your current location is:Home > Finance > depthHomedepth

After ending churn, Netflix is now more focused on revenue

(Note: Netflix now pays more attention to revenue and profitability)

(Note: Netflix now pays more attention to revenue and profitability)After its first churn of subscribers and a big plunge in its stock price, it looks like streaming giant Netflix has finally come out of the dark stages of the first half of the year and is back on the road to subscriber growth. After getting out of the trough, Netflix is quietly transforming its focus: from user growth to revenue growth, changing its thinking to embrace advertising, and realizing revenue diversification.

End user churn

Netflix's earnings report on Tuesday certainly got investors excited. Netflix's revenue for the quarter rose 5.9% year over year to $7.926 billion, beating consensus estimates of $7.85 billion. Net profit for the quarter fell 3.5% year-on-year to $1.398 billion, but also beat market expectations. Both core financial indicators were higher than market expectations.

However, investors are not most concerned about financial metrics, but net subscriber additions. Netflix added 2.41 million net subscribers globally in the third quarter, almost twice and a half as expected. In July of this year, Netflix predicted that it could add 1 million net subscribers in the third quarter, while Wall Street had expected a net addition of only 1.09 million subscribers.

In addition, Netflix also gave an optimistic forecast for user growth in the fourth quarter, predicting that there will be 4.5 million net additions in the current quarter, exceeding market expectations of 4 million. Netflix believes that lower-priced plans with ads and a crackdown on shared accounts will bring more subscribers to the company.

At the end of the third quarter, Netflix had more than 223 million total global subscribers, an increase of 4.5% year-over-year. And every market achieved net user growth in the quarter. Among them, 1.43 million new users were added in the Asia-Pacific region, which once again became the growth driver of Netflix. It is worth mentioning that even the U.S. and Canada markets, which had lost the most before, also resumed growth, with a net increase of 100,000 users in the quarter.

Stimulated by the positive earnings report, Netflix shares soared 14% after the bell on Tuesday. After hitting a bottom of $162 in July, Netflix's stock price has steadily recovered to the current price of $270 in the past three months, but it is still far from the all-time high of $700 at the end of last year, and it is still at the share price three or four years ago. Level.

The more important significance of this earnings report is that Netflix has finally ended the user loss momentum in the first half of 2022. "After a challenging first half, we believe Netflix is on a path to re-accelerate growth," Netflix founder and co-CEO Reed Hastings said after the earnings release.

Netflix credits the return of subscriber growth in the third quarter to the launch of several blockbuster new shows, including "Stranger Things 4" and "Monster: The Jeffrey Dahmer Story." In fact, the turnaround in Netflix's business has been evident since the second quarter. User churn has improved significantly in the quarter. The scale of user churn (1 million) is only half of the previous forecast (2 million), and it is expected to grow again in the third quarter.

(Note: Netflix's price increase over the years and global user growth chart)

(Note: Netflix's price increase over the years and global user growth chart)Stocks plummet, forcing layoffs

The past two years have been the dark days of the global new crown epidemic, but Netflix has ushered in the best time, with a cumulative increase of more than 60 million new users in the two years, and the total global subscribers exceeded 200 million. Driven by the strong growth of the user base, Netflix's share price has also skyrocketed, becoming the "epidemic stock" with the most eye-catching share price growth in the past two years, and its market value once exceeded 350 billion US dollars.

But this high-speed growth suddenly hit the brakes after entering 2022. The number of Netflix subscribers fell by 200,000 and 1 million in the first two quarters of this year, respectively. This is the first time Netflix has suffered a loss of subscribers since launching its streaming business in 2007.

From a content production perspective, Netflix hasn't done a bad job over the past year. They were nominated for 27 Oscars this year, leading Hollywood studios for the third year in a row. "Squid Game" produced by Netflix not only set a new high in viewership, but also won two of the most important awards at this year's Emmy Awards: Best Director and Best Actor. At least eight of the top 10 TV shows on U.S. streaming platforms are from Netflix.

Why does Netflix experience subscriber churn? At the time, the company’s two co-CEOs attributed the problems to several reasons: slowing growth in smart TVs, user-sharing accounts, increased competition in the streaming market, inflation, and withdrawal from the Russian market (loss of 700,000 users), among others.

Users sharing account passwords is also a headache for Netflix. Netflix estimates that at least 100 million people worldwide log in with existing user accounts, with 30 million in the U.S. and Canada alone, costing the platform nearly $9 billion a year. In order to plug this loophole, Netflix began experimenting with a policy requiring users to pay extra to share accounts in several Latin American markets in the first quarter of this year, and plans to fully implement it next year.

While Netflix sees the loss of subscribers as short-lived, the market is showing panic selling. On April 19, just after the first-quarter earnings report, Netflix stock plunged 35%, wiping $50 billion off its market value in a single day. Just a month later, Neftlix shares fell below $200, a 70 percent drop from its all-time high late last year.

On the one hand, there is the loss of users, and on the other hand, the stock market declines. Since the end of April, the Federal Reserve has successively launched historic interest rate hikes to combat inflation at a four-year high. In the volatile U.S. stock market, Netflix became the technology stock that fell the most. Not only did it give back all the gains during the epidemic, but it also fell back to the stock price level in 2018.

The slump in the stock price has dealt a heavy blow to Netflix's employee morale, as it directly relates to the stock option portion of their compensation. While Netflix executives felt the market was overreacting, they also had to make series internal adjustments for cost control. Netflix cut hundreds of jobs in the second quarter, cut staff in its animation division and leased some of its office space. This was unimaginable in the previous period of rapid growth.

(Note: Netflix will launch a $6.99 ad-supported package next month)

(Note: Netflix will launch a $6.99 ad-supported package next month)Change Concepts and Embrace Advertising

Just before the results were released, Netflix also announced the long-awaited news: starting next month, the basic plan with ads will cost $6.99 per month, which is $3 lower than the current minimum plan of $9.99. This is the first time Netflix has accepted advertising since the launch of its streaming business, and it also means a major business model transformation for Netflix. Moreover, Netflix will be a direct competitor to Google YouTube.

Users who choose the $6.99 ad package will see 4-5 minutes of ads every hour, with ad breaks before and during the video. But surprisingly, Netflix's ad tech partner chose Microsoft, which doesn't have much presence in online advertising, rather than industry giant Google.

Hastings, the founder of Netflix, is known to hate ads because it ruins the user experience, which is the main reason Netflix has previously refused to launch plans with ads. As long as you buy a package, all the great content is served at once, without the interruption of advertising, which is the secret of Netflix's success. Even the trump card American dramas like House of Cards, Netflix does not hesitate to offer them one at a time, and never engages in such tricks as distribution release or advance release.

For the past 15 years, Netflix has resisted advertising, and Hastings has been unimpressed even as other streaming platforms offer low-priced or even free tiers with ads. Perhaps Hastings also doesn't want his company to compete in the advertising market with Google and Facebook, two Internet advertising giants he previously sat on the board of directors.

Hastings believes that users who buy a plan don't like seeing ads. When Netflix launched its streaming service, the world was still in the age of cable TV, where users not only paid for cable, but also watched up to 15 minutes of commercials per hour on average. And Hastings' marketing positioning for Netflix is, "It's all on Netflix, no ads." Until January 2020, Hastings also publicly stated to analysts that one of the reasons users choose Netflix instead of cable TV Just no ads. He stressed at the time that Netflix would be more focused on attracting more subscribers.

However, Netflix soon found the market increasingly competitive. In just two years, 2019 and 2020, formidable competitors such as Disney+, HBO Max, and Paramount+ have entered the market. Not only do they have a solid source of content, they're cheaper than Netflix, and they even have a free tier for watching ads. Perhaps Netflix at the time also felt the market threat, but the arrival of the new crown epidemic changed the tide of the streaming media industry and made Netflix let go of its vigilance. Streaming platforms have grown rapidly over the past two years, with Netflix adding more than 60 million subscribers.

Netflix believes in the user stickiness of its platform. According to data from market research firm Antenna, Netflix's previous subscriber churn rate was only 2% for a long time, only half of the streaming industry average. It is out of confidence in user stickiness that Netflix raises prices every 18 months. In the past nine years, the price of Netflix's basic package has risen from $7.99 to $15.49, and the price has risen three times in a row in the past three years, from $12.99 before the epidemic to $15.49. Perhaps Netflix overestimated the loyalty and willingness of its own users to increase prices.

Things are starting to change as early as the end of 2021. Antenna's survey data shows that now more than 20% of Netflix's new US subscribers will cancel their subscription after one month. This churn rate shows that Netflix has not been much different from other streaming media platforms, and both face cruel price and content comparisons. compete.

It wasn't until the first quarter of this year that Netflix management felt the crisis. On March 16 this year, when Netflix held its annual meeting at the Hilton Hotel in Anaheim, California, many middle and senior executives felt the problem for the first time: The CEO and CFO, while showing the strong growth performance of the past year, euphemistically revealed the current situation of stagnant growth. .

That same month, Netflix CFO Newman intriguedly said, "Never say never," when asked about the advertising business at an investor conference. And as a month later, Netflix's stock price plummeted due to the loss of users, Hastings, the most resistant to advertising, finally changed his attitude and announced plans to launch an advertising business in the next year or two.

(Note: "Knives Out 2", which is currently being shown in North American theaters, is produced by Netflix)

(Note: "Knives Out 2", which is currently being shown in North American theaters, is produced by Netflix)Shifting focus to revenue growth

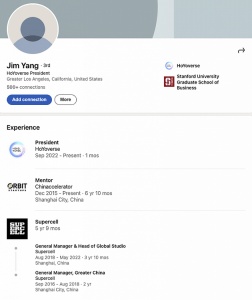

However, just after Netflix's net subscriber additions returned to growth, the company hopes the market will stop focusing too much on user growth metrics and focus more on profitability and sustainability. It appears that the first movers and leaders in the streaming industry are now more focused on revenue than their rivals.

Netflix said after the release of its earnings report that it will no longer provide expectations for net user growth from next year, and will only continue to provide regular performance expectations such as revenue and profit. "We are increasingly focusing on revenue as our primary metric," Netflix wrote. "This will become even more important in 2023 as we develop new revenue models such as advertising and paid sharing."

In addition, Netflix also plans to expand its game business. It plans to add 55 games to the current 35 games, and expand its game business revenue through in-app purchases and advertising.

Netflix is still the leader in the streaming media industry, with 700-800 content releases per year and more than 223 million users worldwide. In the key US and Canadian markets, Netflix has 73.39 million people, accounting for 8% of US TV viewing rates. These The data far exceeds that of competitors such as Disney, HBO, and Paramount.

Netflix executives still believe in future user growth, and believe that the subscriber base can reach at least 500 million. Even in the United States, where streaming media platforms are popular, the market share of cable TV relative to streaming media is still as high as 65%, which means that there is still huge room for growth in streaming media.

Netflix co-CEO Ted Sarandos reiterated after the earnings report that the company plans to spend $17 billion on content production this year, but is also working to make spending more rewarding. Netflix is ahead of its competitors in finding a model for how to create content and monetize it. There will also be a major transformation in the streaming industry as competitors stop investing and focus on profitability.

"It's hard to build a massive and profitable streaming business, and we expect all other competitors to lose money on streaming," he said. "The entire streaming industry will have an operating loss of more than $10 billion this year, and Netflix has been able to Achieving an operating profit of $5 billion to $6 billion.”

A more significant transformation may be yet to come, as Netflix is considering synchronizing its own content into offline theaters, according to an internal memo in June. Not only can this bring huge box office revenue to Netflix, but it can also attract more theater audiences to the online platform. This is also an important strategy HBO Max used to attract new users. The suspenseful blockbuster "Knives Out 2" currently in theaters in the United States is produced by Netflix.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~