your current location is:Home > Finance > NewsletterHomeNewsletter

The aftershocks of the currency circle continue! FTX "sells itself" to trigger a liquidity crisis and the collective decline of encrypted assets

In the European market on Wednesday (November 9), cryptocurrencies continued to decline, as Binance's acquisition of FTX exchange raised financial doubts, causing more concerns about the liquidity of cryptocurrencies.

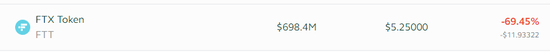

According to BitStamp's quotation, as of press time, the FTX ecological token FTT was reported at $5.25000 per piece, a drop of nearly 70% in the past 24 hours, and a drop of nearly 80% at one point.

(Source: BitStamp)

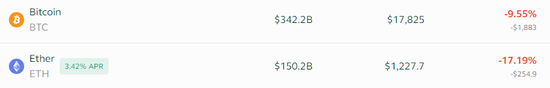

(Source: BitStamp)The decline also spread to other cryptocurrencies. Bitcoin fell 9% to $17,610 after falling more than 10% earlier; Ethereum fell 17% after falling more than 20% earlier.

(Source: BitStamp)

(Source: BitStamp)Yesterday, Binance founder Changpeng Zhao announced on social media that Binance signed a non-binding letter of intent to acquire cryptocurrency exchange FTX. At the same time, Sam Bankman-Fried (SBF), founder of the FTX exchange, also confirmed the news.

Media analysis pointed out that both parties are "giants" in the industry, and the acquisition will completely integrate the power of the cryptocurrency world, subvert the encryption ecosystem, and have a profound impact.

However, it should be pointed out that this letter of intent is not binding, making the market uneasy about the prospect of fulfilling the transaction, and FTT, which once turned upward, returned to the slump mode.

Prior to this, some media pointed out that Alameda Research, an encrypted quantitative trading company under SBF, held a large amount of FTT, which caused investors to worry about the liquidity of the cryptocurrency and began to withdraw funds in a stampede manner.

Although two days ago, SBF swore that the assets on FTX were "very good", but "selling" Binance the next day was equivalent to confirming this rumor. Analysts said that while the collapse of FTX was only a short-term liquidity event, it once again showed the risks implied by the lack of transparency in the cryptocurrency.

Separately, the FTX crisis is particularly reminiscent of the bloody UST and Luna coin crashes earlier this year, when a South Korean court issued an arrest warrant for 31-year-old Do Kwon.

It is worth mentioning that SBF is the same age as Do Kwon, while Vitalik, the founder of Ethereum, is only 28 years old, which makes the outside world pay attention to the "younger" of the encryption industry. Some netizens commented, "Do you really want to save your life? Bet on these post-90s?"

In addition, the voting results of the U.S. midterm elections as of press time show that Democrats will retain control of the Senate with a high probability of 50-50, which may accelerate the regulatory action on cryptocurrencies.

At the same time, the Republican Party, who originally bet on risk assets, failed to win a big victory, and the yields of the US dollar and US bonds rebounded significantly, putting pressure on encrypted assets during the day.

Previous:Meta has laid off more than 11,000 people! Zuckerberg apologizes to employees, says he screwed up

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~