your current location is:Home > TechnologyHomeTechnology

The Twitter acquisition case of chicken feathers in one place: buy it or pay a high breakup fee

On August 9, the world's richest man Elon Musk cashed in nearly $6.89 billion in news.

According to two documents released by the SEC, Tesla CEO Elon Musk sold a total of 7.92 million shares of the company on August 5, August 8 and August 9. worth nearly $6.89 billion.

Musk was then asked on Twitter if he had completed the sale of Tesla shares, and he replied "yes," adding that if the Twitter deal didn't close, he would buy again.

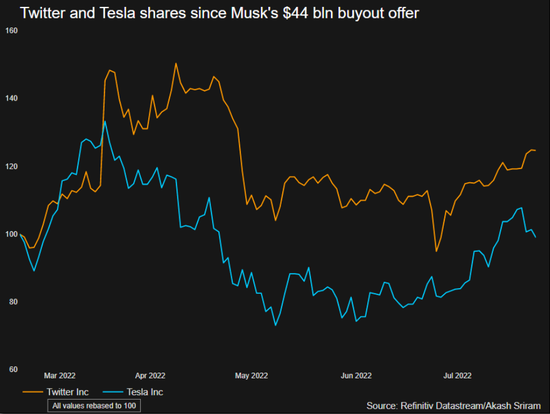

Interestingly, on April 28, Musk said on social media that "there are no further plans to sell shares." Following the SEC's news, both Twitter and Tesla's stock plummeted.

Musk also claimed that he would buy back some of his Tesla shares if he didn't end up buying Twitter, and joked about building his own social media platform X.com.

The beginning and end of the acquisition

In early July, Musk proposed to terminate the $44 billion acquisition of Twitter. In response, the social media giant sued Musk, forcing him to close the deal.

The two sides will have a court hearing on October 17. If allowed to walk away from the deal, Musk could be forced to pay a hefty termination fee.

In a late Aug. 9 tweet, he said: "Although unlikely to happen, it is critical to avoid an emergency sale of Tesla stock if Twitter forces a deal to close and some equity partners don't come to an agreement. "

Shares of Twitter rose 3.5% to $44.43 on the Aug. 11 benchmark, but were still well below Musk's $54.20-a-share offer. Tesla shares also edged up 2.52% to $883.07.

Illustrator: Kristen Radtke / The Verge; Getty Images▼

The standoff marks the latest chapter in a months-long saga. The story begins in January 2022, when Musk started investing in Twitter.

Musk struck a deal with Twitter in April, but in the weeks since, he has raised concerns about spam accounts on the platform, saying Twitter has not provided him with an accurate estimate of the number of those accounts. Twitter disputed that claim, saying it had provided information to Musk under the conditions set out in the acquisition.

In May, Musk said the deal was "on hold" due to spam/bot account issues. In the eyes of investment firms in the industry, this is just an excuse for buyers who are remorseful due to a downturn in the stock market, especially technology stocks. Some analysts also said that Musk deliberately let Twitter's share price fall so that he could have a better price when he acquired it.

When the Twitter acquisition was announced in April, Musk had already sold $8.5 billion worth of Tesla stock and said at the time that there were no further sales planned. In 2021, he sold $16.5 billion in stock, mostly to pay taxes required to exercise options.

He now owns less than 15% of the automaker (previously 20%). According to the company proxy statement, more than half of his shares have been pledged for personal loans.

After Musk announced a $44 billion acquisition of Twitter in April ▼

The court will see

On the other side, Tesla's stock has fallen since the moment the Twitter acquisition began, amid fears that Musk might cash out to get some of the money to pay for the acquisition. Since then, legal experts have suggested that Musk is likely to need to sell more Tesla shares if he is forced to complete the acquisition or fined him for abandoning the acquisition to settle the dispute.

Under the terms of his Twitter offer, Musk initially secured a $12.5 billion margin loan with his stake in Tesla as part of his $44 billion purchase of Twitter. The loan was subsequently reduced to $6.25 billion before being cancelled entirely.

It was a relief for Tesla shareholders, with shares down 12% on the day the acquisition was announced and 35% in June.

"If Musk is forced to sell the part of the stock that he used as collateral, it will cause the stock to fall. When the stock falls, banks and financial companies will ask Musk to sell more stocks to ensure the return of the loan funds and endorsement of repayment ability. , which will cause the stock to fall further," Tesla's annual filing said.

Musk has replaced the loan with another $6.25 billion in equity financing. That increased his equity financing for the deal from $27.3 billion to $33.5 billion.

Twitter's agreement provides for a $1 billion breakup fee. But the breakup fee is conditional. Musk must go ahead with acquisitions unless he can prove he was misled or a "material adverse event" happened to Twitter. He can also give up if the debt needed to complete the transaction is no longer available.

That raises the risk of a court hearing in October, with Musk likely to face being ordered to deal on the original terms or forced to try to reach an out-of-court settlement with Twitter.

Wedbush analyst Dan Ives said the potential for Twitter to get a $5 billion to $10 billion settlement from Musk is already starting to be priced into the social media giant's stock.

Gary Black, managing partner of Future Fund LLC, said in a tweet: "The sale of shares by Elon Musk greatly increases the odds of the Twitter deal closing, albeit at a slightly lower price of $50-51 per share. ."

On top of Musk's $33.5 billion personal commitment, the bank's $13 billion debt package for Twitter's future cash flow has become increasingly shaky -- a digital advertising slump that is plaguing the world-renowned social networking site.

Shares have risen nearly 15% since Tesla reported better-than-expected earnings on July 20. Like Tesla, Twitter's stock is on the rise, up a third from its July lows, though still 20% below its trading price.

Musk may still be raising the cash he needs, and it remains to be seen whether he will need to raise more.

related articles

Article Comments (0)

- This article has not received comments yet, hurry up and grab the first frame~