your current location is:Home > Finance > depthHomedepth

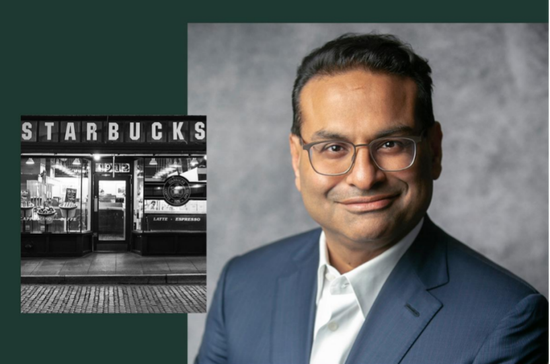

"Injecting" Asian CEOs into the Cup of Starbucks

Three months after casting a wide net around the world, Starbucks has found a new "head".

On September 2, local time, Starbucks announced the appointment of 55-year-old Indian-American Rushman Narasimhan as the company’s chief executive officer. Just the day before, Reckitt Benckiser announced that Narasimhan will return to work in the United States for personal reasons and will resign as CEO of the company at the end of the month.

It seems that Reckitt Benckiser was dug into a corner by Starbucks.

According to foreign media reports, Starbucks offered Narasimhan an annual salary of $1.3 million and an annual bonus of $2.6 million, and paid Reckitt Benckiser’s severance loss. In addition, Narasimhan will be eligible to receive annual equity awards worth $13.6 million from fiscal 2023.

In addition, Starbucks said Narasimhan is known for his extensive operational expertise, proven track record in developing purposeful brands, and future ambitions by driving consumer-centric digital innovation.

Digital transformation has been Starbucks' key strategy in recent years. In 2017, Howard Schultz, the "soul man" of Starbucks, pushed Kevin Johnson to the top, precisely to let the latter lead Starbucks to achieve digital transformation.

However, in terms of current development alone, compared to the new coffee brands born in the digital age, Starbucks’ performance is still much inferior.

According to Luckin’s financial report, the company’s net income in the second quarter of 2022 was 3.3 billion yuan, a year-on-year increase of 72.4%. In contrast, Starbucks China's revenue in the third fiscal quarter of 2022 was US$540 million, a year-on-year decline of 40%, passenger traffic fell by 43%, average customer unit price fell by 1%, and same-store sales fell by 44%.

Since the Chinese market is one of the most important markets for Starbucks in the world, and it is also a market that is rapidly iterated by various digital means and new consumer brands, it is clear that it is very important for Starbucks to succeed again in this market.

On September 14, Starbucks released the 2025 China strategic vision at the global investor exchange meeting, proposing that by 2025, the number of Starbucks China stores will reach 9,000, covering 300 cities, with 95,000 partners (employees), doubling net income and operating Profits are four times the current growth target. Combined with the goals, Starbucks has proposed six growth engines: building multi-modal stores oriented to customer needs; pursuing omni-channel service expansion; upgrading member experience; developing home coffee and out-of-home coffee; expanding products.

Once, around the secret of Starbucks' success, Schultz summed up four words-injecting the heart. It seems that, for the sake of this "less popular" Starbucks, he has planned to change the formula and inject an Asian CEO into it.

01

From the resume, Narasimhan is a standard professional manager.

According to public information, he first obtained a bachelor's degree in mechanical engineering in India, a master's degree in German and international studies at the University of Pennsylvania, and then an MBA from the Wharton School. Narasimhan joined McKinsey in 1993, where he led the consumer, retail and technology businesses in the US, Asia and India. He joined PepsiCo in 2012 and rose through the ranks to the company's Chief Commercial Officer, responsible for R&D, e-commerce, design and global accounts and strategy. In 2019, he took over the CEO position of Reckitt Benckiser from his fellow Indians.

It is widely believed that Schultz is looking for Narasimhan's ability and determination in the digital field.

Just like the concept of "third space", Starbucks regards the online business under digital transformation as the "fourth space", maintains connection with customers with various creative content, and derives the experience in the store outside the store. The coffee culture represented by Starbucks permeates every aspect of consumers’ lives, meaning stickier brand loyalty.

Originally, this plan could be advanced in a rhythmic manner.

2018 was the peak of Starbucks, with an annual revenue of $24.7 billion and a profit of more than $4.5 billion. There is no rival in the coffee market. Under the thriving situation, Schultz resigned as the company's executive chairman with peace of mind, handed over the management to Johnson, and fully supported the latter to lead the company's digital transformation, while enjoying his retirement.

But the outbreak of the new crown epidemic has disrupted the rhythm of Starbucks.

After the global outbreak of the epidemic, Starbucks has repeatedly faced the dilemma that offline stores have been operating intermittently. Although the single product Starbucks sells is coffee, the real popularity of Starbucks in the world depends on the "third space" culture created by the company - the sense of belonging provided by physical stores to consumers is the most selling point and attractiveness of Starbucks compared with its peers. The magic weapon of power. The epidemic has made Starbucks' leisurely and comfortable offline space often useless, and the store's customer flow has naturally declined.

In order to stabilize investor confidence, Starbucks announced a stock review plan of up to 10 billion US dollars.

In addition, the "zero yuan purchase" and other riots and the lack of epidemic prevention and control measures have intensified the labor-management conflict at Starbucks in the United States: Starbucks, which has not had a labor union for many years, created its first labor union, and "era Z" employees frequently posted short videos such as TikTok. On the voice of the complaint, all kinds of "outrageous" clips recorded by Starbucks employees have frequently become Internet hotspots.

In April, Johnson abruptly announced his retirement after five years in office. To stabilize the situation, Schultz had to come out for a third time as Starbucks' interim CEO, ensuring seamless management of the company until a replacement was found.

At that time, Schultz announced a series of measures to ease labor disputes, suspended the stock buyback program, and emphasized that Starbucks "must transform again for a new and exciting future."

It is reported that Schultz will serve as an adviser to Narasimhan after taking office and will remain on the company's board of directors. Compared with the previous resignation of all real positions and the complete delegation of power to Johnson, Schultz is relatively cautious this time. After all, dealing with the severe inflation situation and tense labor relations will take time for the experienced "airborne soldiers" to adapt.

At Starbucks, only Schultz can show up to stabilize the situation. Although his self-effacing is currently only a transition, it can be expected that he will be the real helm of this "coffee empire" for some time to come.

02

The United States and China are the two most important markets for Starbucks, and Narasimhan is no stranger to both.

Needless to say, in the US market, he also has outstanding performance in the Chinese market. As the CEO of Reckitt Benckiser, Narasimhan visited China, visited a number of customers, and conducted a comprehensive strategic assessment of the business in Greater China. Subsequently, Reckitt Benckiser sold its Mead Johnson China business to Primavera Capital for $2.2 billion. For this decision, Narasimhan gave reasons covering politics, economy, social culture and other fields, fully demonstrating his familiarity with the Chinese market environment.

At present, among the many problems facing Starbucks, how to regain the initiative in the Chinese market is definitely the most important one.

In 2017, Schultz publicly stated that Starbucks would "bet on the Chinese market", and he believed that China's hundreds of millions of consumer population could fully allow Starbucks to achieve double or even several times the development.

Directionally, Schultz was right. According to iiMedia Research, the market size of China's coffee industry in 2021 is 381.7 billion yuan, and it is expected to reach 485.6 billion yuan in 2022, and it is expected to exceed one trillion yuan in 2025.

The only thing Schultz did not expect was that the popularity of freshly ground coffee in the Chinese market was not accomplished by Starbucks, but by local Chinese brands represented by Luckin.

That is, in 2018, when Schultz gave way to Johnson, Luckin was born, relying on "store battles" and "price wars" to make subversive changes in China's coffee market. Consumers who were accustomed to the high price of coffee turned to affordable local brands under the advantage of price. White-collar workers reduced the frequency of entering coffee shops and became more and more accustomed to ordering coffee takeaway. It sprang up like mushrooms after the rain.

In 2020, when Ruixing’s financial fraud was exposed and it had to be delisted from Nasdaq, many people thought that the company was finished. However, in a short period of time, Ruixing used the means of stripping off the "Shenzhou Department" and debt restructuring to stabilize investors, while attracting consumers with private domain traffic and a steady stream of new products. The explosive product "raw coconut latte" has even sparked the "raw coconut wave" in the beverage industry in the past two years, selling 100 million cups a year.

As of this quarter, Starbucks operates 5,761 stores in 228 cities in China, while Luckin has 7,195 stores in China.

03

Luckin’s price war regardless of cost objectively cultivated a group of coffee consumers and led to the sinking of coffee consumption.

For a long time, Starbucks' stores in China have been concentrated in office buildings and shopping malls, symbolizing mid-to-high-end business status. Although coffee is "compulsive", the people who are willing to consume are in the tens of millions in terms of absolute scale. Ruixing’s price of more than ten yuan per cup directly pushes freshly ground coffee to the level of milk tea shops. All student parties and office workers who can afford milk tea can also have a cup of coffee every day. The scale of domestic coffee consumption groups was suddenly pushed to 100 million class.

Statistics show that as of June this year, there were about 425,000 tea shops and 117,000 coffee shops in China. The gap between the number of the two is extremely significant. Under the circumstance that the growth of tea stores is gradually slowing down, the industry regards coffee stores as a growth point, and major brands are pouring into the enclosure.

Some analysts predict that from 2020 to 2025, when the average annual growth rate of coffee consumption in the world is only 2%, the average annual growth rate of coffee consumption in China will be as high as 15%.

With a vast consumer group in front of us, the question thrown to Starbucks has become how to take over.

The "third space" theory that Starbucks adheres to makes it clear that what the brand provides is not just coffee, but culture and consumer experience, which also means high costs under high-standard operations. But in the Chinese market, Ruixing has proved that low prices and more products are another feasible way, or even a more efficient way. More and more brands are choosing to emulate Luckin instead of Starbucks.

For "China Hand" Schultz, the answer may be obvious.

In order to take the first place in the industry, Starbucks seems to have chosen to compromise, and unabashedly learned its strategy from its younger generation, Ruixing Coffee, including plans for 300 cities and 9,000 stores, which seems to be rushing to overtake.

Since there are 337 cities in China (2020 data), that is to say, within three years, Starbucks will cover nearly 90% of the country's urban markets, of which, except for 24 first- and second-tier cities, all are relatively sinking third-tier and below markets.

It's just that in most cases, sinking and low prices are two sides of the same thing. But at present, it seems that there is no price reduction in Starbucks' plan list. On the contrary, it just raised the price once in February this year.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~