your current location is:Home > TechnologyHomeTechnology

Silicon Valley giants are more miserable, and Apple is alone?

Apple also failed to stop the decline of US stocks.

A few days ago, Microsoft, Google, and Meta released financial reports: Meta’s profit plummeted 52% to $4.4 billion, Microsoft’s revenue growth rate dropped to the lowest in five years, and Google’s revenue growth rate plummeted from 41% in the same period last year to 6%. . The general financial performance of Waterloo has caused their stock prices to fall to varying degrees. After the earnings report was released, the stock prices of Google and Microsoft fell by more than 6%, and Meta plummeted by nearly 20%.

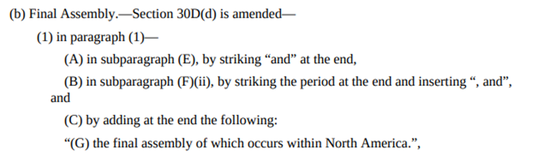

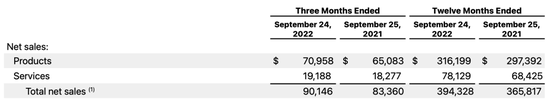

In the wailing, the U.S. stock market waited for Apple’s performance report. On October 27th, Eastern Time, Apple released its financial results for the fourth fiscal quarter of 2022 (as of September 24, 2022, hereinafter referred to as the "third quarter"). Compared with other giants, this financial report is not so bad, and the total revenue and profit are higher than analysts' expectations-data show: In the third quarter, Apple's total revenue was 90.146 billion US dollars, an increase of 8.1% year-on-year; net profit was 20.71 billion US dollars, a record high in net profit for the same period.

Apple's revenue in the fourth quarter of 2022 | Source: corporate financial report

Apple's revenue in the fourth quarter of 2022 | Source: corporate financial reportHowever, Cook still mentioned the currency impact on the business: "There was a foreign exchange headwind of over 600 basis points in the quarter, which was a big (impact) . Without the foreign exchange headwind, we could have grown by double digits." After the earnings release , Apple shares fell more than 5% after the market.

The polarized iPhone 14 series

The mainstay iPhone business had revenue of $42.6 billion, up 9.7% year-over-year, but below analysts' expectations of $43 billion.

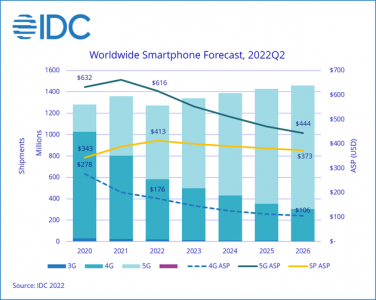

In the overall downturn of the mobile phone market, the iPhone is still the most stable one. According to data released by Canalys, the third quarter of 2022 is the worst third quarter for the mobile phone market since 2014, with global mobile phone shipments falling by 9%, showing a downward trend for three consecutive quarters. Among them, Apple, which occupies 18% of the market share, is also the only brand in the top five to maintain growth.

In the Chinese market, the same data from Canalys shows that in the third quarter of this year, the shipment of smartphones in mainland China was 70 million units, down 11% year-on-year, of which Apple ranked fourth with 11.3 million units. is the only brand that keeps growing.

Zhu Jiatao, an analyst at Canalys, said the smartphone market in mainland China will be flat in 2023 or a slight recovery in 2022, but still below 2021 and pre-pandemic levels, and demand is unlikely to improve before late next year. As strong as the iPhone, it is difficult to restore the situation.

As a new series released in the third quarter of this year, the sales of the iPhone 14 will largely determine Apple's performance in the next few quarters. Although the overall performance is good, if you continue to dig deeper, you will find that it is not easy for the iPhone 14 to reproduce the strength of the iPhone 13.

Apple's revenue from various business lines | Source: corporate financial report

Apple's revenue from various business lines | Source: corporate financial reportBefore the release of the iPhone 14, the market was generally optimistic. Tianfeng International analyst Ming-Chi Kuo once said through overseas social platforms that based on his survey of Chinese dealers, retailers and scalpers, the demand for iPhone 14 in the Chinese market may be stronger than iPhone 13, because the above-mentioned people are iPhone 14 Paid the "largest down payment ever".

But actual sales may not be as good as expected. At least in the Chinese market, Jefferies analysts pointed out that the overall purchase volume of Chinese consumers at the beginning of the launch of the iPhone 14 series was lower than when the new models were launched last year . The sales volume of the Apple iPhone 14 series in the first three days was 987,000. Department, 11% lower than last year's comparable sales of the iPhone 13 series.

However, the sales of the iPhone 14 series are higher than those of the 13 series. The reason is that the polarized product market feedback is the main reason. According to Sandalwood's e-commerce monitoring data, the 7-day pre-sale sales of the iPhone 14 series on the Tmall platform increased by 7% compared with the 7-day pre-sale of the iPhone 13 series, and sales increased by 17% year-on-year.

Such data shows that the Pro series was almost done by itself - the 7-day pre-sales of the iPhone 14 series standard version on a certain platform decreased by 70% year-on-year, and the pre-sales of the Pro series increased by 56% year-on-year.

Clearly, consumers are more willing to pay for innovation. Compared with the previous generation, the iPhone 14 standard version has not been upgraded much, while the Pro series has attracted more consumers with its "Smart Island" design.

iPhone14|Image source: Apple official website

iPhone14|Image source: Apple official websiteApple CFO Maestri also said after the earnings report that demand for the iPhone 14 Pro model is strong, but supply is limited. In response to market feedback on different products, Ming-Chi Kuo said that Apple has asked Hon Hai Foxconn to switch the production line of the iPhone 14 to the iPhone 14 Pro model. In the second half of 2022, the shipments of the iPhone 14 Pro will account for the total shipments of the iPhone 14 series. 60–65%.

Shortly after the release of the iPhone 14 series in September, Ren Zeping once fired at Apple on Weibo: "Apple has become an increasingly soulless and innovative company, and the rest is more about piling up hardware, pseudo-innovation, price discrimination, and suppressing competitors. , monopoly, arrogance, over-consumption of Apple's love for Jobs... The iPhone 14 Waterloo may be a sign of the rise and fall of the Apple empire."

In fact, this is almost a common problem in the current mobile phone market. After more than ten years of rapid development, the mobile phone industry has entered the era of stock, and the appearance and color have more recognizable features, which have become major mobile phone manufacturers competing for consumers. "trump card".

In the past two years, the concept of folding screens has emerged in the mobile phone market, but at present, it has not been fully recognized by consumers. And Apple, which has been in this field, seems to have new ideas. Market research company CCS Insight released a report that Apple will choose a completely different strategy from other mobile phone manufacturers to introduce folding screen technology from the iPad product line.

Combined with the mobile phone market environment and the sales of Apple's own products, whether or not to make a folding screen phone, Apple also needs to come up with more attractive innovations.

New engines of growth are also under pressure

Let’s take a look at Apple’s other lines of business.

Services revenue was $19.2 billion, up 5% year over year;

iPad revenue was $7.17 billion, down 13.06% year-on-year;

Mac revenue was $11.51 billion, up 25.39% year-on-year;

Wearables, home products and accessories revenue was $9.65 billion, up 9.8% year over year.

Among them, Mac revenue is one of the few bright spots in this earnings report. The iPad released a new product on October 18, and its sales impact will be reflected in subsequent financial reports.

More interesting is Apple's services business. In the third quarter of this year, the services business recorded the slowest growth rate of the business in Apple's history, and Apple CFO Maestri said that the revenue deceleration was due to the impact of foreign exchange and the slowdown of digital advertising and games.

Apple's service business mainly includes subscription services, advertising revenue and fee income. In the past few years, this part of the business has been an important driving force for Apple's growth, and has achieved over 10 billion in revenue for 16 consecutive quarters. For Apple, this part of the business is also an important sector for improving profits and gross profit margins.

In May of this year, in order to continue to increase the revenue of the service business, Apple reorganized the service team and identified streaming media and advertising as the two main growth directions.

In October of this year, in an email to developers, Apple said that starting from October 25, it will add two new advertising spaces to the existing App Store in all regions except mainland China, namely "Today" (Today)” page, and the “You Might Also Like” area at the bottom of each app’s detail page.

Bloomberg reporter Gurman previously said that Apple's advertising division generates about $4 billion in annual revenue, and Apple's advertising chief Todd Teresi hopes to raise that number to at least $10 billion a year. Apple plans to start showing search ads in the iPhone's Maps app next year.

The aggressive recruiting also reflects Apple's ambitions to grow in the advertising field. Apple's advertising business currently employs about 250 people, according to LinkedIn data, and they plan to continue to recruit more than 200 employees. Research firm Evercore ISI predicts that Apple's advertising business will grow to $30 billion in four years.

Apple TV+

Apple TV+Additionally, Apple's streaming business is on the rise. According to JustWatch, as of February 2022, Apple TV+ has a global market share of 5.6%, which is well behind Disney+ and Netflix but is approaching HBO Max. In March of this year, Apple TV+'s original film "Listening Girl" won the Oscar for best picture, which boosted the influence of Apple TV+ in one fell swoop.

Apple's advantage also lies in ecology. With Apple One, Apple users can enjoy seamless service with Apple TV+, iCloud, Apple Music, Apple Fitness, News and Arcade as a single unit.

This year, Apple has also increased the price of streaming services, from $4.99 to $6.99 a month for Apple TV+, $10.99 for Apple Music from $9.99 a month, and an all-in-one Apple One home plan from $9.99 a month. From $19.95 to $22.95.

Although the demand for the iPhone 14 Pro series is strong and the company is also making great efforts in the new growth engine "service business", Apple still faces many challenges. In this financial report, Apple still did not give performance expectations, which also shows that the company has certain uncertainty about the future. Cook also said that Apple is already slowing the pace of hiring.

The mobile phone market is still, and may be, at a low level for a period of time. Canalys analyzed that in the case of deteriorating market demand, manufacturers should quickly adjust to adapt to the severe business environment. Whether it is to reduce inventory or control labor costs, the industry must prepare for the winter.

Previous:The iPhone 14 Pro is hard to stop Apple from falling

Next:Fired CEO and CFO, how will Musk achieve his Twitter ambitions?

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~