your current location is:Home > Finance > NewsletterHomeNewsletter

Musk: Oil and gas are still needed in the short term, otherwise civilization will collapse!

Tesla CEO Elon Musk, the world's richest man, made a surprising statement at an energy conference in Norway this week. He said humanity must rely on oil and gas "in the short term" or "civilization will collapse".

"Especially these days, with Russia being sanctioned, we really need oil and gas to keep civilization going, any reasonable person would conclude," he said in an interview with the media. At the same time, sustainable energy must be accelerated. development of."

Image source: Vision China VCG111395775038

Image source: Vision China VCG111395775038When asked if Norway should drill for more oil and gas, Musk said "some additional exploration is warranted at this point." He also highlighted Norway's potential to harness wind and hydroelectric power, possibly exporting this energy to southern Europe.

Musk said the transition to sustainable energy will take decades to complete. In his speech at the meeting, he emphasized that he does not agree with the demonization of oil and gas. "Now, we need more oil and gas, not the other way around. But at the same time, we need to move quickly towards a sustainable energy economy."

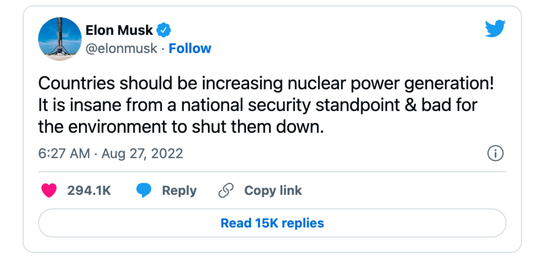

Additionally, Musk tweeted on Friday that "Countries should increase nuclear power generation." "From a national security standpoint, closing a nuclear power plant is insane and bad for the environment."

The Russia-Ukraine conflict has upended the fossil fuel market. For example, in Germany, coal power generation, as an important traditional energy source, has been steadily declining in the proportion of coal power generation in the country's energy structure in recent years. In 2021, the share of coal in Germany's electricity production will be 27.4%.

Just a few days ago, on August 29, local time, the news of the restart of the Hayden No. 4 coal power plant in western Germany aroused special attention from the outside world. Hayden 4 is the largest coal-fired power station of all power stations in Europe, with a capacity of 875 MW. The coal plant burns 265 tons of coal per hour at full capacity.

Another signal is that "stock god" Buffett recently sold "new energy" BYD and bought "old energy" Western oil, which has attracted great attention from global investors.

At the beginning of August, Berkshire Hathaway spent $390 million to increase its holdings of 6.68 million shares in Occidental Petroleum, raising its shareholding ratio to 20.2%; then the regulatory authorities also approved Berkshire Hathaway's application for Occidental Oil companies can hold up to 50 percent of their shares.

In the eyes of market participants, the valuation of the new energy sector is too high, and in the context of the Fed raising interest rates, the pressure on these high valuation sectors to adjust is increasing; Profits are also expected to continue to improve, and Buffett's approach fully embodies "people give up on me".

Previous:Musk's lawsuit continues, UC Law School launches "Musk's Law" course

Next:U.S. antitrust agency opens probe into Amazon's takeover of robot maker iRobot

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~