your current location is:Home > Finance > depthHomedepth

After handing over "catastrophic" earnings, Intel's new hope is on foundry?

From chip design to wafer foundry, Intel began to accelerate the transformation from Party A who placed the order to Party B who placed the order.

The official announcement of MediaTek indicates that Intel will enter the new role of wafer foundry from WiFi chips and digital TV chips. In the past year, Intel invested $20billion to build a factory in Arizona and spent a lot of money to acquire tower. Intel has devoted a lot of effort to this new business.

Behind the transformation plan is the overall decline in revenue and profits, as well as the anxiety caused by the negative growth of the main PC chip and data center businesses. The second quarter financial report showed that Intel's total revenue and net profit fell by 22% and 109% year-on-year, respectively, while also setting a number of embarrassing records. Among them, customers calculated that the group's revenue and operating profit were US $7.665 billion and US $1.085 billion respectively, with a year-on-year plunge of 25% and 73% respectively.

In the case of embarrassing businesses such as edge computing and autonomous driving, betting on wafer foundry seems to be the only option. But in the face of the monopoly of TSMC and Samsung on customers, talents, technology and all links of the supply chain, can Intel really stand out from the siege?

In this regard, we cannot help but put a big question mark.

Win the order of Lianfa branch

Intel overweight wafer foundry business

On July 29, Cai Lixing, the chief executive of MediaTek, publicly responded to the details of the cooperation with Intel for the first time. According to Cai Lixing, Intel will be responsible for the OEM business of MediaTek digital TV and mature process WiFi chips, but the OEM business of advanced process chips will continue to maintain a close cooperative relationship with TSMC.

According to the value Institute (id:jiazhiyanjiusuo), this cooperation is of great significance for both MediaTek and Intel.

From the standpoint of MediaTek, as the smart phone market shrinks, they must be prepared to alleviate growth anxiety by developing other emerging businesses. Considering TSMC's production line based on advanced manufacturing processes and relatively high prices, switching to Intel is a more economical choice.

Take WiFi chip as an example. According to IDC's report, the shipment of WiFi chips will reach 5.3 billion in 2022, and the average price of terminal WiFi modules will increase by nearly five times compared with 2020, with great growth potential. Public information shows that MediaTek raised the quotation of WiFi 6 chips by 20%-30% in the fourth quarter of last year, and the possibility of further price increases will not be ruled out in the future.

More importantly, even if the price rises again and again, WiFi chips are still in short supply. Since the second half of last year, the shortage has become more and more serious, forcing manufacturers such as MediaTek and Broadcom to find new OEM partners and speed up the preparation and delivery. According to the economic daily, the delivery cycle of MediaTek's WiFi chip has been extended to more than 52 weeks in the first quarter of this year.

As we all know, although TSMC and Samsung have been expanding their production capacity, their focus has always been on advanced process chip production lines. Mature process chips such as WiFi chips are in great demand, but the problem is that the profit margin is much lower than that of advanced process chips. In this context, the urgent need for orders made the first shot, and Intel and MediaTek, which urgently needed to shorten the delivery cycle, naturally hit it off.

Of course, for Intel, in addition to the real money return, winning the major customer of MediaTek is a symbol that its OEM business is on the right track, and also lays the foundation for transformation and attracting new customers.

In order to get the OEM business on the right track as soon as possible, Intel can be said to have paid a lot of money. In February this year, Intel announced the acquisition of tower, a foundry of analog semiconductor solutions, for $5.4 billion, which has now been incorporated into ifs, Intel's foundry services division.

In addition, more information was also exposed about the wafer foundry that officially broke ground in Arizona last September.

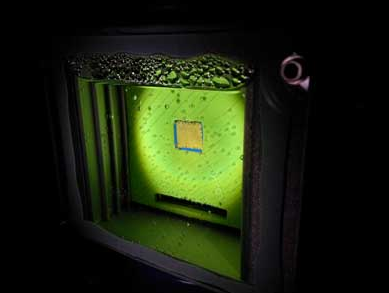

According to the official introduction, Intel plans to build the plant at a total cost of about US $20billion. After completion, it will have a total of six foundries in the ocotillo Park in Arizona. Fab 52 and Fab 62, the latest two factories, are expected to be fully operational in 2024, mainly responsible for the OEM business of 20a (equal to 2nm) advanced process chips.

The initial investment of wafer foundry is huge, which can be illustrated by the history of the prosperity of industry pioneers such as TSMC and Samsung. For this reason, winning the order of MediaTek and enabling the OEM business to complete the transformation from blood transfusion to autonomous hematopoiesis as soon as possible is crucial to the long-term development of this business.

As mentioned above, with the decline of the smart phone market, the position of WiFi chips and TV chips in the commercial territory of MediaTek is rising. If this cooperation can make a good start, Intel can look forward to more cooperation opportunities in the future. Randhir thakur, President of Intel OEM services, expressed high expectations for the cooperation between the two sides:

"As one of the world's leading chip design companies, MediaTek will help Intel OEM services enter the next stage of rapid growth."

Various signs show that Intel's strategic positioning for the OEM business is constantly upgrading. As the semiconductor overlord in the PC era, Intel is probably seeking the most important transformation since its establishment - and it is not so much an active change as a passive survival.

Why must we transform? The second quarter financial report released almost at the same time as the cooperation news of MediaTek provides us with all the answers we want.

Revenue recorded the largest decline in recent 23 years

Intel's quest for change is imminent

On July 28, just one day before Cai Lixing publicly responded to his partnership with Intel, the latter just handed over its worst financial report since entering the 21st century: revenue, net profit and gross profit margin plummeted, and the core PC chip business performed poorly.

After the financial report was released, Intel's share price fell sharply by 11% on the 29th and is currently hovering below $37. After this round of decline, Intel's market value also shrunk to $151.1 billion, which was again surpassed by AMD with $157.4 billion.

For a long time, the market value of AMD has been Intel's "bottom line". Now, looking at the once bankrupt competitors riding on their heads, Intel's executives and shareholders must feel bad. After reading the financial statements, the value Institute (id:jiazhiyanjiusuo) believed that the disappointment of the capital market was completely understandable.

On the one hand, revenue and profits are greatly discounted, and the downward trend is difficult to contain.

Data showed that Intel's total revenue in the second quarter was US $15.321 billion, a year-on-year decrease of 22%; The net loss was US $454million, down 109% from US $5.061 billion in the same period last year; Diluted loss per share also reached US $0.11, with a year-on-year decrease of more than 100%.

Behind the bad figures, Intel also set a series of embarrassing records: revenue hit the highest year-on-year decline since entering the 21st century; For the first time in nearly 30 years, Intel posted a quarterly net loss; The gross profit margin fell sharply from 50.4% to 36.5%, also setting the lowest record since the new century

For this financial report, Intel CEO pat Gelsinger did not make too much excuses, and many executives admitted the company's difficult situation on the earnings call. At the same time, Intel also announced that it would slow recruitment and reduce capital expenditure in the second half of the year, and planned to reduce capital expenditure by $4billion this year.

On the other hand, from the perspective of revenue structure, the revenue and profit of Intel's main PC chips, data centers, artificial intelligence and other businesses fell year-on-year, and its basic market is no longer stable.

The second quarter financial report showed that the business revenue and operating profit of Intel Customer computing group were $7.665 billion and $1.085 billion respectively, down 25% and 73% year-on-year respectively. According to the breakdown data, the revenue of notebook business plummeted from $6.734 billion in the same period last year to $4.751 billion today, with the most obvious decline.

The situation of data centers and artificial intelligence groups is also not optimistic. According to the data, the total revenue of the business group in the second quarter was US $5.547 billion, a year-on-year decrease of 16%, slightly lower than the 22% decrease in the first quarter of this year; However, the operating profit in this quarter was only US $214 million, down 89% from US $2.09 billion in the same period last year.

Of course, from the perspective of the change curve, the retreat of the customer computing group is even more a headache for Intel. In the past four quarters, the revenue of the business group recorded a year-on-year increase of only 9% in the fourth quarter of 2021, and the operating profit margin hovered at a low level for a long time. In the final analysis, the deterioration of the PC industry environment has been very obvious, and Intel's moat has long been riddled with holes.

According to the data released by canalys, in the first quarter of this year, global PC shipments fell by 3% year-on-year, and notebook shipments fell by 6%. After the epidemic eased, the growth momentum that lasted for seven quarters came to an abrupt end. According to the forecasts of gartners, IDC and other institutions, the PC market size will decline by 5%-7% year-on-year at the end of this year, which is an important blow to Intel's chip business.

When the main business is impacted, Intel naturally needs other businesses to come forward and share the pressure on revenue and profit.

In addition to the customer computing group and the data center and artificial intelligence group, Intel's current revenue includes the network and edge computing group, the accelerated computing system and graphics business group, and the autonomous driving business Mobileye. Unfortunately, these businesses have their own problems.

The accelerated computing system and graphics business is an investment for the future. It is burning money seriously and is still at a loss at present. According to the financial report data, the total revenue of the business group in the second quarter was 186million US dollars, but the operating loss was as high as 507million US dollars, which was further expanded from 168million US dollars in the same period last year.

Although the network and edge computing group recorded a year-on-year growth of 11% and has achieved profits, it also has the problem of high costs. According to the data, the operating profit of this business in the second quarter of this year plummeted by 60.17% compared with the same period last year, and the operating profit margin was as low as 10.33%, which was a drop in the bucket for the whole group.

As for the highly expected self driving business, Intel CEO pat Gelsinger also announced at the earnings call that he would suspend its listing plan, which shows that its financing process and market valuation are not satisfactory.

In the face of this reality, Intel seems to have to bet on wafer foundry. However, in this Colosseum full of gods, is Intel really capable of grabbing more market share?

TSMC and Samsung monopolize 70% of the shares

Can Intel really snatch food?

If Intel wants to steal the cake of the wafer foundry market, it must first look at the faces of the two overlords, TSMC and Samsung.

According to public data, TSMC's wafer foundry business revenue reached US $66.82 billion in 2021, accounting for 59.5% of the market. Especially on the track with advanced 7Nm and 5nm processes, it is basically difficult to meet an opponent. Although Samsung did not separately announce the revenue of wafer foundry business, the revenue of the entire semiconductor business division increased significantly last year, reaching US $19.995 billion, forcing Intel to become the largest semiconductor enterprise in the world.

According to omdia's report, Samsung's share in the wafer foundry market is stable at about 17%. Although it is a long way from TSMC, it still has advantages compared with its competitors such as liandian, lattice core and SMIC international, which are behind. In other words, TSMC and Samsung, the two giants, have long monopolized the wafer foundry market with a market share of up to 70%, leaving little space for other competitors.

The wafer foundry industry has extremely high technical barriers, which is an important reason for the increasing Matthew effect in the industry. However, in the view of the Value Research Institute (id:jiazhiyanjiusuo), TSMC and Samsung's domination of the wafer foundry market is not only based on technical advantages, but also due to the control ability of the whole industrial chain. This advantage is reflected in production equipment, technicians and other links.

According to foreign media reports, 70% of the ultra violet technology currently produced by ASML has been sold to TSMC, and the orders of TSMC have always been listed as a priority. Considering the monopoly of ASML in the field of lithography and the importance of lithography to the wafer foundry industry, it is not difficult to understand how important TSMC is in the industry.

For Intel, it is worth celebrating that it won the large order of MediaTek and made a good start for the OEM business, but the future is not easy. For both sides, it may be more meaningful to take this opportunity to explore technical cooperation beyond OEM.

Prior to this, Qualcomm and Samsung, apple and TSMC have also made similar attempts. Samsung also provided CMOS advanced processing technology services for Qualcomm after it began OEM for Qualcomm in 2005. Even in many self-developed CPU architecture plans, the two sides had a benign interaction.

In June last year, due to doubts about the performance of arm's public version scheme, foreign media revealed that Qualcomm wanted to restart the CPU architecture research and development plan, and nuvia, a CPU architecture design company that had just been acquired, would undertake this important task. In addition, Samsung will also play an important role in the R & D team.

Although there is no more news about this plan at present, Qualcomm and Samsung undoubtedly show us the possibility of more cooperation between chip design companies and wafer foundry manufacturers - not to mention that Intel itself is an old chip design player who has joined the wafer foundry industry across the border.

The well-known technology media leitech (id:leitech) has analyzed the advantages and disadvantages of various OEM modes in the semiconductor industry. In the industry, semiconductor chips have three modes: fabless, integrated device manufacturing (IDM) and foundry.

Fabless refers to typical chip designers, such as Qualcomm and AMD, which do not involve OEM production, testing, packaging and other links at all; Foundry is a pure foundry manufacturer, and the representative enterprise is TSMC. Samsung is the representative of the IDM model between the two, that is, an integrated enterprise covering all links of the industrial chain such as design, manufacturing and testing, while Intel is working in this direction.

Intel's goal is not only to produce chips by itself, but also to provide OEM business. At the same time, it will continue to hand over some process chips to other manufacturers, which is equivalent to "mixed upgrading" of the three modes. Under this mixed protection mode, the cooperative relationship between Intel and major manufacturers will become closer, and it can also provide more opportunities for technical cooperation.

In the field of technology, although Intel and MediaTek have competition, there is also room for cooperation in many links. Before that, MediaTek and AMD had successful cooperation experience in WiFi 6e module. The Nb platform of Intel is also of great significance to the WiFi chip business of MediaTek.

At present, in addition to using its own chips, the most important external supplier of Intel NB platform supply chain is Ruiyu. If MediaTek can replace the latter, it will naturally be a profitable business. In a word, there is a lot of room for imagination for the cooperation between the two semiconductor giants, and there are more business opportunities waiting for them to explore.

Write at the end

When he was appointed as the new CEO of Intel in January last year, pat Gelsinger was once regarded as the "savior" of the semiconductor giant by the outside world and received much higher attention than his predecessors.

As the first CTO of Intel, plus his experience in EMC and VMware, pat Gelsinger's technical strength is well-known in the industry. After fed up with the former CEO Bob swan's style of emphasizing finance over technology, investors and Intel insiders hope that pat Gelsinger can lead them back to the "right path" dominated by technology.

However, more than a year has passed, and the "savior" with the halo on his head did not lead Intel out of trouble as the outside world wished. Today, the patience and support of the board of directors and shareholders for pat Gelsinger are also weakening - a regulatory document released in May this year showed that Intel shareholders voted to reject pat Gelsinger's sky high annual salary of $178million last year.

According to the Wall Street Journal, the annual salary of the CEO of AMD and Qualcomm last year was $27.1 million and $25.9 million respectively, less than a fraction of pat Gelsinger's. With the annual salary far exceeding that of the CEO of the competitor, the financial statements handed over are getting worse and worse. No wonder shareholders are extremely dissatisfied with this.

After the revenue fell to the bottom in the second quarter, Intel and pat Gelsinger's personal careers have reached the most dangerous juncture. No one dares to make a final decision whether they should redeem each other or sink together.

Of course, looking for new growth points through OEM shows Intel's determination to change to a certain extent. Now the key is to see whether they can come up with convincing technology to truly leverage the strengths of TSMC and Samsung.

Previous:If the iPhone can no longer dominate Apple's fortunes, can services?

Next:Google's performance is good, but it is all set off by its peers?

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~