your current location is:Home > TechnologyHomeTechnology

AMD fell more than 13%, conservative on PC market prospects

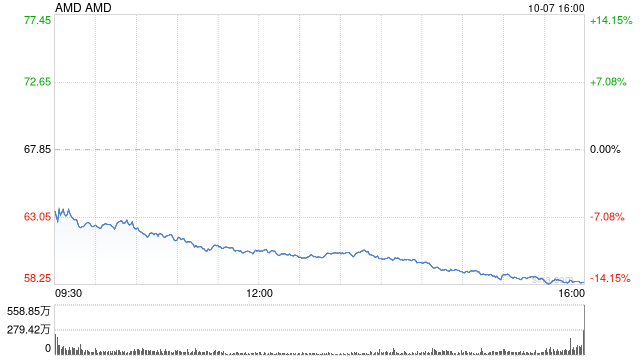

This morning, large U.S. technology stocks fell across the board, chip stocks hit hard, and AMD bore the brunt. As of the close on the morning of the 8th, AMD's stock price was reported at US$58.44, a decrease of 13.87%, and the market value was evaporated by US$15.18 billion.

AMD just released its preliminary third-quarter results after the market on Thursday. It currently expects revenue of about $5.6 billion, a drop of $900 million compared to the previously given revenue forecast range of $6.5-6.9 billion, far less than market expectations. In addition, based on preliminary results, AMD's third-quarter non-GAAP gross margin is expected to be approximately 50%, down 4% from previously announced expectations. AMD CEO Lisa Su responded to the drop in revenue with "weaker-than-expected performance in the PC market and a major inventory correction across the PC supply chain."

A number of institutions, including Wells Fargo, KeyBanc, Piper Sandler, and Bank of America Securities, lowered AMD's target stock price today, but still maintained a "buy" or "overweight" rating. According to the latest data from the Wind platform, Piper Sandler lowered its price target for AMD to $90, and Wells Fargo lowered its target price to $85.

Judging from the preliminary performance data released by the company, among the four major business divisions of AMD, the revenue of the three major business divisions of data center, gaming and embedded showed a growth trend, while the revenue of the customer business division experienced a sharp decline, which also led to AMD this quarter. The main reason is that the revenue is far below market expectations. AMD's Customer Division primarily includes desktop and notebook PC processors and chipset products. For the quarter, the Customer segment expects revenue to decline 40% year over year and 53% sequentially.

Chai Daixuan, director of CIC Consulting, told the First Financial Reporter that the current downturn in the downstream market has limited the shipments and performance of upstream manufacturers. PC hardware such as CPU and graphics cards are limited by downstream demand, and the sluggish demand for upgrades and replacements has made upstream manufacturers together There has been a backlog of inventory problems, and other chip manufacturers such as Intel and Nvidia, which are on the same PC upstream track as AMD, have been impacted to varying degrees. On the other hand, the gradual extension of the replacement cycle of PC-related components has further tightened the upstream market's shipment scale. Supply chain adjustments have reduced processor shipments, and PC upstream manufacturers are suffering from higher inventory costs.

AMD has long been aware of the sluggish situation in the PC market. According to the meeting held on August 2, when reviewing its second-quarter revenue performance, AMD stated that "from a quarter ago to now we have believed that the PC business will decline, and this is also taken into account in the guidance for the third quarter. We are more conservative in our PC outlook, with the PC market size of between 290 million and 300 million units.” It is worth noting that AMD last Thursday was due to a larger-than-expected decline in the PC market and supply chain issues. Just lowered its sales forecast for the third quarter.

In addition, industry insiders told reporters that the previous Ethereum merger incident had an obvious impact on AMD's operations. On September 15, the 8-year-old Ethereum completed the merger, which means that the operating mechanism of Ethereum began to shift from the PoW (Proof of Work) blockchain to the PoS (Proof of Stake) blockchain. As suppliers that provide a lot of computing power support products for "mining", Nvidia and AMD have been hit a lot in this incident.

AMD has not split the mining business at present. According to the information released in the historical financial report, the business revenue including mining graphics cards accounts for about 50% of the company's overall revenue. Chai Daixuan told reporters that it can be expected that the impact of the Ethereum merger on the shipments of NVIDIA and AMD will be more obvious. In the short and medium term, AMD's mining graphics card inventory backlog and low prices will have a certain impact on revenue in the short term. In the long run, a series of manufacturers such as AMD need to solve the problem of excess inventory through strategic adjustment.

At present, due to the continuous decline of the PC business, the data center and semi-custom game console business have become the main drivers of performance growth in the third quarter. AMD expects the fourth quarter to be similar to the third quarter, with the data center and embedded businesses leading growth and the PC business continuing its conservative approach this quarter.

Previous:TSMC's quarterly revenue is still a record high, but revenue in September fell 4.5% month-on-month

Next:See you on October 28th! Judge sets deadline for Musk takeover of Twitter

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~