your current location is:Home > Finance > NewsletterHomeNewsletter

The FTX crisis triggers deleveraging in the currency circle, and institutions say Bitcoin may fall to $13,000

The currency circle fell into a dark "Lehman moment", and the liquidity crisis of the leading cryptocurrency exchange FTX triggered a series of negative market chain reactions.

On November 10, local time, the JPMorgan Chase strategist team analyzed to foreign media that affected by the FTX liquidity crisis, the cryptocurrency market will face a deleveraging process that will last for several weeks. This “turbulent” period could lead Bitcoin to drop to around $13,000. Meanwhile, JPMorgan predicts that the cryptocurrency market will face a “cascade of margin calls” given the interplay between the FTX exchange, its “sister” trading firm Alameda Research and the rest of the crypto ecosystem . According to Coindesk, as of press time, the price of Bitcoin is below $17,000, having dipped below $16,000 earlier today. On November 9, the price of Bitcoin was still around $20,000.

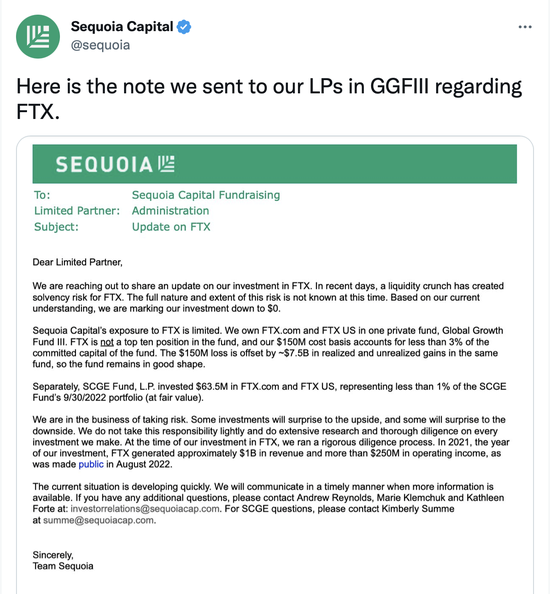

On the same day, Sequoia Capital issued a statement to investors on social platforms, saying that the liquidity crunch has brought solvency risks to FTX, and Sequoia Capital will write down the value of its invested FTX to zero.

Sequoia said it performed rigorous due diligence when investing in FTX. “Data released in August 2022 showed that in 2021, FTX achieved a revenue of approximately $1 billion and an operating income of more than $250 million.”

Sequoia has limited exposure to FTX, investing $150 million in FTX and FTX.us primarily through private fund Global Growth Fund III, and "a $150 million loss was covered by 75% of the fund's losses," the statement showed. $63.5 million was invested through the SCGE Fund (LP), but at the end of September 30, 2022 in the Fund’s value) accounted for less than 1%.

"We are in a risk-taking industry. Some investments will be pleasantly surprised, and some will be disappointing," Sequoia Capital stressed in a statement.

JPMorgan strategists also pointed out that the number of entities with stronger capital that can rescue the low-capital and high-leverage cryptocurrency institutions is declining, which is exacerbating the problems facing the cryptocurrency market today.

It took less than 24 hours from Binance’s announcement of the rescue to its departure.

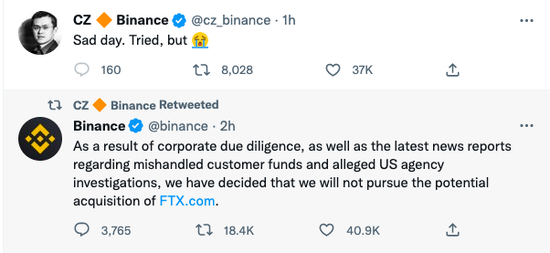

On November 9, local time, Changpeng Zhao, the founder and CEO of the cryptocurrency exchange Binance, announced on the social platform that Binance will acquire FTX due to the liquidity crisis of its competitor FTX. However, on November 10, Binance announced that it had decided to abandon its potential acquisition of FTX based on the results of due diligence and news reports about mishandling of customer funds and an investigation by U.S. regulators.

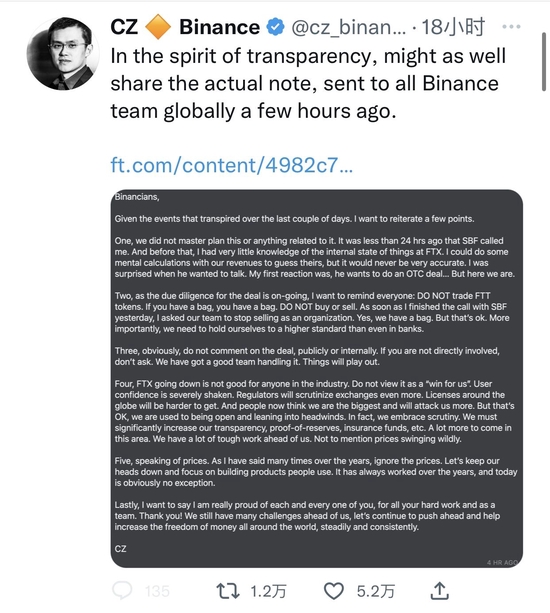

Before deciding to abandon the acquisition of FTX, Changpeng Zhao published an email he posted to the company's employees on social platforms. It mentioned that Changpeng Zhao knew very little about FTX's internal situation before Sam Bankman-Fried, the founder and CEO of FTX, came to ask for help, and reminded employees that "due diligence on the acquisition transaction is in progress" and "do not trade FTT tokens" ".

Changpeng Zhao published emails to company employees on social platforms

Changpeng Zhao published emails to company employees on social platformsChangpeng Zhao emphasized that the decline of FTX is not good for anyone in the industry, "don't think this is our victory". He pointed out that the confidence of users in the cryptocurrency market has been severely frustrated, and regulators will conduct stricter scrutiny on cryptocurrency exchanges, and it will be more difficult to obtain licenses on a global scale. certificates, insurance funds, etc.

The near collapse of FTX and the movements of Binance quickly caught the attention of regulators.

According to foreign media reports on October 9, local time, the U.S. Securities and Exchange Commission (SEC) and the CFTC are reviewing the relationship between FTX and FTX.us, and the U.S. financial regulator is further investigating the relationship between FTX and Alameda Research. The SEC investigation focused on FTX.us and its crypto lending activities, including customer funds handling and lending issues. In the end, based on the results of due diligence, investigations by U.S. regulatory authorities and other factors, Binance announced that it would abandon the acquisition of FTX.

Zhao Changpeng tweeted, "Sad day, worked hard."

According to foreign media, FTX founder and CEO Sam Bankman-Fried has told FTX investors that FTX faces a funding gap of up to $8 billion and needs $4 billion to maintain solvency. "Companies are trying to raise rescue funds in the form of debt, equity or a combination of the two. Without a cash injection, the company will need to file for bankruptcy."

"Actually, the biggest problem with FTX is that it misappropriates too much client assets and uses too much leverage," a cryptocurrency observer said to The Paper (www.thepaper.cn), "Now we have to see if there are other capitals willing to rescue them. FTX. If not, then FTX can only go to bankruptcy, and then users and investors file lawsuits.”

"The first impact of the FTX incident on the market is in terms of funds. Because there were many quantitative institutions or individuals' funds on the FTX platform in the past. Now this part of the value is equivalent to evaporating out of thin air, resulting in bad debts for institutions. So also It cannot be ruled out that there will be a chain reaction, and some other institutions will be affected, especially those with high leverage.” The above-mentioned cryptocurrency watcher said, “The other is the impact on the psychological level of market investors. Although there have also been many cryptocurrency transactions in the past. Even the Mt.Gox exchange, which once ranked first in the industry, closed down. But at that time, the entire cryptocurrency industry was small, with little influence, and the leverage ratio was not high at that time. Now the industry has developed for 10 years. , the volume is already very large, and there is still an opaque situation, which will reduce investors’ confidence in the entire centralized exchange industry.”

From a regulatory perspective, the cryptocurrency market may face more stringent regulations in the future. "After all, the industry has grown in size and its influence has grown. And in the past two years, many traditional capital and traditional financial investors have entered the market. The regulators also want to exert more influence." The above-mentioned cryptocurrency observer said The rapid collapse of the two leading projects in the cryptocurrency industry this year, Luna and FTX, undoubtedly provides the best reason for regulators to strengthen supervision.

He also pointed out that the original reason for the birth of Bitcoin and blockchain is because the traditional financial industry is opaque, there is the problem of misappropriation of customer assets, and amplifying leverage has caused a financial crisis. After 10 years of development, the cryptocurrency industry has not only failed to solve the problem of transparency, but also created more and more problems. "Dragon slayers become dragons," he said.

Previous:Musk's promises become empty words? Twitter accused of banning content that is bad for Tesla

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~