your current location is:Home > investHomeinvest

Goldman Sachs raises $10 billion

It's been a while since we've seen such an astonishing dollar raise.

This time, it was Goldman Sachs’ own official announcement: at the end of September, its asset management department (referred to as: GASM) completed a huge fundraising - West Street Capital Partners VIII (hereinafter referred to as: WSCP 8 Fund), with a total amount of 9.7 billion raised. Dollar. In Goldman's own words, this is the company's largest PE fund since 2007.

Founded in 1869, Goldman Sachs is one of the oldest and largest investment banks in the world, and it dominates Wall Street. After more than 150 years of ups and downs, "investment bank" is also the most profound label Goldman Sachs has left to the outside world. But in fact, this beast has long been quietly involved in private equity investment and venture capital, and has invested in a number of unicorn companies. In China's venture capital market, we can always capture the presence of Goldman Sachs.

The mood in the primary market is low, and Goldman Sachs raised such a large amount of money, which makes people feel complicated. Looking back a year ago, Goldman Sachs CEO David Solomon began to emphasize: “When I look back on my 40-year career, there have been many periods where greed far outweighed fear—and now we’re in a period like that. ." After reading it carefully, everyone still has different feelings.

Goldman Sachs PE Team

Raised about $10 billion in one go

In fact, this PE fund Goldman Sachs has been raised for nearly two years.

The regulatory announcement shows that the new fund, named Goldman Sachs WSCP Phase 8 Fund, received an investment commitment for the first time in November 2020. After nearly two years of fundraising, it has finally come to an end. Goldman Sachs official said that the final fundraising scale of the new fund far exceeded the target.

This time, Goldman Sachs PE Fund has assembled a diverse group of LP investors, including pension funds, sovereign wealth funds, financial institutions, family offices and other institutions, as well as high net worth investors. It is worth mentioning that Goldman Sachs and some of its employees also participated in the raising of the new fund, and accounted for a large proportion.

With the entry of $9.7 billion, Goldman Sachs GSAM will manage $2.5 trillion in assets, of which private equity funds account for $176 billion. Julian Salisbury, global co-head of GASM at Goldman Sachs, said in a statement, "We see a lot of opportunity in a variety of industries that are undergoing disruptive changes driven by technology, industry and geography."

How to vote? Goldman Sachs said that this PE fund will continue its strategy of focusing on controlling investment in mid-to-large-scale enterprises. The main areas include financial and business services, health care, consumption, technology and climate transformation. The investment valuation is between 750 million and 20 million. Companies with an average investment size of $300 million.

While raising and investing, the Goldman Sachs PE team has already launched some projects. According to reports, the 8th phase of the WSCP fund has currently invested in a number of companies in various regions and industries, including the European specialty pharmaceutical company Norgine, the Japanese road paving company Nippo Corporation, the global market contract research organization Parexel, the US membership-based medical and health platform MDVIP and UK quality certification, inspection and consulting services company LRQA.

The name of Goldman Sachs is not unfamiliar in the arena. In 1848, a Jew named Marcus Goldman came to the United States in the first wave of Jewish immigration. After being a coachman and tailor shop owner for 21 years, in 1869, seeing businessmen who could not borrow money due to the Civil War and bank credit crunch, Marcus Goldman tapped a new business opportunity - promissory note transaction, that is, from businessmen Buy a promissory note at the office, then resell it to a commercial bank to earn the difference, and set up a company.

By 1882, Marcus Goldman had been running the company alone for 13 years, that is, in this year, he promoted his son-in-law to partner, three years later his son was also promoted to partner, and in the future he made the company go further. Shanghai investment banking business road, thus began the Goldman Sachs Group's partnership system for more than 100 years. The company changed its name to Goldman, Sachs & Co in 1888. , the predecessor of Goldman Sachs.

In the 1890s, Goldman Sachs became the largest commercial paper dealer in the United States, and entered the New York Stock Exchange and became a member of Wall Street. During the period, it cooperated with Lehman Brothers in securities underwriting business and became a real investment bank. In the decades that followed, Goldman Sachs experienced numerous storms and almost went bankrupt at one point.

What really made it a blockbuster was the 1956 IPO of Ford by Goldman Sachs, which created the highest IPO financing record at that time and shocked the US investment banking industry. Goldman Sachs also ranked among the forefront of the IPO market with this classic case.

At the end of the 20th century, under the leadership of Henry Paulson, the third-generation godfather of the group, Goldman Sachs became the most profitable investment bank on Wall Street. It is an all-round investment bank with diversified business lines such as , market making and derivatives, and it is also one of the oldest and largest investment banks in the world.

Goldman Sachs has been controversial for over a century. Some see it as a role model for the investment banking world, while others see it as a greedy vampire. Goldman Sachs was greedy in the subprime mortgage crisis, the Greek debt crisis, and the Vietnam financial crisis, and investors from all over the world, including the United States, suffered greatly.

Many times, Goldman Sachs seems to be a savage of fraud and speculation, but its position on Wall Street is still unshakable today.

This year's net profit has been cut in half, and it has just been reported that large layoffs

Goldman Sachs enters the primary market

So the question is, investment banks are doing a good job, why does Goldman Sachs do PE so aggressively? This has to mention the storm that is hanging over the top Wall Street investment bank.

The predicament of the IPO market is obvious to all. In the face of aggressive interest rate hikes by the Federal Reserve and expectations of an economic recession, a large number of companies gave up the idea of issuing stocks and bonds, and the investment banking business fell into a downturn. Through the first half of the year, Wall Street saw a 90% decline in the number of IPOs, a 75% drop in high-yield bond offerings, and a 30% drop in acquisitions and mergers.

This has directly led to the investment bank's revenue falling into Waterloo, so of course Goldman Sachs, whose core business is the investment bank, is not immune. Goldman Sachs’ second-quarter 2022 financial report shows that operating income in the second quarter was US$11.864 billion, a year-on-year decrease of 22.9%; of which investment banking revenue was US$1.79 billion, a year-on-year decrease of 48%. Net profit attributable to common shareholders was US$2.786 billion, down 48% year-on-year. In addition, Goldman Sachs earned $7.73 per share in the second quarter, down 49% year-on-year.

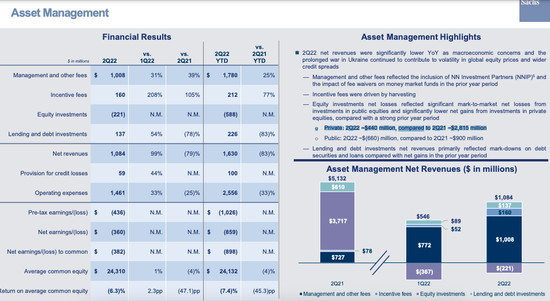

Goldman Sachs is also stretched thin in its asset management business. According to the financial report, Goldman Sachs’ asset management business revenue in the second quarter was only US$1.084 billion, a drop of nearly 80% from US$5.1 billion in the same period last year. This was mainly due to the net loss of its equity investment portfolio, and the still significant decline in net income from loans and debt investments.

Goldman Sachs lost $660 million in public-market equity investments in the second quarter amid a dismal performance in technology stocks. And this is the fourth consecutive quarter that it has lost more than $100 million in public market stock investments, and has lost $2.6 billion in four quarters. In the private equity market, Goldman Sachs also lost $440 million in the second quarter. In other words, Goldman Sachs lost a total of US$1.1 billion in the primary and secondary markets in the second quarter, or about 8 billion yuan.

In terms of the performance of the secondary market, Goldman Sachs’ stock price has been falling since the beginning of the year, from a high of $418 to a minimum of $278, the largest drop in the range of nearly 30%.

The external economy was sluggish, and internal revenue and profits fell, and Goldman Sachs began to take precautions. According to information disclosure, Goldman Sachs has restarted the last elimination mechanism and embarked on the largest layoff since the outbreak of the new crown epidemic, and 500 people may be eliminated. As a result, Goldman Sachs became the first leading investment bank on Wall Street to start layoffs to control expenses.

The new PE fund of US$9.7 billion can be understood as a move by Goldman Sachs to deal with uncertainty, and it is also a forward-looking layout in the trough of the economic cycle. At present, it is affected by multiple factors, even if High-quality assets, valuations are also low, some people think it is a good time to sell.

In other words, this was originally the ammunition that Goldman Sachs prepared to support the investment banking business, making a more secure Pre-IPO round of investment when the market was full of uncertainty, and anchoring clients who were preparing for the IPO in advance.

In fact, when it comes to PE investment, Goldman Sachs is serious. In the eyes of the outside world, Goldman Sachs has always been a leader in investment banking. But in fact, in the past few years, it has also been successful in the VC/PE arena, and its activity is not inferior to that of venture capital institutions.

Over the years, relying on the rich bag of money, Goldman Sachs has also cast a unicorn. Just take the Chinese market on the other side of the ocean as an example, well-known companies such as Shukun Technology, KEEP, Monster Charge, Gan & Lee Pharmaceuticals, SMIC and other well-known companies have Goldman Sachs behind them. Among them, in 2021, Goldman Sachs invested more than 20 projects in China in one go, and traced its investment path in China, and a certain proportion of the shots occupied the leading position.

"Funds issued at low levels tend to have better returns"

Is it low now?

Will the world get any worse? The scene we are currently facing needs no further elaboration. Wall Street and Silicon Valley are equally mourning, as Zuckerberg lamented: "This recession may be one of the worst we've seen in recent history."

In this context, greed or fear is a heart-wrenching question.

Goldman Sachs tallied a sentiment index that was negative for the 31st week in a row, near a record level. This shows that investors have finally abandoned the investment philosophy of "There Is No Alternative to equities (TINA)". "Rising rates are causing a shift in investor mentality from TINA to TARA (there are plenty of other stock alternatives in the market, There Are Reasonable Alternatives)."

Another Goldman Sachs research report also said that financial institutions accustomed to investing in secondary market stocks are increasingly interested in private equity in technology companies in the primary market.

This may also be a signal. As we've seen, BlackRock raised $3 billion last year to invest in the private equity secondary market, and Morgan Stanley Investment Management announced earlier this year that it had successfully raised $2 billion for its private equity fund, not to mention the coveted Tiger Global Fund and so on.

In a research report published earlier this year, Goldman Sachs portfolio strategist Peter Oppenheimer argued that a new “paradigm shift” is underway in the investment environment – the modern cycle is over, and the postmodern cycle is beginning. In the new cycle, the risk of inflation will be greater than that of deflation, accompanied by economic regionalization, labor, and commodity prices. During this period, the stock market's overall return will decline as higher interest rates will cause valuations to contribute less to earnings.

On the other side of the ocean, the domestic primary market is also experiencing similar fluctuations. The era of high returns on IPOs is gone, and the investment performance of the fund is both happy and unhappy. In uncertainty, "confidence" is a topic that is often brought up, which is related to how to raise money, what good projects can be invested, and how to achieve graceful exit.

On the optimistic side, the more divergent the market is, the more favorable investment opportunities there are. As a VC investor in Beijing who is preparing for a new fund tactfully said: "The more the market is in a downturn, the more LPs have to dare to take action. For any fund issued at a high level in the secondary market, the net value of the fund has fallen sharply, and the lower it is. Funds issued tend to have better returns.”

At present, most of the investors who are still active in the market have a consensus that VC is a highly cyclical industry and will always experience peaks and troughs. Historical experience is that troughs are often the best times for VC/PE to take action.

But how far is the trough? Many colleagues witnessed the current situation, lamented that the cold winter may be longer than expected, and "keep cautiously optimistic".

At this moment, some people go left and some people go right.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~