your current location is:Home > TechnologyHomeTechnology

US Social Media Myths Busted: Who's to Blame?

according to reports, after 10 years of rapid growth in social media advertising in the United States, it has now come to an abrupt end. Who killed the industry?

As the "blame game" kicked off in Silicon Valley, both Meta founder Mark Zuckerberg and Alphabet CEO Sundar Pichai noted on a conference call last week that the global economy Clearly overcast.

Today, however, the weakest signals are concentrated on social media platforms.

According to market research firm eMarketer, U.S. advertisers will spend $65.3 billion on social networks such as Facebook, Snap and Twitter this year, up just 3.6 percent from a year earlier and one-tenth of the pace in 2021.

To what extent will social media growth slow down in 2022? It has been reduced to almost the same level as television and radio, which have been shrinking for years as representatives of traditional media.

Meanwhile, the big ad agencies have been spared the turmoil: WPP, Omnicom, Publicis and Interpublic all raised their full-year forecasts. "Snap said in the first quarter that the ad industry was in recession," said WPP CEO Mark Read. "We haven't seen that yet."

So, who is killing the rapid growth of social media?

big advertiser

With the U.S. economy turning, high inflation and supply chain congestion, some big advertisers are taking a cautious approach. Growth from big advertisers "remains challenging," Meta CFO David Wehner told analysts.

Phil Smith, director general of ISBA, a trade association representing UK advertisers, said marketers were "thinking twice" about everything from financial services to consumer goods. "Some things are hard to sell right away," he said.

Colgate said on Friday it would scale back marketing spending. But Coca-Cola and Nestlé did the opposite. Martin Sorrell, CEO of S4 Capital, pointed out that the digital advertising market is still expected to grow significantly in the coming year. "The rumors that digital advertising is dead are overblown," he said.

Social media platforms may have taken a hit because of their advertiser mix. Digital platforms rely more on aggressive publicity campaigns by venture-backed companies to grab market share, WPP's Reid said. “A lot of this type of financing has dried up.”

apple

Apple's privacy policy has also had an impact on the digital advertising industry.

CEO Tim Cook said last week that the new App Store ad business is "relatively small." Its rapid growth, however, coincides with new iOS privacy rules that cost Meta $10 billion in lost revenue last year.

Just last week, Meta accused Apple of "squeezing down other businesses in the digital economy...to make their business bigger."

However, Meta executives insisted on a conference call last Wednesday that the impact of Apple's app-tracking policy changes "diminished" in the third quarter when they developed new ad effectiveness measurement tools.

game

As interactive entertainment has grown over the past decade, game publishers have also become big advertisers on digital platforms. Mobile game developers are especially good at calculating returns on ads on Instagram or YouTube.

But Apple’s privacy policy adjustments have made it difficult for them to continue to calculate this return, and at the same time, many people have also returned to reality from the gaming world after two years of the epidemic.

In August, EA CEO Andre Wilson noted that mobile gaming is showing some signs of slowing down from a macro perspective. While the gaming industry has shown enough resilience in past downturns, this was before the rise of free-to-play mobile games.

The impact of this trend is already reflected in Apple and Google's App Store revenue, many of which are driven by social media advertising.

Apple CFO Luca Maestri said the gaming industry is showing "some signs of weakness" as the macro economy faces headwinds, which he expects to continue. Google's chief commercial officer, Philipp Schindleer, attributed "less user engagement in games" to lower Play Store sales: "This is putting downward pressure on our ad revenue."

e-commerce

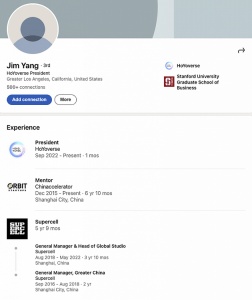

Retailers including Walmart and Target are quietly building their own digital marketing operations to keep up with Amazon. This clearly poses a threat to social media platforms.

Suddenly, advertisers have more opportunities to reach consumers. Search and banner ads also reach customers closer to the point of purchase, a factor that some marketers value.

So-called retail media outlets have also been relatively unaffected by the latest storm of privacy policy changes, as they do not rely on "third-party" data to track users across the web.

Analysts believe that some of Facebook's ad revenue goes to Amazon, Walmart and Target. Amazon said this week that its ad revenue rose 25% in the third quarter to $9.5 billion.

Zuckerberg

Meta is refusing to lower its investment in the Metaverse despite declining ad revenue. That has troubled Wall Street, with some investors and analysts even arguing that the founder is now the biggest threat to Facebook's longevity.

Analysts at MoffettNathanson even believe that Meta is no different from the traditional media that has been disrupted by tech giants over the past decade. "With each passing quarter, the claim that Meta is perpetually losing the competition has grown more credible," they wrote.

Evercore analyst Mark Mahaney questioned on a conference call last Wednesday that Meta executives had been slow to redevelop an ad-targeting tool that was stifled by Apple's privacy policy. "The financial impact is very significant," he said. "But on the conference call, I didn't see at all that they were making this a major investment."

Meta executives insist they have improved ad tech. But Zuckerberg himself did not mean to apologize. Notably, he was the last tech giant in Silicon Valley to have absolute control over the company, making it immune to investor anger.

"I just want to say that there's a difference between being experimental with something and not knowing how good it will end up being," he said. "I think people who are patient with us and keep investing in us, eventually Get rewarded."

Previous:NASA InSight detects meteorite hitting Mars

Next:Four years after another, will Apple's search engine be "stillborn"?

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~