your current location is:Home > TechnologyHomeTechnology

TSMC Q3 earnings report: Smartphones are the largest contributor to revenue, and inventory adjustments will continue until next year

On October 13, TSMC announced its financial report for the third quarter of 2022. The data shows that TSMC’s total revenue in the third quarter was 20.2 billion US dollars, an increase of 35.9% year-on-year and an increase of 11.4% month-on-month. Gross profit margin reached 60.4% and operating profit margin reached 50.6%, both exceeding market expectations. However, at the earnings conference call held on the same day, Wei Zhejia, president of TSMC, said that "it is expected that in 2023, the semiconductor industry may usher in a decline (cycle)."

On the 14th, during U.S. stock trading, TSMC’s share price rose and stabilized, with an increase of more than 9%, and finally closed at $66.62, an increase of 3.92%. However, in the past five trading days, TSMC's share price has been halved, and its market value has fallen from a high of $750 billion at the beginning of the year to $345.5 billion, evaporating nearly 54%.

Goldman Sachs released a research report today, reiterating TSMC's "buy" rating, but removing the "convinced buy" list, and the target price was lowered from $126 to $89 to reflect weakening earnings prospects and rising demand uncertainty.

Smartphone businesses such as Apple boost revenue

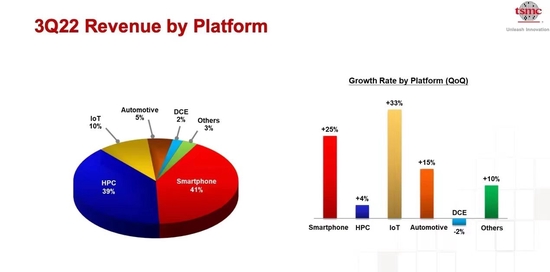

As can be seen from the data released by TSMC, smartphones (41%) and high-performance computers (39%) occupy the top of TSMC's revenue. In terms of smartphones, people familiar with the matter revealed to the first financial reporter that Apple is still the largest contributor to TSMC's smartphone revenue in the third quarter. In 2021, Apple's business will account for 25.93% of TSMC's revenue.

In the specific financial report, TSMC's smartphone business accounted for 41% of the revenue in the third quarter, up 25% from the previous quarter; high-performance computing (HPC) revenue accounted for 39%, a quarterly increase of 4%; IoT business revenue increased by 33% to 10% %.

In terms of regions, revenue from North American customers accounted for 72% of total revenue, up from 64% in the second quarter, and revenue from mainland China accounted for 8%, down from 13% in the previous quarter.

Although Apple has previously delayed TSMC's 3nm process product N3 OEM orders and switched to N3E due to process issues such as cost and power consumption, it has added new stock for the 5nm process. Industry insiders said that this further increased TSMC’s share and profitability in advanced process chips. As can be seen from the third quarter earnings data, advanced technology nodes (7nm and above) accounted for 54% of TSMC's total revenue. Of these, 5-nanometer contributed the largest revenue (28%), followed by 7-nanometer (26%).

Since Apple's new products this year have adopted the 5nm process, it is expected that the overall proportion of 3nm mass production will remain low by the end of the year. In this regard, TSMC pointed out that customer demand exceeds the company's supply capacity, partly due to ongoing machine delivery problems, and it is expected that 3nm will reach a fully utilized state in 2023. The current N3E technology development progress is ahead of schedule, and mass production is expected in the second half of 2023. Compared with N5, N3 is expected to have a higher revenue contribution in 2023.

Inventory adjustment continues until mid-next year

Although the revenue structure in the third quarter was unchanged from the second quarter, TSMC pointed out that from the fourth quarter of 2022, the company's 7nm and 6nm (N7 and N6) capacity utilization will decline, mainly due to smartphones and PCs Weak end markets and delays in customer product schedules.

TSMC said that inventories will peak in the third quarter and begin to decline in the fourth quarter, and due to weak demand and the slack season in the first half of the year, the inventory is not expected to rebalance to a healthier level until the first half of 2023.

In terms of process, due to the lag of the semiconductor supply chain, TSMC expects that the decline in 7nm and 6nm utilization will continue into the first half of 2023. At the same time, TSMC stated that the market demand for 7nm and 6nm is more inclined to cyclical factors rather than structural phenomena, and the demand for 7nm and 6nm is expected to pick up in the second half of 2023.

Regarding the expansion of the fab, Wei Zhejia said, "The expansion plan of the Nanjing plant is also proceeding according to the plan. Although the demand for 7nm is slowing down, the construction of the Kaohsiung plant is also proceeding according to the schedule. The Japanese plant is also proceeding according to the schedule, which meets the needs of customers." According to reports, the progress of TSMC's plant in Arizona is currently "in line with expectations."

Weak PC and mobile phone markets

In terms of terminal demand, TSMC continues to observe the weakening of consumer terminal market demand. Based on its fourth-quarter revenue forecast, TSMC said it would cut capital expenditures to $36 billion from an original estimate of $40 billion. In July of this year, the budget figure was still $44 billion.

Earlier, AMD and Intel both announced their latest revenue results, which were both lower than market expectations. For the decline in revenue, AMD CEO Lisa Su responded by "weaker-than-expected performance in the PC market and a major inventory correction across the PC supply chain." Last week, AMD slashed its third-quarter revenue forecast.

Chai Daixuan, director of CIC Consulting, told the First Financial Reporter that the current downturn in the downstream market has limited the shipments and performance of upstream manufacturers. PC hardware such as CPU and graphics cards are limited by downstream demand, and the sluggish demand for upgrades and replacements has made upstream manufacturers together There is an inventory backlog problem. In addition, the gradual extension of the replacement cycle of PC-related components has further tightened the upstream market shipments, and supply chain adjustments have reduced processor shipments.

CINNOResearch data shows that since July this year, in the domestic smartphone market, except for Apple, the market sales of mainstream Android brands have all shown negative growth. Among them, the year-on-year growth rate of shipments of vivo and OPPO declined by more than 30%.

Regarding the prospect of a bottoming out of the PC market, Chai Daixuan believes that this is related to business demand. He told reporters that since the outbreak of the epidemic, the field of corporate e-commerce procurement has continued to expand, from the initial procurement of general-purpose materials for corporate consumption to the field of specialized, customized products and production materials; Purchasing is the main focus, and it has expanded to the field of enterprise service procurement, which has driven the major customer market to gradually tilt towards e-commerce procurement. "The trend of e-commerce of large customers may bring a new round of demand stimulation to the PC market."

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~