your current location is:Home > Finance > depthHomedepth

Before the storm, CEOs, CFOs all slipped away

If you pay attention to the movements of major technology companies in the United States, you may find that an undercurrent is surging in many companies recently-a large number of executives of American companies, especially the chief financial officer, have announced their departure one after another.

For the entire U.S. tech sector, this is an unusual signal: Changes in company executives, especially CFOs and CEOs, tend to be more sensitive and noticeable than layoffs or departmental adjustments to rank-and-file employees. Because these two roles often have a comprehensive understanding of the business and financial situation of the company, their departure will generally send a bad signal to the outside world.

In recent months, executives of some U.S. technology companies have left one after another, casting a shadow over the already cold winter market.

|CFOs with a keen sense of smell take the lead in "running" in the cold winter

The CFO holds the financial power of a company, which is generally directly related to the company's financial security and development prospects. As the brains of CEOs, CFOs have an irreplaceable right to speak in the company. Many companies hire experienced CFOs with high salaries to help promote the company's financial expansion or listing. CFOs are often the highest paid company executives after the CEO. position.

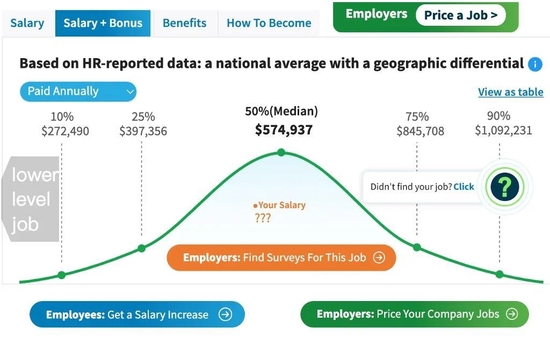

According to statistics from Salary.com, as of September this year, the median base salary of CFOs in the United States was $362,000, while the median total compensation after bonuses and benefits reached $506,000.

Image via Salary.com

Image via Salary.comThe salaries of CFOs at many large tech companies are staggering. For example, in 2015, Google hired Ruth-Porat from Morgan Stanley as the company’s CFO. The signing fee alone was $5 million. Google also promised that the CFO would receive a total of $70 million within two years. Previously, Snap hired Tim Stone, Amazon's vice president of finance, as CFO, and also offered an annual salary of $500,000 plus $20 million.

As the controller of the company's financial information that has not disclosed important financial information of the listed company, the CFO's decision to resign may be largely due to the pre-awareness of the major financial risks the company will face in the future and to avoid risks. , to avoid taking responsibility and other considerations to make a sudden decision to leave. Therefore, the recent frequent departures of CFOs of US technology companies have also made the market particularly vigilant. Recently, many American companies, especially some technology-based growth companies, have successively reported the news of the departure of their CFOs.

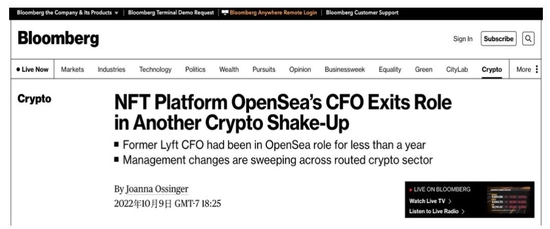

Earlier this month, Brian Roberts, the chief financial officer of OpenSea, the world's largest integrated NFT trading platform, announced his departure, just 10 months after he announced his appointment at the end of last year. Previously, Brian Roberts served as Lyft's chief financial officer for seven years and helped Lyft complete various financing rounds and IPOs.

Image via Bloomberg

Image via BloombergThe current role of Brian Roberts has changed from the company's CFO to Opensea's consultant. The resignation of Brian Roberts may also confirm once again that Opeansea's current situation is not optimistic.

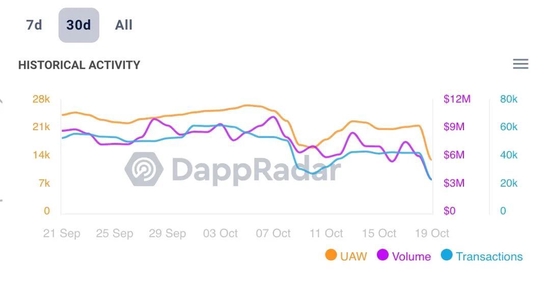

Since the beginning of this year, the business level of Opensea has shrunk seriously. According to the statistics of NFT market research company DappRadar, in the past 30 days, the transaction value of the OpenSea platform was only about 250 million US dollars, which was a 90% decrease from the US$2.5 billion transaction volume in December last year; its NFT sales in the third quarter The total was $3.4 billion, compared with $12.5 billion in the first quarter of this year.

In addition, the management level of the company is also turbulent. Opensea had previously announced a layoff rate of up to 20%, and in addition to the recent departure of Brian Roberts, Ryan Foutty, vice president of business development, recently stated that he had also resigned from Opensea.

Opensea's transaction data, the picture comes from DappRadar

Opensea's transaction data, the picture comes from DappRadarSuch operating difficulties not only happened to Opensea, but also the news of CFO's resignation as the hardest hit by the recent valuation drop in technology finance.

Last week, Silicon Valley business credit card giant Brex, which was valued at $12.3 billion at the beginning of the year, announced 11% layoffs and confirmed the impending departure of its chief financial officer, Adam Swiecicki.

Brex was once one of the most successful start-ups incubated by YC in recent years. Its founder, Henrique Dubugras, is arguably the most striking young man in the Silicon Valley startup scene: he founded the first financial technology company at the age of 16, and he was three years old. A year later, he sold the company and went to Stanford University. After 6 months, he dropped out of school to start a business again. At the age of 22, he founded Brex and has raised $1.2 billion so far.

But at the moment of the ebb of financial technology, Brex is not immune to it. In June, Brex announced that it would stop serving traditional small businesses and instead focus on a new product, Empower, to help early-stage startups scale, and news of massive layoffs soon followed.

In addition to financial technology, news of the CFO's departure has also been reported in the fields of new energy and autonomous driving, which are undergoing rapid adjustment. On Wednesday, Faraday Future announced that its interim CFO, Becky Roof, had resigned, effective immediately, and said the company had passed layoffs and pay cuts in exchange for equity, cutting costs and saving cash.

Image via Yahoo Finance

Image via Yahoo FinanceIn addition to the above three companies whose CFOs recently announced their departure, according to incomplete statistics from Silicon Stars, companies whose CFOs have left in recent months include Paypal, Silicon Valley big data company Splunk, the largest food delivery platform Blue Apron in the United States, and the health management platform Duo. Corner Noom et al.

| Some CEOs and executives can’t sit still

In addition to the CFO, the management of some US companies is also undergoing dramatic changes. Many of these founders and CEOs are also joining the wave of departures.

Last week, Rowan Trolllope, CEO of Five9, a listed cloud software company, announced his resignation, causing Five9's stock price to plummet 25% that day. As a communication service provider with an eye-catching performance in the epidemic, Zoom once threw an all-stock acquisition intention worth $14.7 billion to Five9 in mid-2021, but Five9 was on the rise at that time. Too low ended up rejecting Zoom.

However, Five9 has lost more than 70% of its value since peaking in August 2021, leaving it with a current market cap of less than $4 billion.

Image via Rowan Trolllope Twitter account

Image via Rowan Trolllope Twitter accountIn addition, the turmoil in the crypto space has also been reflected in the departure of CEOs and founders.

At the end of last month, Alex Mashinsky, the CEO of the crypto lending platform Celsius, which was involved in the bankruptcy crisis of Three Arrows Capital, announced his departure. Just a week after his departure, Celsius co-founder and chief strategy officer S. Daniel Leon handed in his resignation to the company last week.

As recently as July, Celsius filed for bankruptcy protection in court due to high debt, with a balance sheet deficit of $1.19 billion and about 23,000 outstanding loans to retail borrowers for a total of $4.11 One hundred million U.S. dollars.

In the field of real estate technology, a few months ago, the start-up company Better.com, which used Zoom to "violently" layoffs thousands of people, rushed to the hot search startup Better.com. In recent months, almost all executives have run out.

The company's vice president of communications, director of public relations and marketing, and Chinese CTO Diane Yu all resigned after the Zoom layoffs. In the past two years, Better.com's development momentum has been very rapid, and it has conducted nearly 10 rounds of financing. The investors include top institutions such as SoftBank, Goldman Sachs, and Amex, and the valuation is as high as 7.7 billion US dollars.

As planned, Better.com is expected to go public this year. But in view of the current large-scale departure of executives, this goal is almost impossible to achieve.

|U.S. capital markets are experiencing the worst period in 20 years

The running of company executives may have a lot to do with the current cold winter in the U.S. capital market.

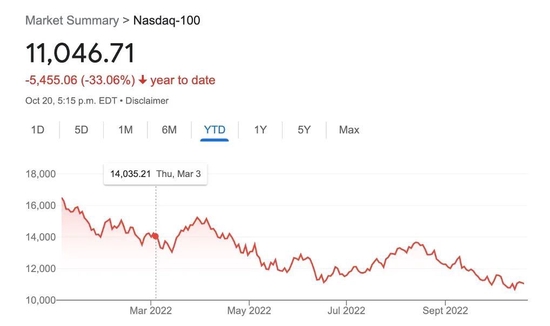

As the Federal Reserve continues to aggressively raise interest rates, recession risks intensify. The valuations of a large number of start-ups have continued to plummet. The Nasdaq 100 has fallen by more than 30% this year, and the S&P 500 has also fallen by more than 20%. The valuations of American companies have been slashed in half and their ankles have been slashed, which has also increased the financial and operational risks of many companies.

Image via Google

Image via GoogleIn addition to the capital market slump, data show that this year's U.S. IPOs have basically come to a complete standstill. According to statistics from research firm Dealogic, since the beginning of this year, the scale of US stock IPO financing is only about 7 billion US dollars, and the total amount is close to a record low in 30 years.

According to Ernst & Young's "Global IPO Trends Report for the Second Quarter of 2022", in the first half of 2022, the number of IPOs and financing scale of the two major U.S. exchanges, the Nasdaq Stock Exchange and the New York Stock Exchange, dropped significantly compared with the same period in 2021. 75% and 94%. Private equity appears to be trying to avoid the IPO market this year.

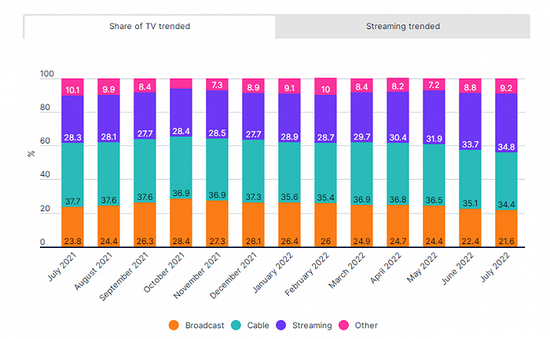

U.S. IPO activity since 2009, the picture comes from Factset

U.S. IPO activity since 2009, the picture comes from FactsetAt the start of the year, many were looking forward to the U.S. tech IPO market in 2022. Because this year, there may have been many technology startups with a valuation of more than 10 billion yuan, including digital payment company Stripe with a valuation of 100 billion yuan, cross-border e-commerce Shein, and online community Reddit with a valuation of 10 billion yuan, game developer Epic Games, grocery delivery platform Instacart, Intel’s self-driving project Mobileye, fintech company Klarna, online marketplace and sneaker and apparel distributor StockX, among others.

But as of now, only Mobileye has submitted an IPO application among these high-profile listed companies. The entire US stock market has been listed for nearly 250 days since the last time a large technology stock with a value of more than 50 million US dollars was listed, setting a new record for the longest time in the past 20 years. time record.

Even with a headwind to go public, these companies have underperformed. In the second quarter of this year, the total of the top 10 IPOs on the US stock market was only $2.5 billion, but in the fourth quarter of last year, the figure was as high as $25.8 billion.

The analysis shows that the downturn in the overall U.S. tech market will continue at least until the end of the year. U.S. markets appear to be having their worst year since the 2008 financial crisis.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~