your current location is:Home > investHomeinvest

The reduction of holdings accelerated, Buffett reduced his holdings of BYD 11.58 million shares in 6 trading days and accumulated a total of 4.8 billion Hong Kong dollars

BYD shares (01211.HK) were reduced by Warren Buffett.

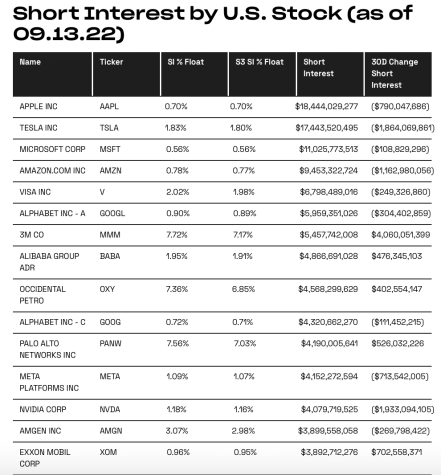

On September 2, the latest information disclosed by the Hong Kong Stock Exchange showed that Berkshire Hathaway, a subsidiary of Buffett, sold 1.716 million H shares of BYD shares on September 1, with an average selling price of HK$262.72 per share. Cashed out approximately HK$451 million.

After this reduction, the number of BYD shares held by Berkshire Hathaway dropped to 200 million shares, and the shareholding ratio was lowered from 19.02% to 18.87%.

Image source: Official website of the Hong Kong Stock Exchange

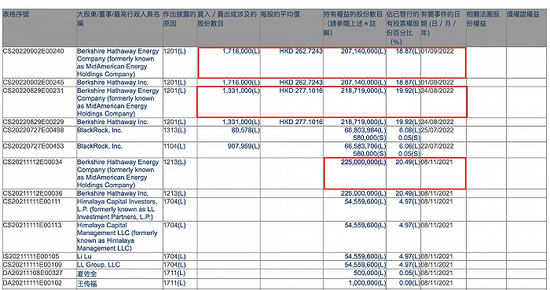

Image source: Official website of the Hong Kong Stock ExchangeOn August 30, the Hong Kong Stock Exchange disclosed that Berkshire Hathaway sold 1.33 million BYD H shares on August 24 at an average price of HK$277.10 per share, cashing out nearly 370 million. Hong Kong dollar.

Once the news of the reduction was disclosed, it caused an uproar in the market. On August 31, BYD's A shares and H shares both dived sharply at the opening. Among them, A shares fell by over 8% at the highest intraday price, and closed down 7.36% to 287.98 yuan per share on the same day, with the total market value shrinking by nearly 41.5 billion yuan; while the Hong Kong stock market In the middle, it fell by up to 13%, and finally closed down 7.91% to HK$242.20 per share on the day, with the total market value shrinking by nearly HK$22.9 billion.

Earlier, Yan Zhaojun, a strategic analyst at Zhongtai International, said in an interview with Jiemian News that "it does not rule out the possibility that Buffett is already reducing his holdings every day." This can also be seen from the continuous decline in Citi's holdings within the CCASS system.

In Yan Zhaojun's view, "Buffett's share of BYD has not changed in the past 14 years, and the reduction in his holdings should be because he sees changes in long-term fundamentals or the valuation has significantly deviated from intrinsic value."

Looking back at Buffett's reduction process, in July this year, Citibank's shares of BYD increased by 225 million shares. Because this amount is consistent with the shares of BYD held by Berkshire Hathaway Energy Company founded by Buffett, market participants have speculated. Buffett will reduce his stake in BYD.

Then with the disclosure of the information of the Hong Kong Stock Exchange, Buffett's reduction behavior "surfaced." Berkshire Hathaway accumulated 6.281 million YD shares in the nine trading days from August 12 to August 24 this year, and the proportion of YD’s H shares fell from 20.49% to 19.92%; In the 6 trading days from August 25th to September 1st, 11.579 million shares were reduced, and the shareholding ratio was further reduced to 18.87%. It can be seen that Buffett's reduction pace is gradually accelerating.

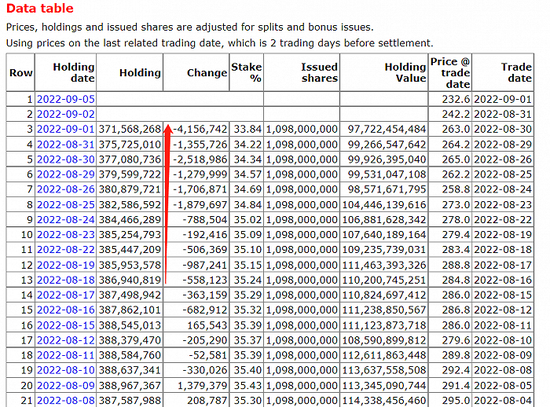

This is also roughly the same trend as Citi's holdings. Data shows that since the beginning of August, the number of BYD H shares held by Citibank has been decreasing, especially since August 25, the rate of decline has accelerated significantly. As of September 1, the number of BYD H shares in the flag bank seat has dropped to 372 million shares, a cumulative decrease of nearly 17 million shares since August 12.

The number of BYD H shares with Citibank seats Image source: Official website of the Hong Kong Stock Exchange

The number of BYD H shares with Citibank seats Image source: Official website of the Hong Kong Stock ExchangeCalculated on the basis of the average price of HK$277.10/share and HK$262.72/share disclosed by the Hong Kong Stock Exchange, the return on Buffett’s first two rounds of reductions was 34 times and 32 times respectively. After the cumulative reduction of 17.86 million shares, he has cashed Nearly 4.8 billion Hong Kong dollars.

After the sale of BYD shares, Buffett still holds nearly 207 million shares of BYD shares. Based on today's closing price of HK$228.4 per share, the market value of the holdings is as high as HK$47.279 billion, with a return on investment of nearly 28 times.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~