your current location is:Home > investHomeinvest

He's back after cheating Softbank's 40 billion yuan

If you want to list the notorious "liars" in the global Internet world, Adam Neumann is definitely the best.

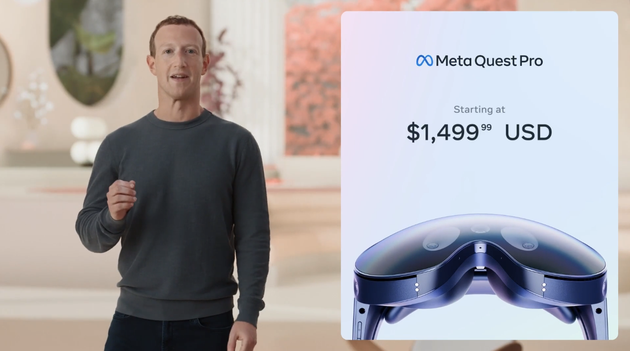

He founded WeWork and turned a second landlord's business into a high-tech company by creating concepts and playing marketing. At its peak, it was valued at $47 billion and was once the world's most valuable unicorn;

When he was at his best, Masayoshi Son of Softbank and Dimon of JP Morgan could not wait to become his fans;

Source: https://www.bbc.com/news/business-62568108

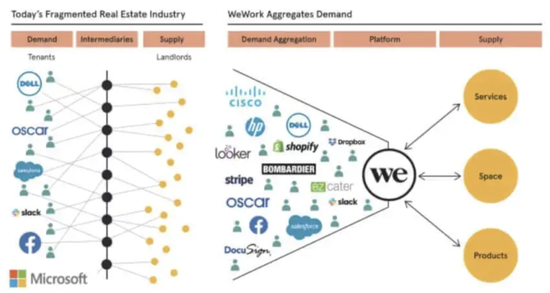

Source: https://www.bbc.com/news/business-62568108He invented a bunch of mysterious names for WeWork: physical social network, iPhone in real estate, another great invention of the sharing economy, etc., just not talking about what WeWork's core business is;

Source: WeWork prospectus

Source: WeWork prospectusHe is also very good at PUA employees. He asked employees to drink leftover beer at parties to show his sincerity, and asked the whole company to be vegetarian, otherwise he would not be reimbursed for meals;

But while WeWork is losing money every day, Neumann's own office is getting bigger and bigger, appearing in various fashion magazines with his equally obsessive wife, and turning WeWork into a mom-and-pop shop;

Source: https://zhuanlan.zhihu.com/p/486790662

Source: https://zhuanlan.zhihu.com/p/486790662As a result, the whole scam collapsed on the eve of the glorious listing of his eloquent empire.

Shareholders led by SoftBank teamed up to oust him from the board of directors, still unable to prevent WeWork’s valuation from plummeting from $47 billion to $7.8 billion, SoftBank also slumped, and recently even sold Ali shares to continue its life, while WeWork is going through SPAC. The stock price also fell horribly after the bleak listing.

The too absurd entrepreneurial experience was also made into a TV series by Apple.

Image source: Poster of the American drama "WeCrashed" (WeCrashed)

Image source: Poster of the American drama "WeCrashed" (WeCrashed)Some people have tied him with Elizabeth Holmes, the founder of the blood testing company Theranos, and called him the two biggest liars in the American startup circle in recent years.

However, while Holmes has already been charged with multiple fraud charges, Neumann has made a comeback.

Source: Flow official website

Source: Flow official websiteHis new company, which was basically a website, raised $350 million in funding.

As previously reported by "Silicon Star", the company he founded this time is a new type of residential real estate company "Flow", which received the largest single investment in a single round in the history of the well-known venture capital a16z, with a valuation of more than 10 One hundred million U.S. dollars.

It basically transferred Neumann's entrepreneurial experience and cake painting experience on WeWork directly to the real estate industry. The company is even at the PPT stage.

This is really incomprehensible. Some people call this a disgusting financing.

Source: Twitter screenshot

Source: Twitter screenshotBut look again at Neumann's dramatic startup history at WeWork, and you might understand how the scammers have a second spring today.

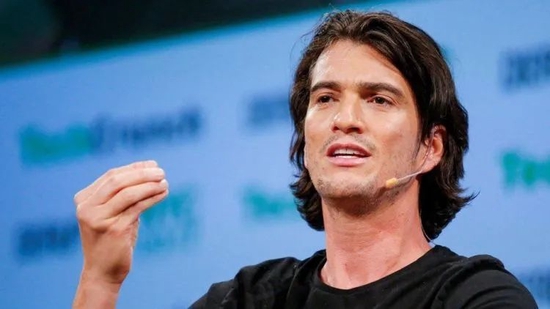

Adam Neumann came to the United States from Israel at the age of 22 to study, and he became obsessed with entrepreneurship before he graduated.

He also began to embody some of the styles that became more and more intensified in him later on, calling it ambition and vision to sound good, and running a train with a mouthful of bad words.

Many of his entrepreneurial ideas were bad ideas.

For example, the first company sells Krawlers, which no one wants, and the second company sells baby onesies for $400 a piece.

Source: Apple TV+

Source: Apple TV+He also told a group of entrepreneurs about the prototype of WeWork early, but was questioned "how is this different from a college dorm."

However, sometimes the scammer can't succeed, or it may be because the scammer has not met a more matching "deceived".

After starting WeWork with his friend Miguel, he began reaching out to more powerful investors.

The first key person who was impressed by him was Dunlevie, a partner of the famous VC Benchmark in Silicon Valley.

Dunlevie, Partner, Benchmark

Dunlevie, Partner, BenchmarkIt is said that Dunlevie obviously did not like WeWork at first, thinking that WeWork is a real estate business and lacks the network effect of the Internet.

However, upon meeting Neumann, Dunlevie was so impressed with his ambition that Benchmark finally participated in WeWork's Series A round in July 2012, raising $16.5 million at a $100 million valuation.

After that, WeWork's valuation began to spread.

In 2013, it received a $40 million financing from DAG Ventures, which often follows Benchmark investments, at a valuation of $440 million.

In 2014, JPMorgan and several other investors invested an additional $150 million in WeWork at a $1.5 billion valuation in a bid to compete for WeWork, a potential hot IPO.

Until Sun Zhengyi completely took the company on fire.

Sun Zhengyi

Sun ZhengyiMasayoshi Son is an investor who looks at the character of the founder very much. He succeeded once in Alibaba, which also made him fall into this path dependence.

When he met Neumann, he actually told him: You have to be more crazy. So the 40 billion swindled in the back is also a Gu that Sun Zhengyi raised himself to a certain extent.

In late 2016, Neumann and Son met in New York. At that time, Masayoshi Son was rushing to meet Trump, who had just been elected president, and Neumann had only 12 minutes to convince Masayoshi Son.

And then it really happened-

Neumann got into Son's car. On the way to Trump Tower, Son chose to believe his feelings and decided to invest $4.4 billion in WeWork at a valuation of $20 billion.

Getting Sun Zhengyi made Adam Neumann the hottest star.

Source: Stills from the American drama "Start-up Players"

Source: Stills from the American drama "Start-up Players"However, his bragging skills have improved faster than his business model and are starting to become proficient.

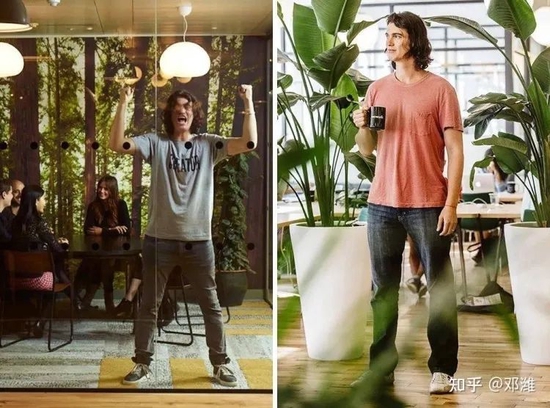

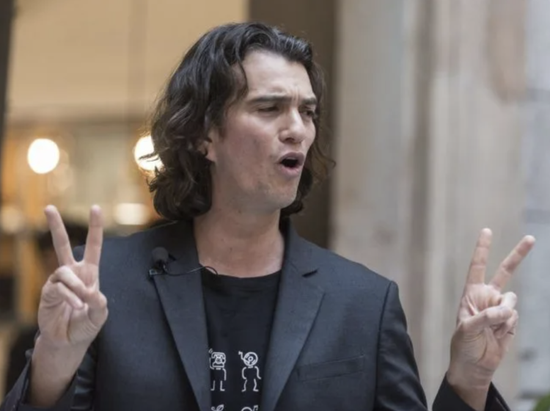

Needless to say, he is also a very attractive individual.

He looks handsome, speaks with an accent, and makes words that investors like.

Neumann is 1.95 meters tall, has flowing hair, and has a hippie temperament and confidence in his speech and demeanor. WeWork's brochures are all modeled by himself.

Image source see watermark

Image source see watermarkAt an industry conference, he said that he would think less about WeWork’s ROI, and would think more directly about ROC—Return on Community. He said that “the inability to change the company’s losses” is refreshing and refined, and he has the ability to invent concepts.

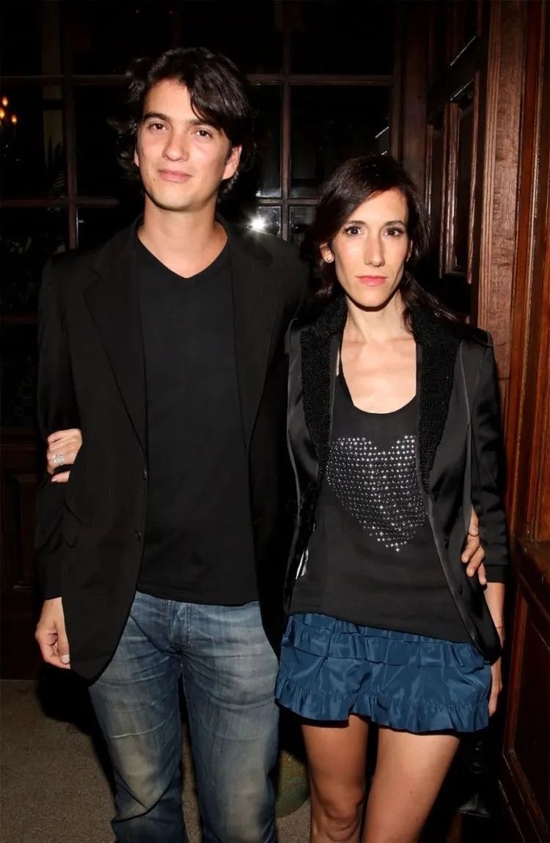

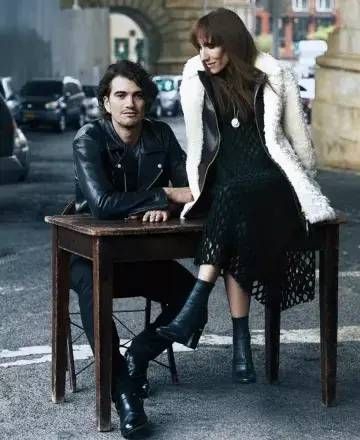

At the same time, his wife Rebekah is no less crazy than him.

Neumann met Rebekah right out of college.

Neumann and Rebekah

Neumann and RebekahIt is said that before meeting Neumann, Rebekah had not dated for six years, devoted to yoga and spiritual practice.

Later, it can be said that the two cherished each other, and they achieved each other by encouraging each other and brainwashing each other along the way.

Rebekah, who found his true love, seemed to have "joined the WTO" a lot and began to frequently intervene in company affairs.

She founded an elementary school called WeGrow in the name of WeWork, calling herself a CEO, and 4 of the 46 students are children of the two.

Image source network

Image source networkShe went back to calling herself WeWork's co-founder and also served as the company's chief brand and influence officer.

Then it is with Neumann frequently on the covers of major magazines.

Image source network

Image source networkAnd the high-profile style of the two also began to go beyond the standard, and even began to use the company's funds to satisfy their own desires.

The money in his hand bought a number of luxury houses in California, the most expensive one in the San Francisco Bay Area, the price of which is as high as 22 million US dollars.

They also bought a Gulfstream G650ER private jet for $63 million.

Source: Stills from the American drama "Start-up Players"

Source: Stills from the American drama "Start-up Players"Because he likes surfing, Neumann also bought a surf pool manufacturer whose business logic has little to do with WeWork.

Even the real estate used by WeWork is leased to the company by Neumann.

Play a good abacus.

Image source network

Image source networkWhen it comes to bizarre entrepreneurs, the United States and Silicon Valley have never been short of them, but it is rare to see such bizarre entrepreneurs as the Neumanns.

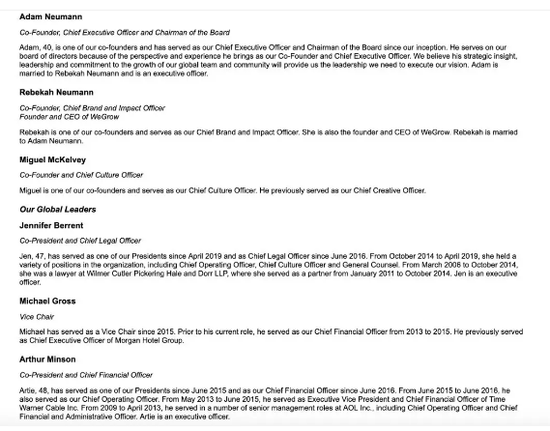

These various shocking behaviors were even written into the WeWork prospectus.

Executive information in WeWork's prospectus

Executive information in WeWork's prospectusFor example, this company lost nearly $2 billion in 2018, but the company’s CEO made money in the process.

Neumann, for example, created The We brand and then sold it to WeWork, earning $5.9 million worth of stock in the process.

Image source network

Image source networkAt the same time, the American media also began to disclose various stories of Neumann.

On the eve of the listing, the "Wall Street Journal" revealed that Neumann had cashed out $700 million through the sale of stocks and mortgaged equity, and used the funds to buy 5 properties and invest in commercial real estate and a number of startups.

Source: News Screenshot

Source: News ScreenshotThere was an uproar outside. Know that most entrepreneurs don't sell their shares before going public, a practice seen as a taboo on Wall Street.

Under such circumstances, no matter how stupid investment institutions are, they will not dare to blow bubbles.

Just before the IPO, WeWork began to crumble rapidly.

In a matter of days, the valuation plummeted from a peak of $47 billion to $7.8 billion at the time, and the IPO had to be delayed.

Image source network

Image source networkWeWork failed to go public, and Sun Zhengyi also suffered.

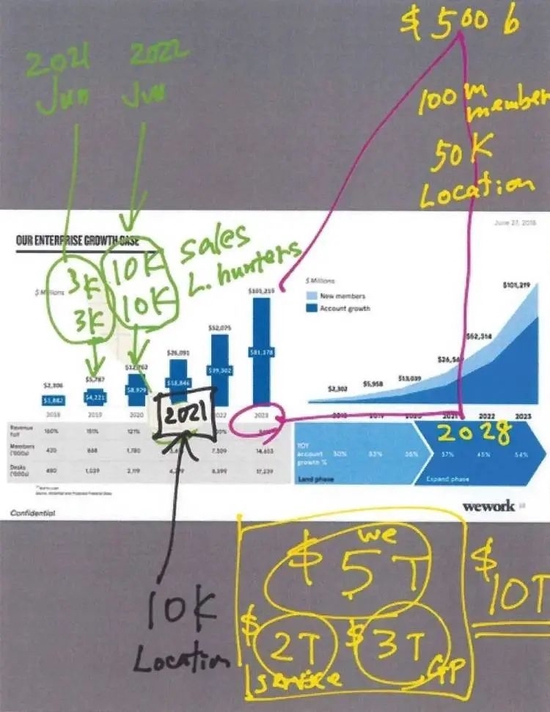

Masayoshi Son's "development plan" for WeWork

Masayoshi Son's "development plan" for WeWorkEven as WeWork was mired in various scandals, SoftBank was already contemplating ousting Neumann.

At that time, while the Neumann family was attending the weekly Jewish Sabbath ceremony, SoftBank quietly held a shareholders meeting, and all board members voted in favor of removing Neumann.

But it was too late.

In March 2020, SoftBank’s stock price began to plummet. Affected by the devaluation of WeWork’s equity, the Vision Fund suffered a huge loss of US$18 billion. Masayoshi Son bowed to the employer and apologized.

Image source network

Image source networkBut Neumann appeared to be unscathed and made a fortune, receiving nearly $450 million in cash, stock returns and fee income from the settlement that SoftBank gave him after suing SoftBank for breach of the agreement.

Image source network

Image source networkThen Neumann went into hiding.

Until this time when Flow got a huge financing, he returned to the public attention again with a high profile.

This time, it's another big show.

In fact, this big play has already had clues.

A person like Neumann who never cared about the rationality of the business model, but only about the concept, encountered a new trend that suits him best:

He started a web3 company and is targeting "carbon reduction", the latest area where he could "change the world".

The project is called Flowcarbon, and its goal is to "use the decentralized features of Web3 to solve the problems of fragmented, opaque transactions and low liquidity in carbon credit transactions under global warming." As always, for the sake of all mankind.

Source: Flowcarbon official website

Source: Flowcarbon official websiteTo put it simply, Flowcarbon issues coins and links them with carbon credits, so that the credit amount transactions are transferred to the chain, and it can have the attributes of stock speculation in the secondary market.

This is another entrepreneurial project with a fair vision (solving the human climate crisis) and more obvious arbitrage space (the carbon emission pricing itself has not been resolved, and the pricing power of issuing coins is simply not too attractive).

The launch of the project has attracted a lot of crusade from carbon emission reduction experts, pointing out that the current carbon credit trading market problem has nothing to do with how to trade more efficiently, and the bigger problem is that there is not enough supply.

However, this did not prevent it from getting $70 million in financing, and it was a16z who led the investment.

Recently, the project has begun to delay issuing coins, citing the “poor virtual currency market conditions”.

Image source network

Image source networkNo matter how you look at it, this project is inextricably linked to Flow, which Neumann has invested in today.

Although the relationship between the two has not been publicly stated, judging from the fact that the two companies share the name Flow and Neumann's past desire to build the We Empire, the two are aimed at combining together to "change the world".

Some foreign media have reported that Flow has not done much business today, and the first action after financing is:

Online virtual currency wallet.

Officials denied that the wallet was immediately used to pay rent, but said it could be used to trade any virtual currency.

Image source network

Image source networkAll of this seems unreliable, but the eyes of the beholder are good, and these model inventions are almost tailor-made for a16z.

Neither Neumann himself nor a16z have really talked about the new company's business model after such a high level of discussion.

It may also be because it looks like a free hand on web3, so it seems unreasonable to give it a valuation of 1 billion US dollars.

But the business model is not what a16z cares about most.

a16z is the most high-profile investment firm in the Web3 space today, and the one best at producing concepts.

In announcing its investment in Flow, a16z said the U.S. is in a severe housing crisis and only Neumann can change that.

"Flow will be able to provide people with a kind of innovation in living space ... which will meet the trend of working from home in the post-pandemic era."

In the eyes of a16z founder Marc Andreessen, Neumann seems to be another person:

Adam is a visionary leader who has revolutionized commercial real estate, the world's second largest

Previous:Apple's Apple-1 prototype once owned by Steve Jobs is auctioned for 4.6 million yuan

Next:Microsoft Xbox CEO: Satisfied with Activision Blizzard deal

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~