your current location is:Home > carHomecar

In the face of Japan's "electric car black hole", can Chinese car companies break in?

At the end of July, China's new energy vehicle giant BYD announced its entry into the Japanese market, which made the auto industry renew its attention to Japan's "electric vehicle black hole".

The Japanese car market is a "wonderful" existence.

Local auto giants such as Toyota and Honda have entered the field of hybrid and hydrogen fuel cell vehicles early, which can easily lead the outside world to think that the country is a fan of new energy vehicles. But the opposite is true.

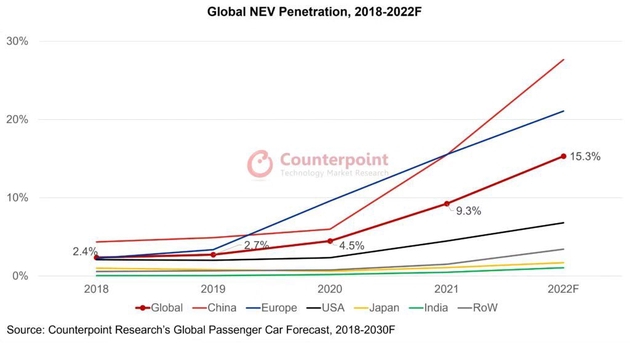

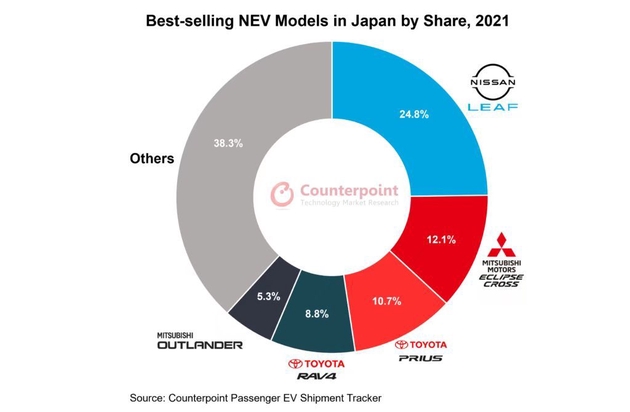

According to the latest survey by research institute Counterpoint Research, the penetration rate of new energy vehicles in Japan is only 1%, while in China, the figure is about 15%.

From 2018 to 2021, the total sales of new energy vehicles in Japan in these four years is only 4% of China's total sales in 2021. It's easy to see that Japan is not a "friendly" market for EV makers.

So, are global automakers totally out of luck in the Japanese EV market?

After in-depth investigation, Counterpoint Research found that it is not hopeless. In fact, the Japanese government is now actively promoting electric vehicles and is also subsidizing the establishment of electric vehicle charging stations.

Fuel Cell Electric Vehicles VS Pure Electric Vehicles

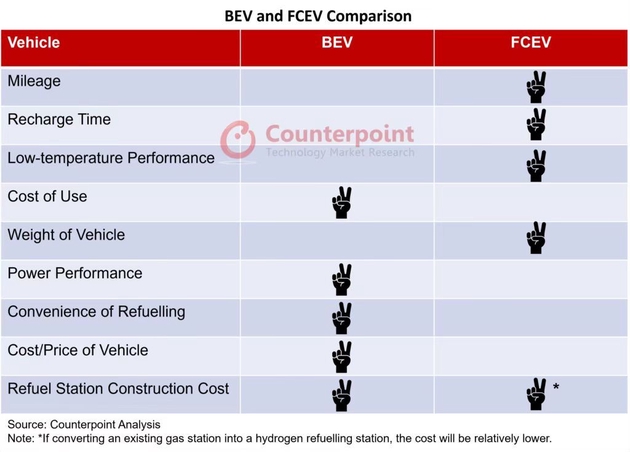

The debate on fuel cell electric vehicles (FCEVs) and battery electric vehicles (BEVs) has been going on for years.

Toyota has mass-produced its first FCEV MIRAI as early as 2014, and now it has launched its second-generation model. The manufacturer has also brought hydrogen fuel-powered vehicles to the field. In May of this year, Toyota Motor President Akio Toyoda participated in the NAPAC Fuji SUPER TEC 24-hour endurance race in a Corolla Sport version equipped with a hydrogen fuel engine.

Honda and Hyundai are also supporters of this category. Countries such as Japan and South Korea have believed for a long time that hydrogen fuel will be the future.

And China has been promoting pure electric vehicles. Almost all new car-making forces, including Tesla, are launching pure electric vehicles.

The emission of hydrogen fuel cell vehicles is water, which is non-polluting to the environment, which is actually very suitable for the current trend of "carbon neutrality". But under today's conditions, its disadvantage is even more obvious. According to a 2021 paper in the journal Nature, it pointed out three major disadvantages of hydrogen fuel cell vehicles. First, with the advancement of power battery technology and the improvement of the energy supplement system, the cost and endurance advantages of hydrogen fuel cells have almost completely disappeared. Second, when the penetration rate of electric vehicles in China reaches 15%, the number of hydrogen fuel cell vehicles in the world is only 25,000. The time window is closing, and it can no longer compete with the tide of electric vehicles. The last point is that the construction of the energy supplement system is difficult. Compared with electric vehicles that are easily used on the grid, the energy supplementation system of hydrogen fuel cell vehicles needs to be rebuilt, and the cost of hydrogen transportation is also too high.

At the end of the article, the journal came to a conclusion for hydrogen fuel cell vehicles - "hydrogen fuel cells have completely lost the opportunity for commercialization". Given the current global macroeconomic downturn, almost any plan to build hydrogen fueling infrastructure will not be supported by governments or industry bodies, at least for the foreseeable future.

Why did BYD decide to enter the Japanese EV market?

When BYD announced its entry into Japan, it released three electric vehicles - Seal, Atto 3 (equivalent to Yuan PLUS) and Dolphin. As mentioned above, the NEV market in Japan is relatively small. So, what motivated BYD to enter the Japanese EV market? The answers may be as follows.

BYD Japan Press Conference

BYD Japan Press ConferenceFirst of all, BYD is not a "newbie" to the Japanese car market. BYD entered the Japanese market as early as 1999. At that time, BYD's identity as a supplier of nickel-chromium batteries and lithium batteries served industrial customers in Japan. In February 2015, BYD started with 5 K9 electric buses, which opened up the situation in the Japanese public transportation market. In addition, through collaborations with Japanese companies such as Toyota, Kansai Electric Power Company and Keihan Bus Company, BYD has a better understanding of consumption patterns in the country. As of July this year, BYD's electric bus market share in Japan has reached 70%.

Secondly, BYD's existing supply chain system has created a strong cost control capability. In the same price segment, BYD's models can win in terms of mileage and other performance parameters.

In addition, in Japan, the size and small size of the "Kcar" has a huge market share, because the local streets are narrow, there are many mountain roads, and parking spaces are scarce. The three models BYD unveiled this time, except for the seals, are relatively small in size, catering to the habits of Japanese consumers.

The day after BYD announced its entry into the Japanese market, a Japanese automotive media was amazed when it evaluated the Atto 3. When the review editor touched the interior of the car, his tone was full of incredible: "Here, here, and here are all wrapped in soft materials, this is a car that only costs 1 million yen."

Chinese EV Manufacturers Going Overseas: Challenges and Opportunities

Unlike the chasers in the age of the internal combustion engine, Chinese automakers are completely leaders in the age of electric vehicles. In the core three-electrical technology fields such as batteries, motors and electronic control systems, China has the first echelon of self-research capabilities. This has also prompted leading players like BYD to come up with the idea of going overseas. However, even if new car-making forces such as Xiaopeng, Weilai, and Aiways go overseas, they choose the European market that is very friendly to electric vehicles - no one dares to go to Japan.

Counterpoint Research pointed out that BYD or other Chinese automakers will still face multiple challenges in entering Japan.

Acceptance is the biggest constraint. Although the safety level of electric vehicles, plug-in hybrid vehicles and hydrogen fuel cell vehicles has improved and is close to that of internal combustion engine vehicles, it still takes time for a large number of consumers to trust electric vehicles. However, as more and more friends, relatives or other surrounding people use electric vehicles, the "iceberg" of Japan is gradually melting.

Cost is another bottleneck. Many times it is price that triggers the decision to buy or replace a car. For Chinese EV makers, cost control is important. Currently, many key components are still manufactured by only a few component suppliers.

Counterpoint Research pointed out that in addition to the core technology of car hardware, Chinese electric vehicle companies also need to introduce new applications such as smart cockpit, driving assistant and driverless options on the software side to improve the car user experience. In this regard, the prevailing view is that Japanese consumers do not seem to care that much about intelligence, and Chinese electric vehicles are just ahead in this regard. Therefore, it is worth noting whether Japanese consumers need "interference intelligent configuration".

The agency also believes that Japanese consumers do not have good stereotypes about Chinese brands, and they are more willing to pay a premium for well-known brands. The work in the education market is a long-term task for BYDs.

Finally, local policy winds may lead to changes in popular categories. This topic, which is almost a certainty in China and Europe and the United States, still has uncertainties in Japan. Because Akio Toyoda, who is also the chairman of the Japan Automobile Manufacturers Association, often obstructs the country's "banning the sale of fuel vehicles" plan, his right to speak should not be underestimated.

To sum up, BYD has entered the Japanese electric vehicle market and played a leading role. If successful, other Chinese automakers could follow suit. For Japanese consumers who are accustomed to traditional and boring electric vehicles such as Nissan Leaf and Toyota Prius, BYD is expected to make them have a subversive change in electric vehicles. Even if it hits a wall, the loss is not unbearable for BYD.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~