your current location is:Home > Finance > depthHomedepth

FTX "dramatically" headed for collapse: The rise and fall of the "King of Cryptocurrencies"

According to reports, Sam Bankman-Fried (Sam Bankman-Fried) is the former boss of the cryptocurrency exchange FTX. In just 8 days, he fell from the "King of Cryptocurrency" to the company filing for bankruptcy, his resignation as CEO, and facing the US federal government's investigation into the company's financial situation.

Over the past few years, there have been many lengthy interviews with him on the Internet. He usually speaks via video chat from his office in the Bahamas. During some of these interviews, there is a disturbing click in the video.

The voice continued as people listened intently to his story of how he became a billionaire in five years. It was apparently coming from his mouse. "Click, click, click", the sound came out quickly and intermittently. Meanwhile, the eyes of Bankman-Fried on the screen falter.

It wasn't clear from the video interview what he was doing on the computer at the time, but what he posted on Twitter provided a good clue. In February 2021, he tweeted: "I'm famous for playing League of Legends on conference calls."

A former FTC boss, Bankman-Fried is an avid gamer. In a series of Twitter posts to his nearly 1 million followers, he explained why: Playing League of Legends was his way of relaxing, allowing him to temporarily forget about the two companies he was managing. The two companies have a daily turnover in the billions of dollars. "Some people drink, some people gamble, and I play games," he said.

The embattled FTX went down dramatically last week, and another anecdote about 30-year-old Bankman-Fried playing the game started to regain traction online.

According to a Sequoia Capital blog post, Bankman-Fried was battling through a game of League of Legends during a high-level video call with the investment team. However, this did not affect the investment interest of Sequoia Capital, which subsequently invested $210 million in FTX. This week, however, Sequoia deleted the blog post and announced that it would write down its investment in FTX as a loss.

Sequoia isn't the only investor that has suffered heavy losses since Bankman-Fried's $32 billion empire collapsed. There are an estimated 1.2 million registered users on the FTX platform, who buy thousands of cryptocurrencies, including Bitcoin, through the exchange. From large traders to ordinary cryptocurrency enthusiasts, many people are wondering if they can still get their cryptocurrencies back in the FTX digital wallet.

It's been a dizzying fall, and Bankman-Fried's rise is a tale of risk, reward and all kinds of anecdotes.

Bankman-Fried was a student at MIT. It is a world-renowned research university where he majored in physics and mathematics. He has said that it was what he learned in student dorms that put him on the road to cryptocurrency riches.

In an interview last month, he recalled his participation in the "High Altruism" movement. Participants in this community seek to explore what practical things people can do in their lifetime to make a positive impact on the world as much as possible. Influenced by this movement, he decided to enter the banking industry to make as much money as possible before giving back to charity.

He learned to trade stocks at Jane Street, a trading firm in New York. However, because of the boredom of stock trading, he then decided to try Bitcoin.

He noticed that there is a difference in the price of Bitcoin among different cryptocurrency exchanges, creating room for arbitrage. Investors can buy bitcoins from platforms with lower prices and sell them later on platforms with higher prices. After making a month of Weibo profits, he teamed up with some college friends to start a trading firm called Alameda Research.

It wasn't easy, says Bankman-Fried, who spent months perfecting the technology for moving money in and out of banks and across borders. After about three months, he and his small team saw the rewards.

"We're very tenacious," he said on a podcast a year ago. "We just keep going. If someone puts up a roadblock, we're going to figure out a way to fix it. If the existing systems can't handle it, we're going to develop A new system to tide over this difficult time.”

By January 2018, his team was making $1 million a day.

A reporter once asked him what it was like. He replied that, based on his methodology, from a rational point of view, "it makes perfect sense", "but deep down, it surprises me every day".

With another, more high-profile company, FTX, Bankman-Fried is officially a billionaire in 2021. FTX has gradually developed into the second largest cryptocurrency exchange in the world, with a daily trading volume of $10 billion to $15 billion.

In early 2022, with a valuation of $32 billion, FTX became a household name. The company has even named an NBA stadium and garnered support from celebrities like NFL star Tom Brady.

Bankman-Fried has always seemed happy to share his lifestyle with his Twitter followers. He often sleeps in a sleeping bag next to his desk, he said, accompanied by a picture of himself sleeping next to a trading terminal employee. In another early-morning post, he wrote: "Can't sleep, go back to the office."

Bankman-Fried's dream of donating huge sums of money to charities is also well under way. In an interview last month, he claimed to have donated "hundreds of millions of dollars."

His generosity was not limited to public good. In the past six months, the "King of Cryptocurrency" has received another nickname: "The White Knight of Cryptocurrency". The cryptocurrency industry has ushered in a cold winter as cryptocurrency prices drop in 2022. Bankman-Fried has given out hundreds of millions of dollars to help other companies in the industry struggle.

When asked why he was trying to bail out cryptocurrency companies on the brink of collapse, he said: "If we're facing real pain and thunderstorms, it's not going to be good in the long run. It's not fair to customers either." In an interview at the time, He also claimed that he has $2 billion in reserves that he could use to help cryptocurrency companies on the brink of collapse.

Last week, however, he got himself into the same situation, having to try to raise money to save the company and customers.

Initially, an article on cryptocurrency news site CoinDesk suggested that a large portion of Bankman-Fried’s trading firm, Alameda Research, was based on a cryptocurrency invented by a FTX sibling, rather than a standalone asset. Subsequently, the outside world began to question the real financial stability of FTX. Subsequently, another industry insider accused Alameda Research of using the deposits of FTX customers as transaction loans.

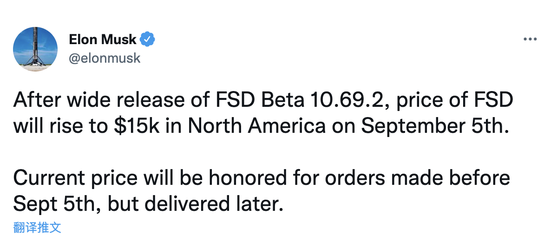

FTX's end was doomed when FTX's main competitor, Binance, publicly sold all FTX-linked cryptocurrencies a few days later. Binance CEO Changpeng Zhao told 7.5 million followers on Twitter that his company would sell all of these cryptocurrencies “in light of recent revelations.”

This sparked a run on FTX, with panicked customers quickly withdrawing billions of dollars from the platform.

FTX immediately suspended funds withdrawals. Bankman-Fried tried to get a bailout, and Binance has publicly stated that it is considering acquiring FTX. However, Binance later announced that FTX’s “rumor of mishandling of client funds and an investigation by U.S. regulators” changed the company’s decision.

A day later, FTX declared bankruptcy. "Really sorry we ended up where we are," Bankman-Fried said in a series of Twitter posts later. "Hopefully we can find a way to recover. Hope this brings some transparency, trust and Governance mechanisms." He also said he was "shocked by the way things have unfolded".

In the cryptocurrency industry, this has been the case in the past, and it is still the case now. Bitcoin prices have fallen to a two-year low. Many people are curious, if FTX and its leaders can fall to the altar, who will be next?

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~