your current location is:Home > Finance > depthHomedepth

It collapsed and the investment went to zero! Lehman time is coming

In May of this year, the collapse of Luna coin made countless people lose their money overnight, and only half a year later, the cryptocurrency hit another super storm - the top cryptocurrency exchange FTX collapsed and declared bankruptcy. ..It can be called the Lehman moment in the currency circle.

This time, a group of well-known venture capitalists became the target of being cut off, scaring financial institutional investors to liquidate their virtual currency assets. However, investors who have stepped on FTX have no choice but to admit their losses, including Sequoia Capital, a well-known investment institution.

1

Institutions have stepped on the thunder, and Sequoia Capital "recognized the plant"

Last week, Sequoia Capital posted a reminder to investors on social media that it had written off the entire value of its investment in cryptocurrency exchange FTX to zero. As soon as the news came out, it directly detonated the currency circle, which means that companies such as BlackRock, Tiger Global, SoftBank Group, and Ontario Teachers' Retirement Fund also stepped on the thunder.

It is reported that two funds under Sequoia Capital invested a total of US$213.5 million in FTX and FTX US. The $150 million exposure to FTX and FTX US in its third global growth fund is less than 3% of the fund's total capital commitment.

“The liquidity crunch has created a solvency risk for FTX in recent days, and based on our current understanding, we have reduced our investment to zero dollars. The full nature and extent of this risk is not yet known, and we are monitoring its development. situation.” Sequoia Capital said, “We are in a risk-taking business. Some investments will surprise people, and some investments will disappoint.”

In a statement, Sequoia assured its LPs that its funds were largely unaffected by the collapse of the cryptocurrency exchange giant FTX and the slump in the cryptocurrency market, and stressed that its limited exposure to FTX would not affect the operation of its funds.

"The $150 million loss was offset by approximately $7.5 billion in realized and unrealized gains in the same fund, so the fund held up well," Sequoia wrote in a statement.

It is worth mentioning that Sequoia Capital was founded in Silicon Valley. According to the "2022 Mid-Year Hurun Global Venture Capital Institution", it has become the most successful venture capital institution in the world. In the first half of this year, it has invested in 328 unicorns and star companies around the world. Antelope Enterprise.

In 2005, Sequoia Capital also co-founded Sequoia China with Shen Nanpeng, and the current scale of funds under management has exceeded 300 billion yuan. As a localized team in China, since 2019, Sequoia China has invested in 67 companies in A-shares, Hong Kong stocks, and U.S. stocks for successful IPOs, many of which have achieved hundreds of times returns. Meituan, Pinduoduo, WuXi AppTec, and Bethany are all representatives of star projects.

With Sequoia Capital's "strong man breaking his wrist" this time, many people in the industry have become more concerned. Which VCs have lost their money?

According to a list of early investors in FTX compiled by industry analyst Frank Chaparro on social media, people can find many familiar names:

BlackRock, Ontario Teachers' Pension Fund, Sequoia Capital, Paradigm, Tiger Global, SoftBank, Circle, Ribbit Capital, Alan Howard, Multicoin, VanEck, Temasek.

A shareholder list provided to the media by FTX at the beginning of the year shows that Sequoia Capital, Temasek and Paradigm will be the three investment institutions that will lose the most in this crash. Temasek has a 1% stake and an estimated investment of $205 million. Paradigm holds a 1% stake and has an estimated investment of $215 million.

It is worth mentioning that in this year's global stock market crash, many of the above-mentioned institutions have suffered heavy losses. For example, the Tiger Global Fund fell by more than 55% during the year. For the first time in 17 years, SoftBank, which suffered two consecutive quarters of losses, suffered heavy losses in the first half of the year. A loss of more than $35 billion.

This year, as the price of cryptocurrencies such as Bitcoin has fallen, mainstream financial institutions have also undergone a sharp shift in their attitude towards cryptocurrencies. Recently, hedge funds and wealthy family offices in Europe and the United States have chosen to liquidate their positions in encrypted digital assets.

2

After plummeting more than 90%, FTX went bankrupt

In May of this year, the Luna coin, known as "Motai in the currency circle", fell from nearly $90 to less than $0.00015, a drop of more than 99%, and the market value of more than $40 billion was almost zero. It can be called a "value destruction machine". After half a year, FTX and its tokens also fell into the abyss, and the company declared bankruptcy.

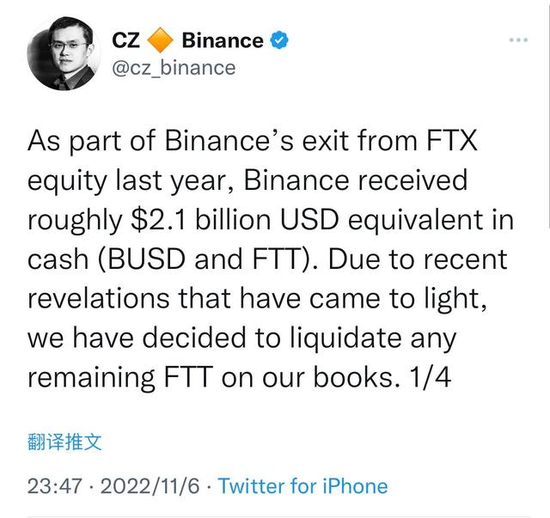

The reason for this is that on November 6th, Changpeng Zhao, the founder of Binance, the world's largest crypto exchange, posted a message on Twitter: We will sell all FTT (the token of the FTX company) on our books.

This tweet is considered to be Changpeng Zhao "shorting" FTX and officially "declaring war" on the world's top three cryptocurrency exchanges, and then the token fell all the way from $25 to $1.6 today, a drop of more than 92% on the 7th .

FTX and its founder Sam held on for two days, but had no choice but to surrender. On November 9, Sam issued a statement on social media, expressing "hope and request for Binance to acquire FTX", "Thank you Changpeng Zhao, thank Binance".

The FTX trading platform was established in 2019 and is headquartered in Hong Kong, China. Similar to virtual currency trading platforms such as Coinbase and Binance, FTX is also a leader in the wild wave of virtual currency in recent years, and has gradually reached the top of the wave, with a valuation as high as $32 billion. FTT coins are issued by FTX, with a market value of more than 100 billion US dollars, and are sought after by hundreds of thousands of people overseas. Now, it has come to an end with the founder's "disarming".

According to statistics, on November 8, Sam also had a net worth of 15.6 billion US dollars, and by the next day, his net worth was less than 1 billion US dollars. Losing nearly $15 billion in one day, the 94% drop set the record for the largest single-day drop in wealth for a billionaire in the world.

It is reported that on November 9, Binance and FTX signed a non-binding letter of intent to acquire. However, a few hours later, Binance announced that, considering the results of due diligence on FTX, as well as the news that FTX allegedly mishandled customer funds and faced an investigation by US regulators, Binance decided not to proceed with the acquisition of FTX.

On the evening of November 11, Beijing time, FTX issued an announcement saying that the company has carried out bankruptcy proceedings in Delaware under Chapter 11 of the U.S. Bankruptcy Code.

Due to the spread of panic, users began to redeem virtual currency and fiat currency in FTX in large quantities, and the run crisis was imminent. FTX announced the suspension of user withdrawals.

However, the emergence of Justin Sun, the founder of Tron, may give FTX, which is deeply mired in a liquidity crisis, a glimmer of life. There are reports that Tron is in fundraising talks with FTX after FTX was unable to resolve user withdrawals. However, Justin Sun declined to comment on the exact amount.

The FTX crisis is dragging down the entire currency circle. In the past 7 days, the price of Bitcoin has fallen below five integer levels in a row, temporarily reporting $16,771, and once fell to $15,465.7, the lowest since October 2020, which means that Bitcoin’s largest drop in a week exceeded 26%. Data shows that in just one day, more than 328,000 people in the virtual currency market were liquidated, and more than 600 million US dollars of funds evaporated overnight.

Industry insiders pointed out that for investors in the currency circle, even a leading trading platform like FTX can "collapse overnight" and become a company facing a crisis of trust and asset loss, then the stability of the entire industry can be said to be vulnerable. .

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~