your current location is:Home > TechnologyHomeTechnology

Advertising is getting colder, the cloud is not making money, and Google has fallen into a "trap"

A few days ago, Alphabet (Google's parent company) released the company's financial report for the third quarter of fiscal year 2022 as of September 30. During the revenue period, Alphabet’s total revenue was US$69.092 billion, an increase of 6% compared with US$65.118 billion in the same period of the previous year, and an increase of 11% year-on-year, excluding the impact of exchange rate changes; Net profit in the third quarter was US$13.910 billion, a decrease of 26.5% compared with US$18.936 billion in the same period of the previous year; diluted earnings per share were US$1.06, compared with US$1.40 in the same period last year.

It should be noted that Google's third-quarter revenue and net profit fell short of market expectations. With the IT environment in an overall downturn, the market's reaction to Alphabet's third-quarter earnings report showed an expected pessimistic attitude: after the earnings report was announced, Google's stock price fell nearly 7%, leading the green of U.S. technology stocks that day. journey of.

In the face of the fact that Google has experienced sluggish growth for several consecutive quarters, how this technology company, which is world-renowned for technological innovation, can achieve commercial success in the secular sense has become a topic that people are most concerned about.

Advertising revenue is getting colder, thanks to the general environment?

According to Alphabet's third-quarter financial report data, Google's advertising business revenue totaled US$61.377 billion, compared with US$59.884 billion in the same period last year. Among them, Google’s search and other business revenue in the third quarter was US$39.539 billion, compared with US$37.926 billion in the same period last year; YouTube’s advertising business revenue was US$7.071 billion, compared with US$7.205 billion in the same period last year; Google’s network business revenue was US$7.872 billion , which was US$7.999 billion in the same period last year.

As the pillar of Google's revenue, the growth trend of advertising business revenue basically represents Google's revenue trend in this quarter. But Google's ad business is going through a difficult time in many ways.

First of all, under the epidemic, the demand in the online advertising market has shrunk along with the weak economic boost. This is especially evident in the Youtube advertising business. Among the customers who place advertisements on Youtube, a considerable proportion are small and medium-sized business owners. When the economic situation declines, these customers must choose to increase income and reduce expenditure, and choose a platform with better advertising effects instead of Youtube, which is heavy on entertainment.

Second, Google's advertising business is facing pressure from industry giants. Although there is a consensus among the industry that the market is entering a cold winter, the next question is: who will survive.

For example, Apple has introduced a new policy in advertising revenue: In October, Apple officially sent a notification email to iOS third-party developers, saying that it will be displayed on the "Today" tab of the Apple App Store and the "Today" tab at the bottom of each software page window. You might also like" section, which displays software-related ads. The price that third-party service providers need to pay for obtaining this series of advertising spaces is the increased prices of Apple Music and Apple TV+ services.

Among them, the price of Apple Music service has been raised from $9.99 to $10.99 per month, while Apple TV+ has been raised from $4.99 to $6.99. As the two major camps in the software ecosystem, Apple’s promotion of accurate advertising delivery means taking away Google’s potential share.

Another example is TikTok, according to data from the analysis agency Sensor Tower: in the third quarter of 2022, in the context of a decrease in mobile app spending by about 5%. TikTok still achieved a headwind rise, setting a revenue record for four consecutive quarters. TikTok's global business (including the iOS version of Douyin client) still ranks among the top revenue lists of "non-game apps" in the Apple App Store and Google Play Store, with consumer spending of approximately US$914.4 million in the quarter.

Although TikTok is very different from Google in terms of monetization logic, it is still a potential opponent that Google cannot ignore in the fields of games, entertainment videos, live broadcasts, etc. Among these businesses, the advertising business will become Google's financial revenue. Basic disk.

Finally, Google faces regional market entry hurdles and penalties.

The European Commission opened an investigation into Google's ad tech business in June last year, arguing that it could gain an unfair advantage over rivals and other advertisers through technological means. Monopoly has always been the lifeline that Google can't get around. Over the past decade, the EU has imposed antitrust fines on Google of more than 8 billion euros (about 7.7 billion U.S. dollars). In early July this year, the EU officially passed the Digital Markets Act (DMA) and the Digital Services Act (DSA), which contain a series of restrictions on first-party digital service providers. Since the series of bills were announced, it has been considered to fundamentally limit the possibility of technology giants implementing monopoly terms.

Therefore, after facing such an external environment, it is understandable that Google's advertising revenue is weak.

Google Cloud, looks beautiful but doesn't make money

As an important supplement to Google's business diversification, Google Cloud business revenue is an indispensable part of Alphabet's financial report. The third-quarter financial report shows that Alphabet's Google division's Google Cloud (Google Cloud) business revenue was US$6.868 billion, compared with US$4.990 billion in the same period last year. Operating loss was $699 million, compared with an operating loss of $644 million a year earlier.

According to data from the analysis firm Synergy Research Group, enterprises spent more than US$57 billion on cloud infrastructure services in the third quarter, an increase of more than US$11 billion from the third quarter of 2021, and this expenditure increased by 24% year-on-year. At last year's exchange rate, the spending growth rate would exceed 30%. In terms of market share, Amazon ranks first with 34%, Microsoft ranks second with 21%, and Google ranks third with 11%.

However, in the context of the continuous expansion of the global cloud computing market, there is an obvious "Matthew Effect" as a whole: Amazon and Microsoft, as the top two giants in market share, are also the only players to achieve large-scale profitability, while Google Cloud, which ranks third in the industry, still cannot escape the fate of continuous losses.

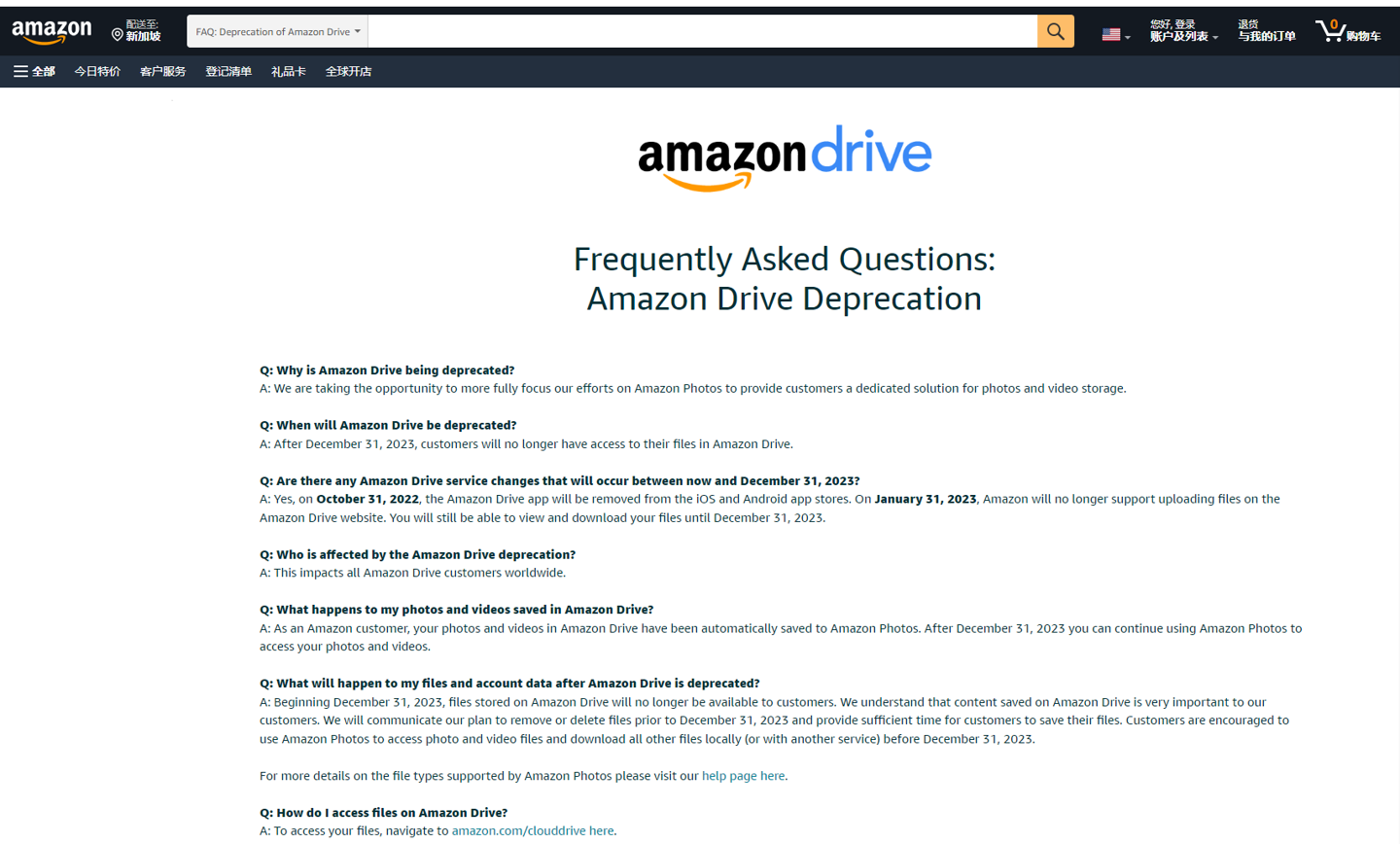

Google Cloud looks beautiful, but it has been struggling to make a profit. Recently, Google Cloud announced that it will stop the Google Cloud Platform (GCP) IoT Core service from August 16, 2023. At that time, Google Cloud IoT Core customers will not be able to access the IoT Core Device Manager API.

It is understood that Google Cloud IoT Core has advanced technical services in serving the IoT needs of small and medium-sized enterprises. Customers can use the host of Google artificial intelligence/machine learning (AI/ML) services to obtain insight and analysis capabilities, so as to achieve more scalable The implementation of the Internet of Things deployment. However, since the launch of IoT Core in 2018, Google has only attracted a small number of users, and its business monetization ability is worrying.

Coincidentally, in the game cloud business, Google has just suffered a major blow. According to foreign media reports, Google will shut down its cloud gaming service Stadia on January 18, 2023. As the pioneer of the cloud gaming platform, Google Stadia's appearance is huge: the ambitious new development model, the gold medal producer hired with a lot of money, and the huge investment of financial and material resources all show that Google Gaming Cloud is setting sail with lofty ideals, but it is very difficult. Soon people discovered that it had been stranded in the shallows, and the reason was simple: Google, which is good at technology, encountered serious cross-border obstacles in order to produce good content. In this case, the game cloud that no one buys will naturally go into the trash can of Google products.

The closure of multiple cloud businesses is the epitome of Google’s deployment of cloud computing: unbounded expansion and no profit.

Get out of the quagmire, rebalance labor costs and values

According to the financial report, Alphabet's total costs and expenses in the third quarter were $51.957 billion, compared with $44.087 billion in the same period last year. Among them, Alphabet's third-quarter revenue cost was $31.158 billion, compared with $27.621 billion in the same period last year; research and development expenses were $10.273 billion, compared with $7.694 billion in the same period last year; sales and marketing expenses were $6.929 billion, compared to $5.516 billion a year earlier; general and administrative expenses were $3.597 billion, compared to $3.256 billion a year earlier.

Under the economic downturn and inflationary pressure, it is of course understandable that Google's operating costs remain high. On the other hand, Google has always been known for its employee care. In the current situation where giants such as Intel and Amazon are rumored to cut costs through layoffs, Google's cost control method appears to be more moderate-Google said in July that in the economic environment Unfavorable conditions will reduce recruitment progress and headcount for the remainder of the year. Alphabet Chief Financial Officer Ruth Porat said Google hired 12,700 people in the third quarter, and that hiring will more than halve in the fourth quarter.

According to the data, as of the end of September, Google employees reached 186,779 people. The sheer size of hiring combined with dismal revenue growth forced Google CEO Sundar Pichai to launch a program called Simplicity Sprint "to increase employee productivity."

The introduction of the plan immediately caused widespread discussion, and its existence means that Google employees need to demonstrate the value of hiring themselves through increased work output, and such a value has rarely been mentioned since Google was created - Google's company Culture is more associated with openness to cooperation, innovative ideas, and humanistic care, and it is these qualities that have made Google a long-term candidate for the greatest company in the world.

However, the 13% growth rate in the third quarter compared with the 62% figure for the same period last year is indeed shabby. When the revenue of a tech company with 180,000 people is stagnant, the consequences of not turning around the revenue woes are indeed dire enough.

From this perspective, Google's idea of improving employee efficiency is more like a rainy day. It conveys a clear attitude to all Google-related parties-Google needs to first solve the problem of survival when facing a crisis.

Such an attitude is still good news compared to layoffs. At least Google can mobilize the entire company to save itself collectively, so as to rebalance costs and revenue in the cold winter of this industry.

Previous:Following Musk's good example, Silicon Valley layoffs are "righteous"

Next:At HKUST Xunfei Global 1024 Developers Festival, we can see the new future of AI

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~