your current location is:Home > Finance > depthHomedepth

Is Sun Zhengyi going to gamble again? SoftBank was revealed to be building a third Vision Fund

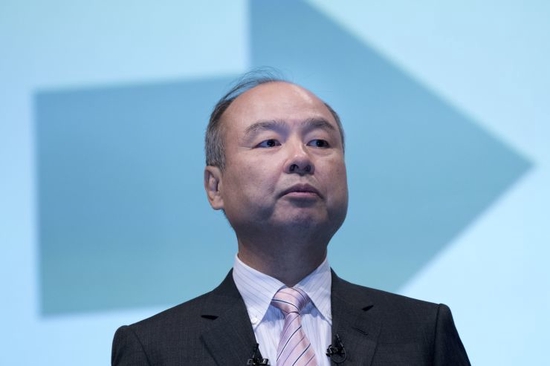

Masayoshi Son, founder and CEO of SoftBank Group.

Masayoshi Son, founder and CEO of SoftBank Group. One month ago, Masayoshi Son, the founder of SoftBank Group, was reflecting on his greed for huge profits and chose to "tighten his belt for the winter", but a month later, Masayoshi Son jumped out of his original defensive strategy and continued to expand, making his career "Waterloo". ” of the Vision Fund map.

On September 14, the "Wall Street Journal" quoted people familiar with the matter as saying that Softbank (Softbank) is considering using its own cash to set up a third SoftBank Vision Fund, and is also considering injecting more funds into Vision II, which will be done in the next few months. make a decision.

After Sun Zhengyi switched back to the "bold and radical" style, he also attracted criticism as before. Many analysts believe that instead of putting their hopes on the third fund, it is better to "intensify" the second phase of the SoftBank Fund. As Sun Zhengyi said in the earnings report a month ago, to reduce unnecessary investment, there are many "golden eggs" in the existing "basket".

Whether Sun Zhengyi's "new way out" will have a miraculous effect on improving the predicament is still unknown, but the resistance in front of him is huge.

At present, SoftBank's liquidity has not been greatly improved. SoftBank Group released its financial report on August 8, recording the largest single-quarter loss of 3.1627 trillion yen (about 23.4 billion U.S. dollars) since the company was established 40 years ago, or reaching a debt level that would only be reached in an emergency situation. Take some extreme measures to survive the winter. Simply put, these "extraordinary measures" include slashing costs, selling all assets available for sale, and severely limiting new investment.

To appease investors and reduce concerns about SoftBank's cash flow. SoftBank Group, uncharacteristically, announced a high-profile early settlement of Alibaba's forward contracts (a financial derivative), cashing out $34.5 billion. SoftBank Group CFO Yoshimitsu Goto said in an interview with the Financial Times not long ago, “As one of the most leveraged companies in Japan, SoftBank Group hopes to reassure investors that the group will not need additional cash in the future. buy back Alibaba shares". In the past, in order to avoid unnecessary impact on Alibaba's stock price, SoftBank Group has always completed the sale plan in a "quiet" way.

In addition, with the huge losses of SoftBank’s two funds, it will be very difficult to raise funds for the new fund. By the end of June, both SoftBank Vision Funds had not paid back their capital (excluding exits). The first phase of the Vision Fund holds a total of 80 investments (excluding exits), with an investment cost of US$68.1 billion and a return on investment of only US$66.3 billion. The second phase of the Vision Fund holds 269 investments, with a total cost of US$48.2 billion. The cumulative investment Returns were also only $37.2 billion.

After the failure of the first phase of the Vision Fund, the largest LP (limited partner, pointed out the investor) behind the Saudi sovereign wealth fund was quite critical and did not appear in the LP list of the second phase of the fund. Under the unfavorable circumstances of the second phase of the Vision Fund’s fundraising, most of the final fund was independently funded by SoftBank, and the scale was also reduced to half from the $97 billion in the first phase.

Today, the Vision Fund has caused SoftBank Group's largest single-quarter loss, and people familiar with the matter said that SoftBank may set up a third Vision Fund with its own funds.

Among the previous disclosures, SoftBank Group’s funds were mainly used to repay debt and share repurchase programs to maintain stock price stability. Now that the third fund has been established through "own funds", the size of its scale will undoubtedly reignite investors' concerns about SoftBank's liquidity.

Analysts believe that SoftBank’s options are very limited now, and the news that SoftBank Group’s precious “own funds” will flow back to startups has disappointed the market. However, from an optimistic point of view, SoftBank is still liquidating its assets during the same period, and its chip maker ARM is also planning an IPO, including its stake in Japan Telecom, which can also generate a certain amount of cash flow.

SoftBank Group held about $42.5 billion in cash and equivalents as of the end of June, according to the latest earnings data.

The establishment of a third fund is more in line with Son's interests. According to people familiar with the matter, the huge losses of the Vision Fund in the past have led to unsatisfactory employee compensation. It is understood that in the first phase of the $100 billion fund, $44 billion is invested in preferred stock, with a promise of an annual coupon rate of 7%. Under the loss, SoftBank still has to pay about $2.2 billion in dividends. In addition to the $33 billion in preferred stocks included in the second phase of the fund, Sun Zhengyi has made a personal investment commitment of $2.6 billion. According to the investment terms, although Sun Zhengyi did not contribute, as long as the fund loses money, the commitment will become "arrears", and the current arrears amount to 2.1 billion US dollars.

Masayoshi Son's new fund will reset the compensation system for executives while improving its incentive scheme for managing the second phase of the fund.

Previous:How did Israel, the country of small balls, create a technological miracle?

Next:The App Store actively embraces advertising, blame the Apple veteran for "halfway"?

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~