your current location is:Home > Finance > NewsletterHomeNewsletter

IDC: Global smartphone shipments this year are expected to drop by 6.5% to 1.27 billion, with prices rising by 6.3%

IDC's latest report shows that this year's smartphone shipments are expected to decrease by 6.5% to 1.27 billion, and prices will increase by 6.3%. The main reason is that due to the influence of inflation and geopolitics, consumer demand has been greatly suppressed.

International Data Corporation (IDC)'s latest Worldwide Quarterly Mobile Phone Tracker shows that the latest forecast is down 3 percentage points from previous forecasts. However, analysts also said that the setback is only short-term, and the market will rebound in 2023, with an annual growth rate of 5.2%, and in the long run, the five-year compound annual growth rate (CAGR) can reach 1.4%.

Nabila Popal, research director of IDC's Worldwide Mobile and Consumer Device Tracker, said:

The supply constraints that have weighed on the market since last year have eased, and the industry has turned to a demand-constrained market. Channel inventory is high, demand is low, and there are no immediate signs of recovery, which has OEMs panicking and slashing orders for 2022. Events over the past 12 months have reduced our market forecast for the second quarter of 2021 by 150 million units. Average price (ASP) rose 10% year over year in the second quarter and is expected to grow 6.3% for the full year, despite declining volumes. Premium phones ($800+) have proven resilient in the midst of economic turmoil, increasing their share of the overall smartphone market by 4 percentage points to 16% and continuing to grow. That includes foldables, the fastest-growing segment right now, with shipments expected to grow 70% year-over-year to 13.5 million units by 2022.

there may be large differences in terms of regions. IDC believes that the North American market is less affected, while the Chinese market, Central and Eastern Europe and other regions are more affected.

Central and Eastern Europe (CEE) will decline by 17.4% in 2022, while Asia Pacific (excluding Japan and China), which was previously forecast to grow by 3.0%, is expected to decline by 4.5% in 2022. However, the biggest drop in sales is in the Chinese market, where sales are expected to drop by 12.5% to about 41 million units, accounting for nearly half of this year's overall sales decline. In contrast, developed markets such as North America (US and Canada) and Western Europe are expected to perform much better in 2022. The U.S. market will be relatively flat, up 0.3% year-on-year, while the Canadian market will be slightly better, up 3.2% year-on-year, and the Western European market will decline only slightly by 0.7%.

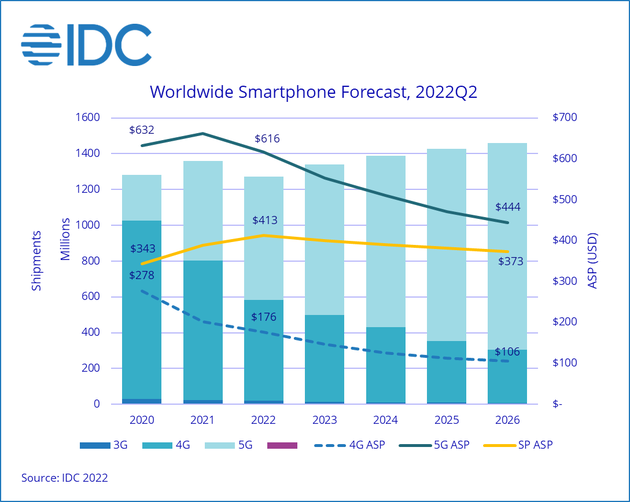

IDC believes that in 2022, global 5G device shipments will grow by 23.6% year-on-year and account for more than half (54%) of all shipments with 688 million devices and an ASP of $616.

In the long term, 5G models are expected to reach 79% market share in 2026, with an ASP of $444. In contrast, 4GASP will reach $176 in 2022, and IDC believes the damage will drop to $106 by the end of the year. As a result, overall smartphone ASP will drop from $413 in 2022 to $373 in 2026.

"The resilience of the upper market is a testament to the success of iOS, which has not seen a decline in full-year iOS shipments since 2019," said Anthony Scarcella, research director in IDC's Worldwide Mobile and Consumer Device Tracker group. "Despite the overall market Declining, but iOS shipments will maintain growth of 0.5% in 2022. Also, the operating system will show minimal growth throughout the forecast period, with asp hovering above $950. As for the world's most popular operating system, Android, in 2022 2020 will see a decline of nearly 8%, but will rebound strongly with 6.2% growth in 2023. Unfortunately, the low-end segment will not fare well in 2022, with android devices under $200 taking the first place in shipments The quarter and second quarter were down 22.4% and 16.5%, respectively. The good news is that sales of devices above $1,000 were up 35.2%, thanks to the success of high-end flagships and recent foldables in the market.”

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~