your current location is:Home > investHomeinvest

The rise of female power in the VC industry in the United States

Recently, Amazon’s AWS Impact Accelerator (AWS Impact Accelerator) launched a program to provide more female founders with the support they need to accelerate their startups.

The AWS Impact Accelerator is a $30 million fund that provides equitable training, mentoring, tools, and resources primarily to Black, Latino, women, and LGBTQIA+ founders. Over an eight-week period, 25 startups accelerated growth by growing their businesses with AWS technical experts, investors, and partners. From customer discovery and retention to deep dives into architecture and learning within Amazon, founders will engage in workshops, roundtable discussions, personal mentoring, peer learning. To fuel their growth, startups will receive $125,000 in cash grants and $100,000 in AWS service credits, all at zero cost and zero equity.

Along the way, female founder participants will learn from companies like Advancing Women in Tech, Visible Hands, and AWS partners like Dropbox DocSend, HubSpot, Carta, and Brex. They can also attend sessions and modules specially curated to address women's entrepreneurship challenges.

Source: AWS

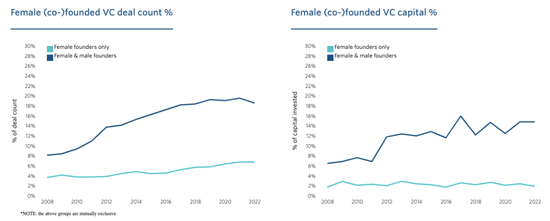

Source: AWSIn the U.S., companies founded entirely by women will receive only 2.4% of total U.S. VC-backed startup capital in 2021, and companies co-founded by men and women will receive about 11.4% of VC funding . The majority of startups and VCs are still founded by white men in the Bay Area.

Nearly 90 percent of startups funded by top VC firms between 2018 and 2019 were men, 72 percent of founders were white, and 35 percent of founders were white, according to a report by RateMyInvestor and nonprofit Diversity VC. Living in Silicon Valley, nearly 14 percent of founders had an Ivy League education.

But more and more women entrepreneurs are now leading venture-backed startups. Women and people of color are starting companies at an unprecedented rate, said Shila Nieves Burney, founder and managing partner of Atlanta-based Zane Ventures.

Source: PitchBook

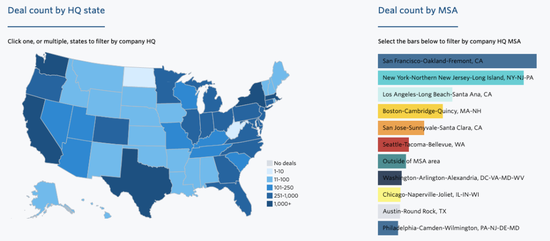

Source: PitchBookGeographically, in Los Angeles, funding rates for female founders are higher than the U.S. average. Nearly 30 percent of companies that received financing in the city had female founders, compared with 22 percent nationally. The Los Angeles-based company raised 7.5% of all seed funding. The average amount per transaction is 20% higher than the national average.

Source: PitchBook

Source: PitchBookWomen-led venture capital funds are breaking down the gender gap

Amplifyher VenturesThe data shows that in the venture capital world, co-ed teams outperformed 63 % of all-male teams .

A BCG study found that for every dollar invested, women-founded startups generate 7.8 cents in profit, compared with 3.1 cents for men-founded startups . So they concluded that diversity yields higher returns, and that female founders will be the next "bet" for VCs.

However, the data shows that, at least for now, VCs are not leaning toward women, at least not at the same rate as mixed-gender or male-founded startups. The lack of female-led funds is one of the reasons why it is difficult for women to raise money. Fewer than 10 percent of decision makers at U.S. venture capital firms are women. That means, however, only 105 of the roughly 1,088 investors are women.

However, while the gap remains large, there are some female-led venture capital funds that are helping to close the gender gap. Among the funds that have been dedicated to supporting female founders, the following ten funds are more worthy of attention:

1. Tola Capital: Founded by two women, it is now the largest VC in Seattle. It was established in 2010 and has $440 million in management. So far, it has 35 investment targets, through SAP, Oracle, SoftBank, Verizon, MasterCard, Cisco and Rapid7 Waiting for company acquisitions, 13 companies were successfully withdrawn. Invests primarily in early-stage or growth-stage next-generation SaaS companies powered by emerging technologies and cloud computing. Almost half of the management team are women.

2. BBG Ventures: An early-stage venture capital fund focused on supporting female founders in the new consumer space, its Funds I and II have completed 39 investment events, and the latest Fund III has invested in 22 companies, of which 10 B2B companies, 9 B2C companies, 5 B2B2C companies. BBG follows the principle that every company it invests in has at least one female founder, usually targeting seed or pre-seed rounds with an investment size between $500-100 million.

3. Halogen Ventures: A Los Angeles-based investment firm focused on investing in women-led consumer tech startups, it has invested in more than 60 women-founded companies to date, including the Skimm, Glamsquad, Hopskipdrive, ThisisL, and Eloquii. Halogen recently established a fellowship to advocate for a focus on risks that are overwhelmingly white males during guest lectures by top employees at UCLA, Harvard and Notre Dame, as well as Silicon Valley Bank and Amazon AWS. The lack of equity and diversity in the investment community.

4. Brilliant Ventures: Founded in 2016 by two women, Brilliant Ventures is a Santa Monica, California-based venture capital firm. The company seeks to make seed-stage, early-stage and late-stage venture capital investments. It has now gone through 17 investments and 5 exits. Advising, consulting and investing exclusively in women-led companies.

5.Forerunner Ventures: Female founders, focusing on early-stage venture capital companies investing in the DTC digital business field. According to the statistics of Yuanqi Capital, Forerunner has a total of 68 investment events, of which 22 companies successfully entered the next round, and 6 companies were later arrested. M&A.

6. Sogal: Founded in 2016, the first female-led millennial venture capital firm invests in early-stage startups in the consumer or healthcare sectors in North America and Asia. Focused primarily on world-class female entrepreneurs, has invested in 100+ businesses and helped build multiple unicorns.

7. Female Founders Fund (F3): Founded in 2014, it aims to invest in the next generation of female talents. In the past 8 years, it has invested in 61 companies founded by women, including Eloquii, Zola, Maven Clinic, Tala, etc., a total of 13 times to exit. F3 mainly invests in early rounds of technology companies such as Internet and software. In addition, they also invest in e-commerce, media, platforms, advertising and network services.

8. The Jump Fund: Founded in 2013, the investment team has an all-female lineup. Since its establishment, a total of 2 funds have been raised. The company has two main goals: one is to stimulate the enthusiasm of female angel investors, and the other is to create women in the southeastern United States. provide financing channels. Since its establishment nearly 10 years ago, it has invested in more than 30 women-led companies, with several successful exits. Having fully deployed both funds, JumpFund is now focused on supporting the growth and development of companies it has invested in so far, saying it is no longer looking to invest in new companies .

9. Rethink Impact: Founded in 2015, Rethink Impact is the largest U.S. venture capital firm investing in women and gender minorities in the tech space, with a primary focus on having a female CEO or C-level positions (e.g. CTO, COO, CRO) or CFO), the company tends to lead or participate in the financing of the late seed round to the C round, and the investment scale is between 2 million and 10 million US dollars. Rethink's requirements for investment targets are: companies with annual recurring revenue of $500,000 to $15 million that are expected to grow to $50 million to $100 million in the next 5 years (or companies that they believe can have a significant impact and are philosophically consistent post-transaction of the company’s mission).

10. Amplifyher Ventures: Founded in 2018 by Tricia Black, Facebook’s former vice president of ad sales, it focuses on investing in female founders in the northeastern United States, mainly investing in the seed stage of companies in the consumer, services, e-commerce, health and technology sectors.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~