your current location is:Home > Finance > depthHomedepth

Blood loss, layoffs, plummeting stock prices: Meta is becoming the Titanic of Silicon Valley

Around 2017, there was a popular discussion on the Internet: Facebook, Apple, Amazon, Microsoft, Google, which of these Silicon Valley giants will collapse first?

At that time, it was at the peak of the popularity of mobile Internet. The revenue and profits of the giants have grown substantially, and their stock prices have broken new highs time and time again, approaching the limit in human business history.

Whether it was the dot-com bubble in the early '00s or Nokia's swift defeat by the iPhone later, the tech industry is full of uncertainty. People understand that dynasties are difficult to last. But now, the Internet has become the new infrastructure. Will the giants that hold key resources really go out of business?

The debate about which giant might go down first has spawned a number of divergent views, with much of the discussion revolving around Apple and Facebook. Many views believe that the business of the two companies is overly dependent on consumer decision-making, and there is no high barrier to form, and it is most likely to experience major fluctuations or even collapse.

Now, five years later, the giants have experienced a new round of growth, and their positions have become even more stable. Only Facebook has suffered a series of serious blows. Since the 2018 "election rigging" (Cambridge Gate) scandal, the company has suffered a series of blows and things have not gone well.

Zuckerberg attends 'Cambridge Gate' congressional hearing | Reuters

Zuckerberg attends 'Cambridge Gate' congressional hearing | ReutersIn October of last year, Facebook announced that it would change its name to Meta, betting all on the "metaverse."

A year on, and Meta's metaverse strategy shows no sign of rising, the fundamentals of the social media business have hit a growth ceiling. Behind him, TikTok is eyeing.

In June of this year, former COO Sheryl Sandberg announced her departure, which was once considered a key figure in Facebook’s ability to balance Zuckerberg, triggering a shock within the company. Taking over, COO Javier Ollivan is more focused on growth and core operating metrics.

The situation is changing day by day.

On the one hand, various marginal departments that are currently ineffective are facing the fate of being laid off, and layoffs have been made one after another; on the other hand, Zuckerberg publicly stated that "some people should not stay here", and there was no "low-key" at all. To deal with, to appease the heart" means.

After nearly 20 years in business, Zuckerberg's experience in founding Facebook has been full of drama and has experienced many "darkest moments". But after every dark night in the past, it always ushered in a bottoming out.

But this time, Zuckerberg's predicament is more serious than ever. In the past year, Meta's market value has evaporated by 60%, and this sinking shows no signs of "bottoming out".

Meta, may be becoming the Titanic of Silicon Valley.

2021 Zuckerberg announces company name change to Meta | Meta

2021 Zuckerberg announces company name change to Meta | MetaSet sail for the "metaverse"

Back in time a year ago, Facebook changed its name to Meta.

It's hard to understand why Facebook was so eager to change its name. Even if the "metaverse" represents a larger and reachable future that is worth investing in, it is not enough to use the method of "changing names and surnames" to throw away brand equity at such an early stage, all-in" Metaverse".

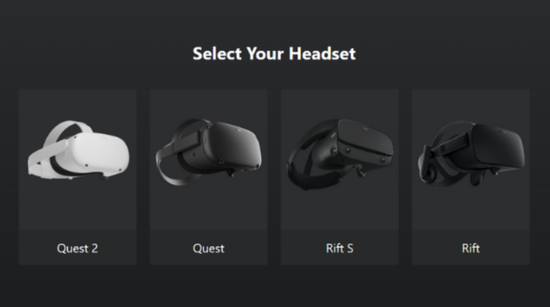

But Zuckerberg remains ambitious. Since the acquisition of Oculus in 2014, Facebook has spent 8 years investing in VR technology, but neither hardware nor software has ushered in a key breakthrough. Both hardware sales performance and software ecological development have fallen into a long-term downturn. Zuckerberg believes that a blockbuster launch is needed to change consumers' perceptions of Oculus headset hardware and the concept of the metaverse.

The name change really gave Meta a shot in the arm. The Christmas season that followed, saw a surge in sales of Oculus VR devices. According to IDC's research results, in 2021, the sales of OculusQuest will be about 5.3-6.8 million units, which is almost double the year-on-year compared to 3.5 million in 2020. This achievement has also been confirmed on the software side: the daily active users of Oculus App increased by 90% year-on-year in the fourth quarter of 2021, and once topped the AppStore rankings in the United States.

In the VR market alone, Meta's Quest has taken the lead. Relying on the relatively low price and Meta's marketing campaign, many people have chosen this trendy and future-oriented toy as a Christmas gift for children.

However, this achievement may be gratifying in the field of VR headsets, but in the broader market context, it is still not worth mentioning.

Oculus Previous Product Lines|Oculus

Oculus Previous Product Lines|OculusOculus VR hardware sales of 5 million to 6 million are far less than PS5 and Switch, which will sell around 17 million and 23 million respectively in 2021. The PS5 has been experiencing capacity hell in 2021, and the supply is in short supply; the Switch is already a console that has been released for 5 years and is at the end of sales.

It can be said that the achievements of Meta after its name change in 2021 are still limited to the very narrow market of VR. The Quest is far from being a successful "game console," let alone a "next-generation Internet access device."

In order to support Meta's metaverse strategy, Quest hardware needs at least 100 million holdings to form initial potential energy - after all, the total number of Meta social media users is 2 billion. In the past five years, all the hardware sold by Oculus has only been more than 10 million units, which is equivalent to only 0.5% of Meta users who can enter that "metaverse".

Moreover, the troublesome problem is not sales, but how to build that "metaverse" from a technical level.

At the press conference a year ago, Meta demonstrated many so-called "metaverse experiences", including sports and fitness, attending concerts... but they were all special effects pictures rendered in post-production, and there was hardly any real experience running on the Quest. machine demo.

When Meta's metaverse application HorizonWorlds landed this year, the effect it showed was "car crash-level".

A screenshot of Zuckerberg's "metaverse" was mocked online | Twitter

A screenshot of Zuckerberg's "metaverse" was mocked online | TwitterWhen the app launched in Europe, the Meta team shared an image on social media of Zuckerberg posing with the Eiffel Tower in the Metaverse. Whether it's Zuckerberg's avatar or the modeling of objects in the background, it looks rough and weird. Soon this picture was "group ridiculed" by the entire technology community, and some game media commented that Meta was equivalent to using VR to re-enact an old game "Second Life" in 2003.

In the face of brutal technological constraints, Meta's "metaverse ideal" is like a bird that can't fly and slams to the ground. Moreover, the hardware performance of VR is very dependent on upstream technologies such as computing power, display, and sensors. It is difficult for Meta to “mutate” the technology by throwing money at it.

At the beginning of the year, news broke that Zuckerberg started using QuestVR to meet in the Metaverse more frequently after the company changed its name to Meta. Therefore, many Meta employees also purchased their own hardware for "office" during the period of working from home. They may know better where the root of the problem lies.

According to Meta’s second-quarter financial report, its Metaverse division, RealityLab, had total revenue of $1.146 billion in the first half of 2022, a year-on-year increase of only 36%, accounting for 2% of the entire parent company’s revenue. The loss of this part of the business is also expanding, and the growth rate is comparable to the revenue growth rate.

Not surprisingly, Meta has lost tens of billions of dollars in the metaverse this year, which is not a big problem.

The social business of 'backyard fires'

Meta's journey into the metaverse may still be a long way off, but a bigger problem has arisen. The company's engine of forward navigation, its core advertising business, is stalling.

In the second quarter of 2021, Meta experienced the first revenue decline in its history, with second-quarter revenue of $28.8 billion, down 1% year-over-year. Profits shrank even more sharply, to $6.7 billion, down 32% year-over-year and falling for three consecutive quarters.

One of the reasons for the drop in revenue is a weak advertising market. Not only Meta, but almost all social media companies based on advertising models have been affected, including Google, Twitter, and Snap, which have experienced slowing or even declining revenue growth.

In Meta, the most intuitive reflection is the unit price of advertisements, which dropped by 14% year-on-year. Meta's advertising system is based on social networks and focuses on "precise delivery". Generally, the unit price is relatively high, but the effect is good. In the second quarter of 2021, Meta's advertising unit price has achieved a year-on-year increase of 47%.

Apple's iOS system tightens privacy policy, which greatly affects social platform advertising business | Embryo

Apple's iOS system tightens privacy policy, which greatly affects social platform advertising business | EmbryoHowever, with the update of the iOS system in April 2021, the app's tracking of users is limited, resulting in the inability of Meta's advertising system to achieve the accurate push effect as before. Coupled with the overall weakness of the market, it ultimately affected the unit price of advertising, resulting in a weak overall business.

Behind the weak advertising business, there is a problem with the basic disk of the Meta social network.

If I had to sum up Facebook's entrepreneurial history in one word over the past 20 years, it would be "growth." For a long time, Facebook's corporate motto was "move fast and break things", emphasizing fast trial and error, finding the best growth path through user feedback, and using explosive growth to cover up those insignificant flaws.

But now, the era of growth is a thing of the past.

Today, Meta's three major social platforms, Facebook, WhatsApp, and Instagram, have nearly 2 billion daily active users. In the past two quarters, the growth of Meta's daily activity has stagnated in volatility, slowly approaching 2 billion, and it is difficult to make a bigger breakthrough. After all, the combined population of the regions where Meta does business is only that much.

In addition to the number of users that are no longer growing, the real hidden danger is engagement and usage time.

With massive popularity, Facebook has been losing the "magic" of its early appeal. Especially for young people, their parents and family members are on Facebook, and using Facebook is easy to be regarded as an old-fashioned behavior. They prefer to try some new, niche social media like Snapchat.

TikTok quickly occupied the young market in Europe and America|MillValleyNews

TikTok quickly occupied the young market in Europe and America|MillValleyNewsMost niche social media never shook Facebook's position until 2019, when TikTok emerged in the US. The rich and fast-paced content on short video platforms has greatly affected the attractiveness of traditional social media to users.

This forced Meta to make drastic changes to social products.

In April, Zuckerberg said the company was improving engagement by changing the way users view content. Both Facebook and Instagram show users more algorithmically recommended content, not just content they follow. At present, about 1/6 of the content in user information flow comes from algorithm recommendation. Meta plans to increase the proportion of algorithm recommended content to 1/3 by the end of 2023.

Using algorithms to push content is clearly imitating TikTok’s product strategy. In addition, Instagram also directly imitated TikTok and launched the short video function Reels. Data from the most recent quarter showed that Reels saw a 30% increase in user time spent.

Meta is carrying out a comprehensive imitation of TikTok, but imitation can only be a defensive measure after all, and it cannot change TikTok's "burning prairie" in the United States, especially in the youth group. When TikTok grows further and its advertising business develops in depth, the competition between the two will only intensify.

For Meta, this may be the battle of life and death to face in the future.

hemostasis for survival

Regardless of the new business or the basic market, Meta's partial bleeding is gradually falling into an irreversible situation.

Since changing its name last year, Meta's share price has fallen by 60% in less than a year. The current market value of less than 400 billion US dollars is far behind giants such as Apple, Google, Microsoft, and Amazon.

The response given by Meta is "save".

In September, according to insiders, Meta plans to cut expenses by at least 10% in the coming months. To achieve this goal, Meta will take a series of measures, including reducing management costs, cutting outsourcing budget, reform and restructuring of non-business departments, and layoffs.

This summer, Meta management has publicly discussed stopping hiring and has announced that it will focus resources on "the most critical priorities" and improve core operating metrics. In July, Meta fired 368 outsourced workers at its California headquarters, including some security personnel.

A bigger change is the divisional restructuring.

For example, Meta is breaking up the company's internal AI lab and assigning people to various product groups. This means that those AI scientists and developers must transform from "research talents" to "engineering talents" to solve more specific problems, rather than just doing some generalized theoretical and technical research.

Such a reorganization is bound to bring about personnel upheaval. Jerome Pesenti, vice president of research at MetaAI, announced his departure from Meta shortly after the restructuring was announced. He was with Meta for 4 years and was responsible for developing Meta's AI supercomputer.

For more employees who do not want to leave, in order to change jobs, they have to conduct a "secondary job search" within the company. For employees whose positions have been cancelled, in order to avoid the spread of layoffs, large Silicon Valley companies such as Meta will provide employees with a period of "transfer period". Employees can apply for jobs internally. Only employees who cannot find a new job after the expiration of the period will be hired fired.

In the past, it was not difficult to transfer jobs. Only those employees who were particularly unattractive would fail to transfer jobs. However, with the intensification of internal turmoil in Meta and the cold external employment environment, the difficulty of transferring jobs is increasing day by day. Many employees with good internal reputation and high evaluations have to leave Meta because of the dismissal of the department and the failure of the transfer.

Zuckerberg walks past attendees wearing Samsung VR headsets at MWC 2016 | Network

Zuckerberg walks past attendees wearing Samsung VR headsets at MWC 2016 | NetworkSome Meta insiders told the media that through departmental reorganization, pressure on the inside, increase the difficulty of transfer, and accelerate the "natural resignation" of employees is a means of layoffs in disguised form. Meanwhile, Meta's management is stepping up performance management, asking middle managers to identify underperforming employees and place them in a "performance improvement plan." In Silicon Valley, entering an "improvement plan" is usually a prelude to leaving.

Cost-saving pressure can be said to be everywhere. Recently, Meta is planning to launch a "flexible work" system, which will no longer provide fixed work places, but let employees apply for reserved work places on their mobile phones before going to work. In this way, the total number of workstations is reduced, office space and management costs are saved.

The relevant news was quickly opposed by employees on the intranet, but this also seemed to be "driving people out". According to insiders, the current series of measures taken by Meta are only the prelude to the next larger layoffs.

At an all-hands meeting in June, Zuckerberg bluntly said, "There may be some people in the company right now that shouldn't be here."

From the ideals of the Metaverse to the fundamentals of the core business; from the company's stock price performance to the career future of grassroots employees, Meta is going through a long dark night with no end in sight.

Everything may be staged, just a slightly violent bump, but it may also be the beginning of the sinking of this giant ship.

The scariest part of the night is that no one knows when the dawn will come.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~