your current location is:Home > investHomeinvest

SoftBank's bad news continues: record quarterly losses, venture capital market investment yields turn negative

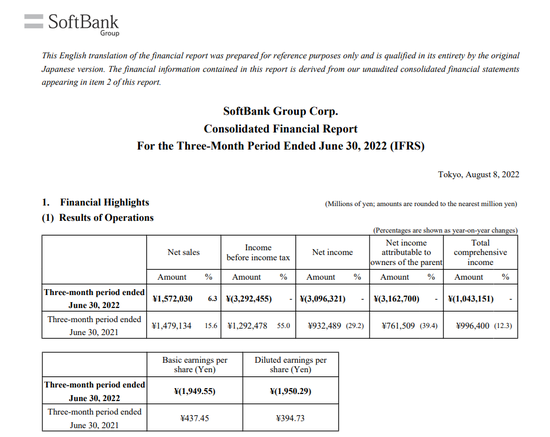

On Monday, local time, Japan’s SoftBank Group disclosed its financial report for the first fiscal quarter (April-June) of fiscal 2022. Against the backdrop of headwinds in technology stocks, the company handed over a transcript of a record loss.

(Source: company official website)

(Source: company official website)In this dismal financial report, the net loss attributable to SoftBank shareholders reached 3.16 trillion yen, and even in the context of the depreciation of the yen, the loss exceeded 23.3 billion US dollars. The company also recorded a loss of 2.1 trillion yen in the last quarter.

The main source of huge losses is still the unrealized investment gains and losses of the two SoftBank Vision Funds. In the current earnings report, the two funds reported a combined investment loss of 2.92 trillion yen. Companies including South Korean e-commerce stock Coupang, food delivery platform DoorDash, Uber and other companies continued to fall amid the market turmoil in the second quarter of this year.

Compared with well-known investors such as Kathryn Wood and Buffett, Masayoshi Son still has a bunch of start-up equity in the technology track. As the main export of SoftBank's investment in recent years, the cumulative investment return of the Vision 2 Fund has fallen into the negative range by the end of June.

As SoftBank is highly optimistic about the changes in the financial and health sectors after the epidemic, SoftBank Fund 2 invested $38 billion in 183 companies last year. However, just a year later, these investments entered a state of loss. At the earnings conference in May this year, Masayoshi Son also publicly stated that SoftBank has entered a "defensive state" and will be more cautious in the process of subsequent investments.

People are scattered

For Son, it's one thing to wait for the capital market's cycle to reverse, but it's another problem for investment giants to "disappear."

According to media reports, Rajeev Misra, Son's long-term right-hand man and head of the Vision 2 Fund, recently left the company to start his own investment fund. Including the departure of SoftBank Chief Operating Officer Marcelo Claure earlier this year, the number of senior executives who have left SoftBank in the past two years has been in double digits.

In fact, since Masayoshi Son decided to transform the telecom giant into an investment company five years ago, this stage is that he enjoys the glory alone, so the problem of not being able to retain executives originally existed. And in the season when the wind is blowing frequently, Yuhi's praise is becoming a burden to fight alone.

In June of this year, Chen Liwu, a well-known venture capitalist, bluntly stated in his open letter to resign as an independent director of SoftBank that the turnover rate of the best venture capital funds is actually very low, because they understand how important it is to retain the best talents.

According to the report, with the investment business mired in the quagmire, 64-year-old Sun Zhengyi is now pinning his hopes on the chip company ARM for a comeback. SoftBank is preparing to push through a series of cost-cutting and efficiency-enhancing measures to make the company more attractive when it IPOs next year.

Previous:The brain drain of SoftBank executives intensifies, and Masayoshi Son faces greater pressure

Next:U.S. court rules: AI systems can't patent inventions because they're not human

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~