your current location is:Home > TechnologyHomeTechnology

IPO valuation falls to one-third, Intel's Mobileye listing is untimely

In less than a year, the IPO valuation of Intel's self-driving company Mobileye has dropped from more than $50 billion to a third.

According to foreign media reports on October 18, Mobileye has determined the terms of the IPO: it plans to issue 41 million Class A shares at a price of between $18 and $20 per share, raising a maximum of $820 million and a valuation of up to $15.93 billion.

But in December last year, when Intel announced that Mobileye would be listed on the U.S. stock market, it said its market value was expected to exceed $50 billion. Going around in circles, Mobileye's latest IPO valuation is about the same as when it was taken private by Intel five years ago.

As the global leader in assisted driving, Mobileye's growth rate in recent years has been impressive: with its algorithm + EyeQ series chips, Mobileye's revenue in 2021 will reach 1.4 billion US dollars, a year-on-year increase of 43%; in the first half of this year, the company's revenue reached 854 million US dollars, Become the fastest growing division within Intel. Its IPO listing has also been placed on high hopes and is regarded by the outside world as "the most noteworthy technology stock this year".

However, this year, the secondary market of U.S. stocks has undergone drastic changes, and the cold winter of the market has indeed caught Intel and Mobileye by surprise.

The Wall Street Journal, citing Dealogic data, said this year was the worst year for initial public offerings (IPOs) since 1995. As of the end of September this year, only 14 U.S. tech companies had successfully listed on stock exchanges, with tech IPOs raising a total of $507 million, according to financial data firm Refinitiv.

Under the cold environment, Mobileye was regarded as the "Son of Heaven" last year, and now it can only swallow the bitter water that the IPO was born at an untimely time.

The IPO was born out of time

This is Mobileye's second listing.

This Israeli company, founded in 1999, was listed in 2014 with a market value of $8 billion, breaking the record for Israeli companies listed in the United States at that time. In 2017, Intel took its revenues privately for $15 billion.

The accumulation of the past 20 years has made Mobileye the global leader in intelligent driving. It is understood that as of October 1, 2022, Mobileye's assisted driving solutions have landed on about 800 models, and its EyeQ series chip shipments have exceeded 125 million.

According to Mobileye's prospectus, 13 of the world's 15 largest automakers are its customers, and more than 50 OEMs around the world have cooperated with it on ADAS (Advanced Assisted Driving System) solutions. Its ADAS solutions will be deployed in more than 270 million vehicles by 2030.

According to the US energy consulting firm Guidehouse Insights, Mobileye owns about 80% of the global assisted driving vision system market.

Its revenue and loss figures are also getting better year by year. From 2019 to 2021, Mobileye's revenue was US$879 million, US$967 million, and US$1.386 billion, respectively; the net losses from 2019 to 2021 were US$328 million, US$196 million, and US$75 million, respectively.

Compared with many self-driving companies in the secondary market of the U.S. stock market, which are quite unable to make ends meet, Mobileye's profitability is already quite dazzling.

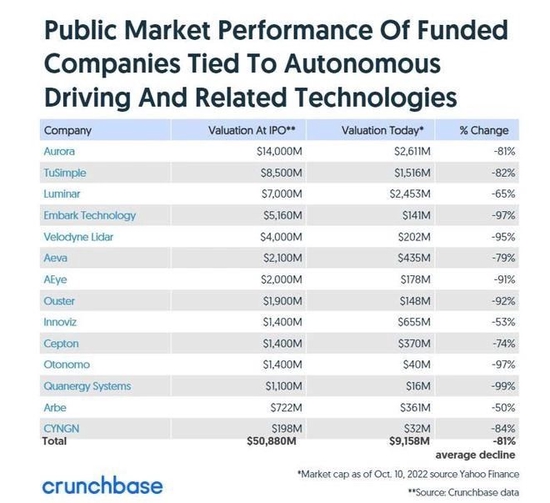

Recently, Crunchbase, an enterprise service database company, sorted out the performance of 14 autonomous driving-related companies in recent years since their listing. The valuation of these companies has dropped by more than 80% on average after listing, with the largest drop of 99%.

Among them, autonomous driving company Aurora fell by 81%, Tucson Future fell by 82%, and Embark fell by 97%; lidar company Luminar die fell by 65%, Velodyne fell by 95%, and Quanergy fell by 99%.

Image via crunchbase

Image via crunchbase

Perhaps to avoid a downward trend in the stock price, Mobileye and its financial advisers hope to attract investor interest by selling fewer shares at a lower price, according to the Wall Street Journal, citing some people familiar with the matter. After the start of trading, the stock price is pushed up.

According to this statement, Intel and Mobileye's active reduction in valuation may be a roundabout tactic to save the country from the curve: expecting the stock price to rebound against the trend.

Of course, whether Mobileye can turn around after the real listing also depends on Mobileye's continued performance and investors' confidence in the industry.

The company's technical products have been criticized: although it has provided assisted driving algorithms + EyeQ series chips for car companies, the ecology is relatively closed and it is difficult to meet the flexible needs of car companies. At the same time, the computing power of autonomous driving chips is not high enough. Nvidia, Qualcomm, Huawei, and Horizon have all snapped up orders.

It is true that Mobileye's years of mass production experience and market position will continue to propel Mobileye forward as the wave of automotive intelligence sweeps across every car in the world. In addition, Mobileye is also gradually opening up its ecology, developing large computing power autonomous driving chips, lidar chips, etc., and continuously expanding its strength.

However, in the booming Chinese market: Nvidia and Qualcomm's chips have firmly grasped most of the advanced autonomous vehicle market, and domestic chip players are crowding into the track, Mobileye's advantage is still not obvious enough.

At the same time, due to the global semiconductor shortage, Mobileye is also facing a shortage of chip materials. It disclosed in its prospectus that in 2021 and the first half of 2022, its sole EyeQ system chip supplier STMicroelectronics was unable to meet chip production demand, resulting in a significant drop in inventory levels. This could also affect Mobileye's performance this year.

Mobileye also knows the difficulty of going public right now, but remains confident. "Imagine an IPO being the first 100 meters of a marathon," its president and CEO Amnon Shashua said in a letter to its 3,100 internal employees. "It's where we'll be when the race starts, not necessarily the start sprint." We are launching our IPO at a very challenging time in global markets, but we believe we need to focus on the outlook.”

Listed and unlisted, must face the cold winter

Despite the slump in valuation, Mobileye is in a relatively solid position today.

Earlier, according to Bloomberg, the self-driving public company Aurora will save expenses through layoffs, executive pay cuts, asset sales, and reduced benefits, and even consider selling the company to cash-rich tech giants such as Apple and Microsoft. Since the company's backdoor listing last year, its stock price has fallen from a peak of $17 per share to about $1 per share.

Tucson Future , which was the first domestically listed on the U.S. stock market , also fell from a peak of $79.84/share to $5.82/share.

There are many reasons for the worrying profitability of self-driving companies. More importantly, in the context of the bear market and economic recession in the US stock market, investors are losing long-term confidence. This round of cold wind is stronger than before.

Even the giant Amazon has recently shut down its unmanned logistics delivery vehicle project. Previously, its "Scout" unmanned delivery team had been operating for 3 years, with a team of 400 people, but a human supervisor was still required during the unmanned vehicle delivery process, and "customers reported that unmanned vehicles could not satisfy them in some aspects. needs.”

In the domestic market on the other side of the ocean, it is difficult for capital to bet on the L4-level autonomous driving Robotaxi, which cannot be implemented at present, and instead bet on more energy-producing assisted driving and new energy.

Although a group of L4 autonomous driving companies that missed the best time to go public are still waiting for the opportunity (Pony.ai, WeRide, etc. have all reported news of going to Hong Kong stocks), they are also transforming into assisted driving for car companies. supplier. The assisted driving company that has already become a Tier 1 car company is racking its brains in order to get more orders from car companies in the fierce involution.

In the cold winter, the fate of autonomous driving companies has long been written: struggling to make products profitable, transforming, dormant or dying.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~