your current location is:Home > investHomeinvest

"Stock God" Buffett suffered a huge loss of $43.7 billion in the second quarter, and Apple's decline was the culprit. Why is he so calm?

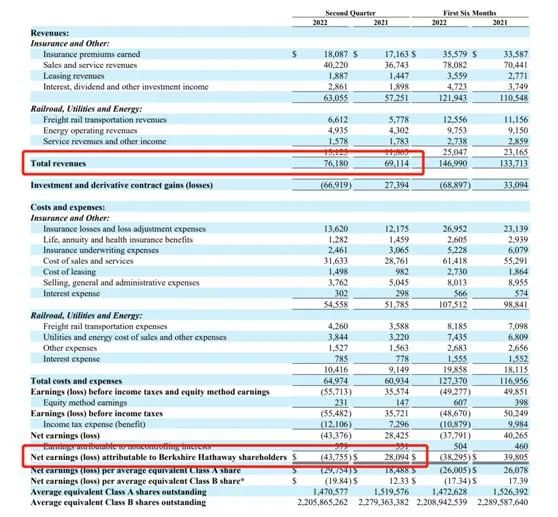

On August 6, local time, Berkshire Hathaway, led by Warren Buffett, announced its second-quarter financial report and semi-annual report. The report shows that the company's revenue in the second quarter of this year was US$76.18 billion, compared with US$69.114 billion in the same period last year, an increase of 10.2%, and operating profit in the second quarter was US$9.28 billion, an increase of 38.7% compared with US$6.69 billion in the same period last year. This profit is the sum of the profits of the insurance, rail and utilities businesses owned by the group.

However, Berkshire Hathaway's net loss attributable to shareholders in the second quarter was $43.755 billion, compared with a net profit of $28.094 billion in the same period last year. That was blamed on the company's $66.919 billion loss on investments and derivatives in the second quarter. In the same period last year, the investment benefit of investments and derivatives was 27.394 billion US dollars.

Throughout the first half of 2022, Berkshire has accumulated a net loss of $38.295 billion, compared with a profit of $39.805 billion in the same period last year.

Heavy holding stocks dragged down investment losses

Under the circumstance that the receivables and net profits of operating businesses are both achieving rapid growth, Berkshire still suffered huge losses, mainly due to the sharp decline in the company's heavily held stocks in the second quarter.

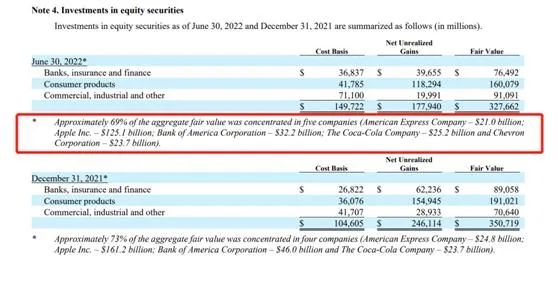

According to the financial report, as of the second quarter of this year, about 69% of Berkshire’s holdings were concentrated in five companies: American Express ($21 billion), Apple ($125.1 billion), Bank of America ($32.2 billion), Coca-Cola Company ($25.2 billion), Chevron ($23.7 billion). Among them, Apple, Bank of America and American Express, the three heavyweight stocks, all fell by more than 20% in the second quarter.

At the end of 2021, about 73% of the holdings were concentrated in four companies: American Express ($24.8 billion), Apple ($161.2 billion), Bank of America ($46 billion), and The Coca-Cola Company ($23.7 billion).

However, the second-quarter earnings report did not fully disclose Berkshire's position change data. Later this month, Berkshire and other large hedge funds will disclose their second-quarter investments to regulators in their F13 filing, when investors will get details on changes to Berkshire's stock portfolio.

In addition, the second-quarter earnings report also disclosed that Berkshire has acquired 17% of Occidental Petroleum's existing share capital, valued at $9.3 billion, which is also a rare large investment by Berkshire in recent years. Occidental's shares rose 97% in the first quarter of this year and 4% in the second.

Shares still outperform

As in the past, Berkshire Hathaway reiterated its call for investors to pay less attention to the quarterly volatility of its equity investments in a press release: Any given quarterly amount of investment gains (losses) is generally meaningless and provides Net earnings per share figures can be extremely misleading to investors with little or no knowledge of accounting rules.

Berkshire believes that given the size of the company's equity securities portfolio, market volatility and changes in unrealized gains and losses on stocks will have a significant impact on the company's performance. In addition, periodic revaluations of certain foreign currency-denominated assets and liabilities, as well as asset impairment charges, may cause periodic net profit fluctuations. The U.S. Financial Accounting Standards Board (FASB) has revised generally accepted accounting principles (GAAP) to require public companies to consider short-term fluctuations in their stock investments in quarterly and annual reports. This means that price fluctuations in Berkshire Hathaway's investments will be reflected in the company's earnings reports, even if it's just unrealized paper gains or paper losses.

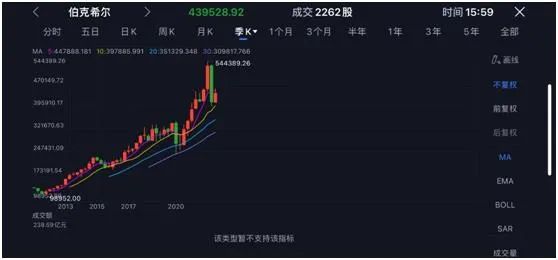

Volatility in Berkshire's earnings also affects share price performance. Berkshire's Class A shares fell more than 22% in the second quarter and nearly 24% from an all-time high hit on March 28, after rising 17% in the first quarter. The S&P 500 fell more than 16% in the second quarter, its biggest quarterly drop since March 2020. In the first half, the Standard 500 fell 20.6%, the biggest first-half drop since 1970. Overall, Berkshire's stock price has outperformed the broader market so far this year.

Berkshire Hathaway stock performance (quarterly line)

Berkshire Hathaway stock performance (quarterly line)related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~