your current location is:Home > Finance > depthHomedepth

Interpretation of Apple's latest financial report: Smartphones are the only bright spot, other businesses decline across the board

The smartphone business was the only bright spot in Apple's latest quarterly earnings report, while revenue from personal computers, iPads, smart wear, smart home and software services fell across the board.

Not long ago, Apple released its third quarter financial report for fiscal year 2022 (March 27-June 25, 2022).

Due to the contrarian growth of the iPhone business, Apple achieved revenue of $83 billion in the third quarter, an increase of 8.6% year-on-year, slightly exceeding Bloomberg consensus forecast ($82.7 billion). At the same time, Apple achieved a net profit of US$19.442 billion, a year-on-year decrease of 10.59%, but still better than the market expectation of US$18.976 billion.

Apple CEO Cook said on the conference call after the earnings report: In terms of product categories, except for exchange rates, the macroeconomic impact of the iPhone in the third fiscal quarter was not obvious; Mac and iPad were greatly affected by insufficient supply, so There is not enough supply to judge the real demand situation; wearable devices and household products are indeed affected by the macroeconomic environment; in terms of service business, digital advertising business is greatly affected.

After the earnings report was released, Apple’s stock price rose nearly 4% in after-hours trading on U.S. stocks, bringing its market value back above $2.6 trillion.

However, as Cook said, the mobile phone business has almost become the only bright spot in Apple's financial report. Under the influence of factors such as sluggish demand, inflation, and the appreciation of the US dollar, the Mac, iPad and smart wear businesses all experienced negative year-on-year growth in this quarter. , the growth rate of software services also fell to a historical low. In a sense, the so-called "good" of Apple's third-quarter financial report is just that the performance exceeded market expectations, and it was not as bad as imagined.

1

Hardware: iphone is a handsome cover a hundred ugliness

From the perspective of revenue structure, Apple's main business is divided into two parts: intelligent hardware and software services. Among them, the hardware business includes five parts: iPhone, Mac, iPad, wearable devices, smart home and accessories. In the third quarter of 2022, Apple's hardware business achieved operating income of US$63.36 billion, down 0.9% year-on-year and down 18% month-on-month.

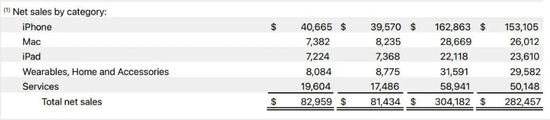

In terms of products, iPhone sales revenue was US$40.665 billion, a year-on-year increase of 2.8%; Mac sales revenue was US$7.382 billion, a year-on-year decrease of 10%; iPad sales revenue was US$7.224 billion, a year-on-year decrease of 2%; wearable devices, home and The accessories segment achieved a total revenue of US$8.08 billion, down 7.9% year-on-year.

From the perspective of product attributes, consumer electronic products belong to the category of optional consumption and are more susceptible to the impact of economic cycles. It is not difficult to see that, in addition to the mobile phone business, the revenue of products such as Apple computers, tablets, and smart wear all declined year-on-year.

In addition, the high base is also a major reason why Apple's hardware business is under pressure. In the past two years, the outbreak of the new crown epidemic has stimulated the emergence of new scenarios such as home office and online classes to a certain extent, and the demand for electronic products such as iPads and computers has exploded.

Data shows that in the fourth quarter of last year, Mac product revenue increased by as much as 25% year-on-year, and single-quarter revenue exceeded the $10 billion mark for the first time. With the gradual control of the epidemic abroad, the sales of Mac, iPad and other products are naturally under pressure.

In addition to the sluggish demand, supply chain pressure is another main reason for Apple's hardware sales in the third quarter. According to reports, half of Apple's TOP200 suppliers have factories in Shanghai and surrounding areas. Therefore, the epidemic control measures in Shanghai have had a significant impact on the production of some factories.

Among them, Mac products were the most affected by the epidemic. According to the data, Quanta, a Taiwanese company, is the sole supplier of Apple's new MacBook Pro series of notebook computers. After Shanghai’s prevention and control was upgraded, Quanta temporarily suspended factory production activities in Shanghai and Kunshan. Affected by this, the arrival time of the new MacBook Pro series notebooks has increased by 3 to 5 weeks.

In this regard, Cook said in the earnings call that in the last quarter, we lost a major source of supply for Mac computers. For much of the quarter, Mac supplies either dwindled or stopped altogether. So that's a very big impact on the Mac business.

Faced with the pressure of the supply chain, Apple chose the strategy of "keep the car and protect the handsome", focusing on ensuring the stability of the iPhone supply chain. Finally, against the backdrop of sluggish global mobile phone sales, iPhone sales have grown against the trend.

According to Canalys data, in the second quarter of 2022, global mobile phone shipments fell by 9% year-on-year, and Apple's market share reached 17%, an increase of 3 percentage points compared to the same period last year.

In the domestic market, in the second quarter of 2022, China's smartphone market shipped approximately 67.2 million units, a year-on-year decrease of 14.7%; among them, Apple sold approximately 9.5 million units, with a market share of 14.1%, an increase of 2.1 units over the same period last year. percentage point.

It can be seen that, in both the global market and the Chinese market, the market share of Apple's mobile phone has achieved a great increase in the second quarter. In addition, from the perspective of the high-end market, the iPhone 13 series products occupy two-thirds of the global high-end market and have been the best-selling smartphone in the world since its release.

According to the data, Cook once believed in the conference call last fiscal quarter that under the continued impact of the new crown epidemic, Apple’s losses due to supply chain problems this quarter are expected to be between $4 billion and $8 billion. But from the end result, Cook's concerns about the supply chain are a bit excessive. In this regard, Cook said frankly on the earnings conference call, "You do see inflation in the cost structure of the supply chain, but the final hit to revenue from supply chain disruptions is less than $4 billion."

However, it was Cook's previous pessimistic expectations and the downturn in the global smartphone market that, to a certain extent, lowered expectations for Apple's revenue. In the end, although the iPhone only achieved a slight increase of 2.8%, it became a positive that exceeded expectations.

In addition, from the gross profit margin data, the profitability of Apple's hardware products has also declined. In the fourth quarter of last year, Apple's hardware gross profit margin reached 38.4%, a record high for many years. However, under the influence of factors such as inflation and logistics, Apple's hardware side continues to face cost pressures. The financial report shows that the gross profit margin of Apple's hardware products in the third quarter was 34.5%, down 1.6 percentage points from the same period last year and 1.9 percentage points month-on-month. The gross profit margin declined for the second consecutive month.

2

Software: Revenue growth hits five-year low

In the past 10 years, the proportion of Apple's mobile phone business has remained at about 50%, and the proportion of hardware business revenue has remained above 80%, which makes the outside world worried about its future development. To this end, Apple has launched some subscription services such as Apple Music, Apple Card and Apple TV to promote the growth of software service revenue.

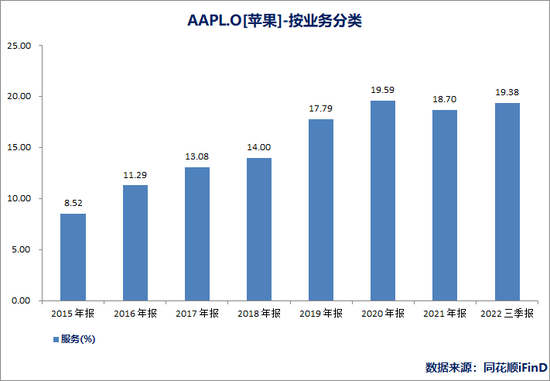

Overall, Apple's software business has maintained a relatively high growth rate in the past few years, becoming a new engine driving Apple's revenue growth. The data shows that from 2013 to 2021, Apple's service revenue increased from $16.051 billion to $68.425 billion, and the revenue share increased from 9.39% to 18.7%.

As the proportion of software business continues to increase, "software and hardware integration" has become Apple's latest focus. But judging from the latest data, Apple's software business appears to be facing growing pains.

The financial report shows that in the third quarter, Apple’s software business achieved operating income of $19.6 billion, a year-on-year increase of 12.2%, which was lower than analysts’ consensus forecast of $19.7 billion. In terms of revenue growth, this quarter was the slowest quarterly growth rate since the fourth quarter of 2015.

Apple Chief Financial Officer Luca Maestri believes that due to factors such as currency effects and the stagnation of business in Russia, the revenue growth rate of Apple's services business in the next quarter will be higher than that of the current quarter (12%). will slow down.

In fact, 20% seems to have become a "ceiling" for Apple's services revenue share. As can be seen from the figure below, the proportion of Apple's software business once hit a record high of 19.57% in fiscal 2020, and then there has been a downward trend. In the first quarter of fiscal 2022, this proportion fell to 15.75%.

In this quarter, due to the 0.9% year-on-year decline in the hardware business, the proportion of Apple's software business revenue increased to 23.63%. However, judging from the overall data for fiscal year 2022, Apple’s service business revenue accounted for 19.38%, which still did not exceed 20%.

For Apple's software and hardware integration strategy, the importance of the hardware business is self-evident. It not only plays the role of entrance, but also the cornerstone of the entire ecology. Therefore, the weakness of the hardware business will naturally affect the growth of Apple's software business.

In addition, from a global perspective, the advertising business has obviously been affected by the macroeconomic downturn, and Apple’s advertising business has naturally also been impacted.

Some analysts believe that, from the perspective of the past few years, Apple itself has not developed any content services, mainly relying on acquisition or investment to expand the content territory, and the content of its news subscription project itself is not perfect. Therefore, it may not be difficult for Apple to implement software charging, but it is not easy to really rely on services to open up the market.

Separately, during the earnings call, analysts asked if Apple was interested in accelerating the growth of its services business by looking to buy outside products. Cook said that Apple is not buying just to buy, or just to make a profit, but will buy things that are strategic to us, not ruling out any possibility in the future. From this point of view, epitaxial acquisitions are still a major means for Apple to expand its service business.

3

Everything has a cycle

According to Gartner's latest report, global smartphone sales will decline by 7% in 2022. Among them, China's smartphone shipments will shrink by 18%, much higher than the global decline. Obviously, this is not good news for Apple, whose smartphone business accounts for more than 50% of its revenue.

On the other hand, despite the easing of the epidemic factors, the global consumer electronics industry chain still faces certain pressures on the supply of components and costs, and the supply chain pressure on Apple's hardware business still exists.

In this regard, Cook said in the conference call that the epidemic has caused some factories to close, and these companies will operate at an efficiency lower than full capacity for the next three quarters. Subject to the constraints of the supply chain, the Mac business may still experience a year-on-year decline of 10 points.

In addition, the decay of innovation capability is also a major challenge that plagues Apple's future development. Since Jobs, Apple has not launched an epoch-making electronic product like the iPod, iPhone or iPad. Time and time again, Cook pulls out of his pants pocket a new iPhone with slightly modified appearance and function. For discretionary consumption, insufficient product innovation will naturally affect consumers' purchasing enthusiasm, especially in such a sluggish economic environment.

According to Apple's rhythm, new versions of iPhones and other wearable products are generally launched in September. But unlike the iPhone 13, which "increases the volume without increasing the price", the upcoming iPhone 14 series may be the "most expensive iPhone in history".

Many observers believe that in order to cope with the increase in material prices brought about by inflation, the pre-sale prices of the iPhone 14 Pro and iPhone 14 Pro Max are $1,099 and $1,199 respectively, which will be $100 higher than the same model of the iPhone 13.

In the context of longer and longer replacement cycles for consumers, can the iPhone 14 still become a dark horse in the mobile phone market? At least judging from the decline in TSMC's production capacity and Samsung's reduction of OLED panels, the prospects of the iPhone 14 should not be blindly optimistic.

The above analysis shows a problem. The prospects of hardware business such as Apple mobile phones are not so optimistic. Once the basic disk business loses its growth potential, Apple's integrated ecosystem will lose its cornerstone, which in turn will affect user growth and revenue data on the software server side. Judging from its slowing revenue growth, Apple software is difficult to support Apple's future growth.

The so-called everything has a cycle, and Apple is hardly an exception.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~