3, the idea of "work and be rewarded with ownership" sounds crazy right now, but it will work out eventually.

Ice Ages are a great time to "build a house". are you ready?

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~