your current location is:Home > Finance > depthHomedepth

Recession shadows: layoff clouds cloud Silicon Valley

”The high-speed growth period of the past decade (Silicon Valley) has undoubtedly ended. " Lightspeed, a Silicon Valley venture capital fund, said bluntly in a research report last month.

The recession is just around the corner. No one knows for sure how large and how long the U.S. economy will fall into recession, but the shadow of this uncertainty may be the most terrible. From technology giants to ordinary people, anxiety is pervasive in Silicon Valley, "freezing recruitment, layoffs, unemployment, reserves for the winter", which has become a hot topic recently, as during the 2008 financial crisis.

Over the past decade, the technology industry has been leading the recovery and growth of the U.S. economy, and has experienced a "golden growth period". From social networks to mobile Internet, from cloud computing to artificial intelligence, from cryptocurrency to blockchain, new technology waves continue to rise. Silicon Valley seems to be used to prosperity. High financing, high valuation, high growth, high salary and high stock price have become the default scene here.

Batch after batch of scientific and technological unicorns have been listed for financing, creating one after another upstarts in scientific and technological enterprises, and achieving waves of wealth creation myths of tens of millions or even billions. The market value of technology companies is the largest in the U.S. stock market, and the scale of revenue is incomparable. At the same time, prices and house prices in Silicon Valley have also risen, making it the most expensive region in the United States.

After the outbreak of the COVID-19 in 2020, as the Federal Reserve lowered interest rates to near zero and continued to release water to stimulate the economy, the U.S. stock market began to soar, and the growth of consumer spending made the performance of technology companies continue to hit new highs. Stimulated by the brilliant performance, over the past two years, various technology companies in Silicon Valley have made large-scale recruitment and expansion, and the total number of employees of meta company increased by 32% last year.

U.S. economy turns downward

However, such a good time, like "Indian summer", has become a thing of the past. After entering 2022, the U.S. economy came to a sudden stop, which not only stopped the pace of recovery after the epidemic stopped in 2020, but also shrank for two consecutive quarters, marking the arrival of the "technological recession".

The Fed's continued interest rate hike is the direct cause of the sudden economic brake. This is mainly because the inflationary pressure remains high. Even if the Federal Reserve raises interest rates continuously this year, the consumer price index (CPI) in June increased by 9.1% year-on-year, which is still at a 40 year high. From food to gasoline to services to industrial products, all commodity prices are rising visually.

In order to curb "historical" inflation, the Federal Reserve has also adopted "epic" tightening measures. Since this year, the Federal Reserve has raised the benchmark interest rate four times; In the past two months alone, the Federal Reserve has raised interest rates by 150 basis points in a row, a tough measure never seen since the 1980s.

The Federal Reserve is focused on curbing inflation, but the whole United States is in a panic, worried that the Federal Reserve's continuous slamming on the brakes may drag the U.S. economy into recession. Under the influence of uncertain factors, people began to reduce consumer spending, housing sales began to slow down significantly, new housing and government spending also began to decline, and even the previously hot job market began to cool down.

According to the statistics released by the US Bureau of economic analysis today, the US gross domestic product (GDP) contracted again in the second quarter of this year, with a year-on-year decline of 0.9 percentage points. According to the usual measurement, the contraction of economic growth in six months can be regarded as a technical recession. Such economic data seems to confirm the previous predictions of some economists and business leaders that the U.S. economy is about to fall into recession. Although economists still have different opinions on whether the U.S. economy is in a comprehensive recession, even the most optimistic economists admit that the current situation of the U.S. economy is not optimistic.

Silicon Valley venture capital Giant Sequoia Capital wrote in a report in May this year, "we don't think that the U.S. economy will suddenly turn around and rebound in a V-shaped way like after the epidemic. The market downturn will directly affect consumer behavior, labor market, supply chain and more links."

It is not only the US economy that is facing the crisis, but also the global economy. In the world economic outlook released this week, the International Monetary Fund (IMF) said that affected by the war, inflation and the covid-19 pandemic in the past few months, the global economy may become the weakest year in the past 50 years. "The global economy may be on the brink of recession.". IMF chief economist wrote.

The performance of technology giants slows down

With the rapid cooling of the macro-economy, the technology industry has also felt a direct chill. At the beginning of this year, after the Federal Reserve tightened monetary policy and sent the signal of raising interest rates, the U.S. stock market began to turn downward, completely ending the situation of "continuous rising and everyone's stock god" in the past two years.

In this stock market adjustment, dragged down by investors' risk aversion, technology companies that had led the stock market up fell sharply. The NASDAQ index has fallen 24% this year, once falling more than 35%, and has obviously entered a bear market. Over the same period, the S & P 500 index and the Dow Jones index fell only 15% and 14%.

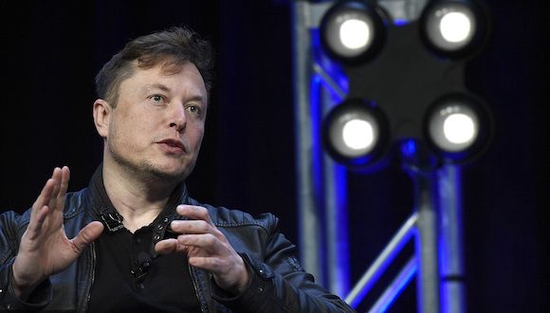

Shares of giants such as Microsoft and Google fell by more than 20%, while NVIDIA and meta fell by more than 40% and 50% respectively, and Netflix plummeted by more than 70%. As the shares of Twitter and Tesla both fell sharply, musk, who lost twice, did not hesitate to break the contract, cancelled the acquisition agreement with Twitter, and faced a litigation war.

The sharp decline of share price is on the one hand, and the slowdown and decline of performance is on the other hand. The uncertainty of enterprises and consumers about the economic outlook has a direct impact on their spending and Consumption Willingness, and the continued strength of the US dollar has also impacted the revenue of the technology industry. Even the technology giants, whose revenues and profits continued to grow during the epidemic in the past two years, are now beginning to feel the chill.

The financial reports of various technology companies released this week can clearly feel the slowdown or even downward trend in the revenue growth of the technology industry. Meta, the parent company of Facebook, saw its first revenue decline since its inception. In the second quarter, its revenue decreased by 1% and its profit fell sharply by 36%. However, meta expects revenue to decline further in the third quarter.

In a conference call with analysts, Zuckerberg bluntly admitted that, "Although the user data of meta's application matrix is still growing, the company is facing a challenging macroeconomic environment. It seems that we have entered the economic downturn, which will have a wide impact on the digital advertising business. Although it is difficult to remember the specific magnitude and duration of the downward cycle, the situation now looks worse than last quarter."

Sheryl Sandberg, the outgoing meta coo, said at the last analyst meeting, "the global economic situation continues to be volatile, high inflation and the uncertainty of the recession outlook have brought new challenges. The recession has put pressure on marketing, forcing them to adjust their budgets and marketing methods."

Although the revenue of Google's parent company alphabet still maintained growth in the quarter, the growth rate was lower than market expectations; Moreover, the profit of alphabet fell by 14% in the quarter, dragged down by the sharp increase in expenditure and its withdrawal from the Russian market. Alphabet CFO Ruth Porat also mentioned that "the uncertainty of the economic outlook has prompted some advertisers to cut their budget spending", and the strong growth in revenue last year has also brought pressure on the year-on-year base for this year's performance.

Earlier this month, alphabet CEO Sundar Pichai said internally that the economic downturn would also affect Google. Satya NADELLA, CEO of Microsoft, also expressed a similar view, "Microsoft will also be impacted by the current macroeconomic situation." Similar to Google, Microsoft's quarterly financial report also encountered the embarrassment of lower than expected revenue, but it still maintained growth.

Lay off workers one after another to prepare for the winter

In fact, since the second quarter of this year, Silicon Valley technology companies have begun to control personnel costs, either freezing recruitment or directly laying off staff. Science and technology start-ups are also known as the "leading indicators" of the economy. They can directly feel the financing difficulties and market impact brought by the interest rate hike more than other industries. Layoffs have become the most direct means of saving money. In this wave of layoffs, startups are at the forefront of Silicon Valley.

According to layoffs According to the public layoff information of fyl, in the two months from May to June this year alone, technology start-ups have cut more than 27000 employees, twice the total layoffs of last year.

Those technology companies directly related to consumer spending are the main force of the layoff wave. Carvana, a used car network platform startup, laid off 2500 people at one time, accounting for 15% of its total employees. Coinbase, a cryptocurrency platform, also announced layoffs of 18%. Rivian, an electric vehicle company, cut its staff by 6%. Bird, an electric scooter company, cut staff by 24%. Redfin, a real estate agency website, also cut staff by 8%, and the Federal Reserve has directly poured icy water on the already hot real estate market by raising interest rates sharply.

The AR game developer Niantic, who was once popular with "wizard Kebao dream", cut 8% directly in June. A nialtic employee who did not want to be named told Sina Technology, "there are no symptoms at all. The CEO simply announced that the whole game group was cut down, just because that project is not the core business. Although our group has not been cut, it is also frightening to see such a scene."

Not only small and medium-sized technology companies, but also industry giants that have greatly expanded their recruitment in the past two years, have cut cost reserves for the winter. After the outbreak of the epidemic in 2020, Facebook announced a high-profile expansion of recruitment. Last year, the total number of meta employees soared by 32% to 83500. But now, with the economic outlook bleak, technology giants have also begun to make the idea of layoffs.

Zuckerberg has made it clear that the company will begin to cut staff in the next year. At the meta internal meeting this month, Zuckerberg told his employees to start preparing for "the worst economic downturn we have seen in recent history", and those employees who cannot improve and prove their value will face layoffs. According to meta's internal employees, at the beginning of this month, meta's human resources department has begun to require all departments to conduct performance evaluation to determine possible layoffs.

Microsoft announced a slowdown in recruitment in May this year, when it involved business teams such as windows, office and teams. In June, Microsoft made small-scale layoffs, but the total number of layoffs was less than 1%. This month, Microsoft further canceled many recruitment plans, including azure cloud computing, which continued to grow.

Talent market enters a bear market

Even apple and alphabet, which have not publicly announced layoffs, have begun to tighten recruitment and even freeze jobs directly. A recruitment manager of a start-up company revealed that even though many companies still have job information on their websites, the actual recruitment work has been frozen, "it's useless for you to submit your resume for these positions".

Over the past decade, Silicon Valley has undoubtedly been a "seller's market" for talents. Startups and industry giants are constantly adding conditions and fiercely competing for technical talents. Most employees of technology companies can find new jobs quickly even if they are laid off. But now the macro-economy has cooled sharply, and the talent market has entered winter.

An employee of meta Hardware Department told sina science and technology, "now even if you receive high paid offers from other companies, you don't dare to accept them. In the past few months, you have seen too many cases. You went to the new company with a big package, and as a result, you were the first to be laid off, or even revoked the offer directly. You have just entered the job, and your salary is high, of course, you are the best layoff object. Being honest is the safest."

Charles was laid off by bird, an electric scooter company, in May this year. In his view, due to the freezing of recruitment by various enterprises, the laid-off employees now face unprecedented difficulties in finding their next home, especially those who have reached the middle level, which is particularly embarrassing. "I'm ready mentally. It may take me a year to find a suitable job opportunity."

Wang Tao, an old employee who has been in Silicon Valley for more than 20 years, recalled that he came to Silicon Valley in 2001, and the desolation at that time was much worse than now. "After the foam of technology stocks burst in 2000, nearly half of the Internet companies in Silicon Valley died, and a large number of software talents were laid off. It was much more difficult to find a job than now. I remember driving on Highway 101 (the main traffic artery in Silicon Valley) during commute time at that time, the traffic flow may not be one quarter of what it is now."

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~